There is always a question when building a hedge fund portfolio of how many names are necessary to obtain a representative return for the strategy. Just because you are within a strategy space does to mean that returns will be similar. There can be large strategy dispersion even in the case of quantitative hedge fund styles. This dispersion can be found within the managed futures space. From the article: "Commentary: CTA crisis alpha - a silver lining for turbulent times".

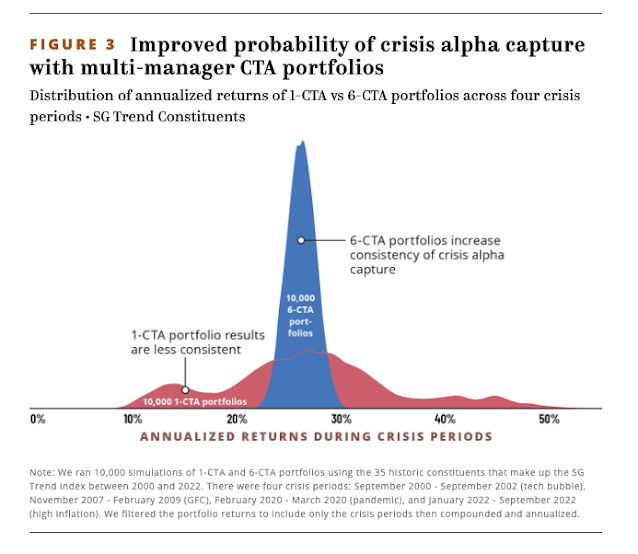

For the managed futures strategy, there is more dispersion in the wings of the return distribution of an 60/40 equity-bond return portfolio especially if you hold only one manager. That dispersion is reduced as the number of managers increases. A diversified portfolio of six mangers will show much less dispersion than what would be the case of single manager. This is very important because if you pick the wrong manager, you may not receive as much crisis alpha at market extremes.

The distribution chart shows that a portfolio of six managers will have a tight normal distribution while the single manager distribution will have fat-tails which is a large risk for allocators who picked trend-followers to add value during a crisis.

No comments:

Post a Comment