There is no need to make comparisons with the 1970's. The current environment is not like that period of stagflation. However, there are lessons to be learned so there is no repeat.

The employment numbers are good, there are plenty of job openings, and quit rates are abnormally high. The issue is that growth, after a strong rebound, looks to be lower than expected. The long-term growth rate in the US is expected to be slightly above 2%. We are following that path plus the residuals associated with congestion and COVID restrictions. The net forward effect is something lower than 2%. The Atlanta Fed is nowcasting an estimate between 1-2% which is half the forecast from the Blue Chip consensus.

Global growth is trending to longer-term averages and China is showing a surprisingly low third quarter estimate based on property development issues and energy shortages.

The inflation environment is higher than expected and some policymakers are responding that this is a "high-class" problem that we should be thankful for. There is no problem here given it is transitory and perhaps necessary. An overreaction to a supply shock problem is wrong; however, there is a demand component that can be better managed with guidance and action.

Can the situation worser? Right now, the risks are on downside: an energy crisis, COVID slowdown, reduced monetary liquidity, lower fiscal policy, and a congestion logistical shock. What this economic environment has in common with the 70's is a shorter-term supply shocked world (not demand right now) with potential for policy mistakes.

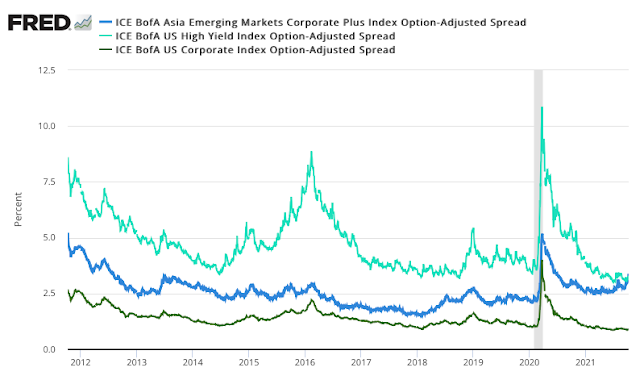

Overall, the risky asset markets will need to correct and fixed income will recalibrate to higher higher nominal rates. This is a not a good environment for a classic passive 60/40ish portfolio.