"Disciplined Systematic Global Macro Views" focuses on current economic and finance issues, changes in market structure and the hedge fund industry as well as how to be a better decision-maker in the global macro investment space.

Monday, February 27, 2023

Monetary surprise tightening - Post announcement risk appetite drift

Sunday, February 26, 2023

Understanding the riskiness of corporate assets (equities and bonds) is critical

Too often investors think about the risk of equities or bonds in isolation. For equities, investors will think about total return and the pay-out through dividends. For bonds, the focus is on coupon payments and the risk to principal. Yet, it is important to think about the risk of combination of equity and bonds as total corporate assets, the pay-out to investors from all sources, dividends,coupon payments, and net repurchases. A recent study provides a new perspective on this issue, see "How Risky Are US Corporate Assets?" .

This study values US corporate assets and their payouts to investors which includes dividends, coupons, and bond principal. The authors find that payouts, unlike equity dividends, are highly volatile, turn negative when corporations raise capital, and are acyclical. However, corporate assets are sensitive to economic growth. What is notable is the impact net repurchases which are often not cyclical alters the total payout to growth and the economic business cycle.

From an investor's perspective, this reinforces the idea that that capital structure matters and investors should focus on both equity and debt markets when thinking about market risks.

Disruption drives credit risk - focus on abnormal financings and innovation

Disruption has a large impact on the risk for credit defaults. Of course, the balance sheet and leverage matter but a new study shows that disruption as measured by abnormally high venture capital and IPO activity sees higher default rate. Innovation and strategy meet the credit markets. New entrants and innovations impact the likelihood that firms will be able to pay their debts. See "Disruption and Credit Markets" by Bo Becker and Victoria Ivashina.

Disruption increases default risk regardless of age, valuation, or leverage. Very large firms which may be diversified, or low-levered firms that have an added cash cushion may avoid these higher risks, but if you are in an industry that is going through change, risks of default will be higher.

Changes in Risk Appetite - RORO and TINA vs TARA

Many investment commentators talk about risk appetite, yet it is hard to measure directly. We can look at changes in flows and price changes in a set of assets to measure direction of preference for risky assets, but this is not the same as a desire for holding risk.

There was a period when investors would focus discussion on periods of risk-on and risk-off environments. The flipping between these two regimes called RORO trading. There would be a flight to quality where bonds would do well and stock poorly - risk-off. These periods would be followed by stocks doing well and bonds doing poorly - risk-on. This flipping of preferences created the negative correlation between stocks and bonds.

More recently, there have been other ways to describe risk appetite. When rates were extremely low, there was a discussion of TINA, (There Is No Alternative) to stocks and bonds. Some would call this the reach for yield. Given no cash alternative appetite was centered on risky assets.

However, times are changing, and we need a new or added narrative. In this case, we can start to think about TARA, (There Are Reasonable Alternatives). With cash now closing in on 5% and some measures suggesting that real rates are positive, investors don't have to reach for yield. They can be choosy and thus their risk appetite has fallen. Lower appetite for risk may take the form of being choosier about what to buy.

A fall in risk appetite fundamentally changes how markets will price risk and this repricing will go well beyond the fact that we are still in a bear market.

Saturday, February 25, 2023

Thinking about the channels of monetary policy

Everyone talks about monetary policy and what the Fed will or will not do, but the real important issue is understanding the channels of monetary policy. First, how the Fed perceives its actions may affect the economy and second, how will Fed actions impact markets and the real economy.

Our simple schema shows that there are three channels for monetary policy: the neoclassical or traditional channel, the credit channel, and the risk-taking channel. Each will impact markets slightly differently and each has its own narrative associated with monetary policy.

The neoclassical channel can impact markets and the economy three ways: one, the cost of capital, two, wealth effects, and the three the exchange rate. An increase in rates will increase the cost of borrowing, will reduce wealth, and increase the value of the dollar. However, there is less discussion on how policy may affect individual companies or households. the credit channel focuses on the impact of higher rates on net worth and cash flows which will impact the availability of credit. The third channel is the effect of a rate shock on risk-taking. Monetary policy can increase risk premium and change risk appetite which will affect what investments are undertaken.

The Fed will likely increase rates in March, so an investor should walk through each channel and think about how different markets will be affected by a policy tightening. This process will allow for better cross-market and sector differential with portfolio trades.

Wishing upon an r* - What is the neutral rate?

The neutral rate of interest r* has been a critical conceptual guiding light for the Fed. While inflation policy is to reach the target 2%, the rate policy if you could day there is one is to reach r*. Yet, r* is calculated rate not a market rate.

The neutral rate is a simple concept, the rate that will stabilize the utilization rate of the economy or allow for zero output gap. It is based on set of assumptions including the Philips Curve, the natural rate of unemployment, the output gap, and the economic utilization rate. The general view is that r* has fallen and is hovering around zero, so the nominal neutral rate should be just over 2% if we are at the inflation target. In the post-GFC era with a zero bound, it was viewed that QE was necessary because nominal rates were too restrictive.

However, there has been some discussion about r* now being higher than the last decade. A structural change in the fundamentals that would create an environment where r* is higher would be a sea change for market thinking and would mean that we will not see the low rates for the decade before the pandemic. A higher r* will allow or force central banks to push rates higher with less concern that they are being too restrictive. For example, if we use the current PCE we are at a positive real Fed funds rate, but we may still be at a loose level given a higher r*.

So what is different today? The neutral policy rate does not have to be as low given stronger fiscal policy, stronger corporate balance sheets, excess household savings, and better household balance sheets, On the flip side, a slower global growth rate and a tightening of credit may require a low neutral rates to balance utilization.

