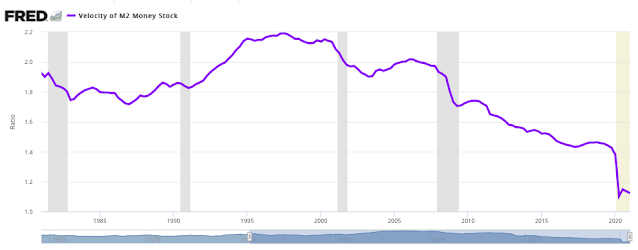

The channels of monetary policy represent a complex system. The Fed is buying bonds and creating reserves, but if the velocity of money is low or declining, the impact on economic activity is limited. Reserves can build but if there is no lending, there may not be corresponding investment growth. Similarly, large excess cash balance may mean that consumer will buy more goods and service which will generate economic growth and inflation to bring the market back into equilibrium, but an alternative response could be an increase in the purchase of financial assets, financial inflation. Consumers can also hold greater money balances as precaution against uncertainty. Money growth may not lead to the intended economic benefits.

Now we have another plumbing problem. Banks are awash in reserves and don't want the money. Money funds are seeing cash balances build and the Fed does not want to see negative interest rates. Hence, there is an extraordinary demand for reverse repo (RRP) which temporarily reduces money in exchange for Treasury collateral. The size of reverse repo has been at the greatest recorded and we are not in a crisis. These RRPs reverse the $120 billion in Fed purchases of Treasuries per month.

Monetary policy is not like a car on an icy road - sliding to one side only to overcompensate to get back in your line with the unintended consequence of further action. The Fed has to do RRPs to keep rates from going negative. Money funds have to do RRPs with Fed to earn some positive return. The Treasury is reducing their balances at the Fed which places more money in bank deposits which banks don't want. The system is not effectively working yet the Fed says it is not ready for any policy change.

This money market behavior cannot continue so there is a greater likelihood for a tail event that creates a divergence from the status quo.