Incentives matter always - The Economist

Incentives matter sometimes - The Psychologist

Money incentives matter - The Finance professional

What incentives matter - The Philosopher

Incentives versus others matter - The Sociologist

Past incentives matter - The Historian

A close professor friend said he focused a whole lecture on the issue of incentives in managerial economics, so it sees relevant to reinforce the simple message that incentives matter. It may not always be money that is the incentive, and it may not always be obvious what incentives make a difference, but consumers, producers, investors, buyers, and sellers all have incentive structures that drive their decisions. Our job is to find those incentives and how they impact behavior.

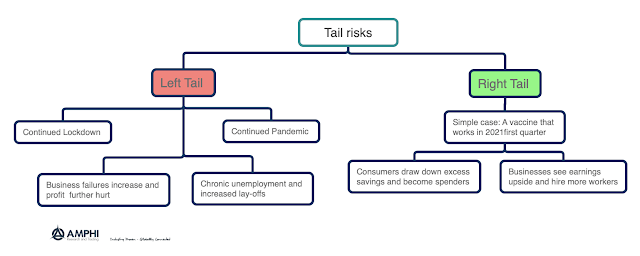

Policy choices have to be made in the context of what happens to incentives. If the Fed drives rates to zero, is there an incentive to hold cash? If private equity markets are not marked to market regularly, is there an incentive to buy this asset class? If the capital requirement for holding government bonds is zero, is there a strong incentive to hold these bonds? Employees don't also respond to monetary incentives, what are those alternative incentives?

There are both carrot and stick or positive and negative incentives. Incentives can work in strange ways and the good analyst thinks through all the incentive permutations to get at the core "incentives matter" question.