Each situation requires a balancing derived from judgment and arising from experience, skills acquired by learning from the past and training for the future.

Theory reduces history's complexity to teachable moments.... Instead theory functions, with respect to the past, as Clausewitz's coups de'oeil do in the present: it extracts lessons from infinity variety. It sketches, informed by what you need to know, without trying to tell you too much. For in classrooms as on battlefields, you don't have unlimited time to listen. Theory, then, serves practice. And when practice corrects theory - when it removes theorists' horse blinders - it returns the favor, preventing stumbles off cliffs, into swamps, and toward Moscow.

- John Lewis Gaddis On Grand Strategy discussing Tolstoy and Clausewitz as the grandest strategists

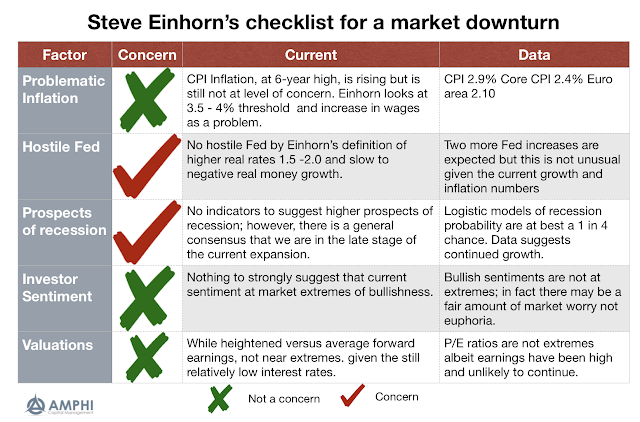

The combination of judgment and experience tied to disciplined systematic thinking in an uncertain world has been a recurring theme in this blog. Systematic and disciplined behavior through models improves the odds for success in a volatile, uncertain, complex, and ambitious (VUCA) environment. Our judgment is gained through theory that does not stand-alone but provides direction for our practice and our discipline. Judgment and experience allows strategy to move beyond abstraction. Strategy is directed by experience and filtered by theory.

For the quantitative-focused manager, theory is needed to form beliefs, but data is needed to set the level of significance and direction in practice. This practice is best served through planning and disciplined. Systematic behavior is not immutable, but can change with new facts. It can change with new situations, but theory, guided by our lessons form the past, serves as a foundation for action.

Gaddis writes about similar issues throughout history in his sweeping book on strategy. Understanding the ends and the limits of our means is critical for success. Failure arises when ends and means are not coordinated and the limitation of means leads to overreach for the ends.

We have discussed Clausewitz in the context of the "fog of trading" as someone who understands the limitations from uncertainty coupled with unclear goals. (See "On the "fog of war" - No one gets this quote right, but the concept stands".) Strategy clarifies goals and limitation with uncertainty. The failure to find the central theme or objective of strategy will lead to ambiguity in action. (See "What is your focus? Schwerpunkt - The center of gravity for your investment efforts".) The complexity of grappling with means, ends, and process has been expressed in the narrative of the hedgehog and fox though Isiah Berlin's broad commentary on Tolstoy. Different visions will impact strategies. Trying to forecast the future will be affected by whether you are a hedgehog specialized or the broader focused fox. (See "The "Hedgehog and the Fox" revisited - Find managers with big ideas, but diversify".)

Investor success will be predicated on their ability to exploit technical and practical knowledge, a variation on the theory of rationalism developed by the philosopher, Michael Oakeshott. (See "Technical and practical knowledge - You need both for asset management".) For Gaddis, the combination is judgment and experience which has been shown to be missing in failure and balanced in success. Disciplined investing is a strategy not developed in a vacuum but based on an understanding of market behavior, decision limitations, and manager experience.