Discussion of Fed policy must be more inclusive than just saying that inflation must get back to 2% and the Fed wants to avoid a hard landing. The rates necessary to get to the dual objective must be considered and should be on the minds of investors.

Inflation - It is not going away

Team inflation transitory was thumping its chest at the beginning of the year, but the inflation environment is changing. The PCE is now at 5.4% from 5% YOY expectations. Last month was revised higher to 5.3% from 5%. The MoM inflation rose to .6% versus expectations of .4%. With the latest PCE inflation increasing and the trimmed inflation stable, the market is realizing that the road to the 2% target may be slower than anticipated just a few weeks ago. one year inflation expectations as reported by the University of Michigan is stable at 4.1% which is a far cry from 2%.

The implications are clear. The Fed will have to continue to raise rates and any rate level will be held higher for longer. The economy is running hotter than expected so any recession concerns will be pushed further into the future. Personal spending increased 1.8% while personal income only increased .6%. The no landing is back to a soft landing but not until at least the third quarter.

Just when it looked like bonds would be a good investment, we are seeing yields break higher and equities are breaking lower. The deflationary trades will now be reversed.

Friday, February 24, 2023

Portfolio diversification requires losers

“Diversification means always having to say you’re sorry.” - Brian Portnoy

If everything in your portfolios is making money, then by definition those assets are correlated. You are only picking or holding current winners, so if the world changes those winners can become losers. You must have some losers in the portfolio if you say you want diversification.

If you sell your losers and replace them with winners with similar characteristics to other assets in your portfolio, you are reducing your diversification. Investors should defend their losers if there is a strong rational reason for holding it.

The wisdom of crowds is based on the foundation that the crowd has participants that have different perspectives. Everyone is not supposed to be alike otherwise, your crowd is a herd or a mob. All perspectives cannot be right. Having wrong opinions is required.

Every portfolio manager should say he is sorry about something in his portfolio.

Thursday, February 23, 2023

Theta trend - Thinking outside the normal trend box

Looking at different type of trend models is important to mix up signals and provide better insights on market direction. A problem with traditional trend models is that they are often simplistic and followed by many traders. A single model is problematic because it may have issues with capturing turning points and with crowdedness.

Trend-followers will often use two moving averages or a combination of trend models to diversify signals. The ensemble approach has benefits; however, there are additional benefits if the ensemble includes two very different models which are dynamically weighted.

An approach that is starting to get more traction with forecasters is the theta model which has performed well in forecasting tests using the M3-competition data set. The theta model focuses on the second differences on a price series. Through measuring the second differences with some different scaling factors (thetas), we can decompose prices between different theta models. In a two model case, there can be a linear model (zero theta) to capture long-term trend and an exponential approach to capture curvature. The decomposition of any price series can be a weighted bundle of two models to form a ensemble forecast.

Theta measures the curvature or second derivative of the price series. If theta is zero, there is no curvature because the second derivative does not exist. Hence, it is a linear forecast. As theta increases, there is more weight on curvature. A theta of one will represent the original series. If the theta is less than one, there is a deflation of the series, but it captures turning points. If the theta value is above 1 then the forecast series is inflated with more emphasis on curvature.

We can create any number of theta models from one that is linear (theta = 0) to one that has a high theta value (theta>1) that places a high value on curvature. The idea of a theta approach is to weight two models, a linear time model which is forecasting the long-term linear movement and an exponential model that captures the turning points. Assume you want to combine two forecasts. An optimizer can be used to find the weight for each theta model that will minimize the forecast error of the combination.

What is really going on is that the trend-follower is forming an ensemble model between a linear trend and exponential model that is focused on getting the turning points, second derivatives. It will provide different insights on price movements.

See:

Grzegorz Dudek — Short-term load forecasting using Theta method

Rob J. Hyndman, Baki Billah — Unmasking the Theta method

V. Assimakopoulos, K. Nikolopoulos — The theta model: a decomposition approach to forecasting

K. Nikolopoulos, V. Assimakopoulos, N. Bougioukos, A. Litsa — The Theta Model: An Essential Forecasting Tool for Supply Chain Planning

Monday, February 20, 2023

Determining price bubbles - Harder than you think

Some many investors and market watchers will throw around the term bubble that most would assume these individuals have a good definition of what is a bubble. I have been doing some work with former professor friend to measure or identify housing bubbles. This is not as easy as most would think.

A conclusion of our research is that defining a bubble is a joint hypothesis of a price dislocation and the model used to define the bubble. If a bubble is an extreme deviation from fair value, then you must have a definition of fair value. One model may show there is a bubble, but another model may justify a high price. One man's bubble is another man's strong move based on fundamentals.

For example, many of the highflyers of the pandemic have fallen significantly. Does that signify these stocks were in a bubble? If new stocks with limited profits get bid higher and then fall to earth after cash flows are unrealized, does that signify a bubble? If prices move higher versus some regression model, is that a bubble or a misspecified model?

Rates do not tell us about the likelihood of bubbles. We have had some of the largest bubbles when interest rates were higher than in the last decade. Whether the 1920's, the Japan property bubble, the dot-com bubble, and the housing bubble before the GFC, rates were not abnormally low, so rates by themselves may not tell us about bubbles. Credit availability and herding are not easy to measure.

I believe there are bubbles and I believe that there is irrationality that can take prices to extremes that are unjustified by data, but proving this proposal is not easy. Higher volatility or range does not constitute a bubble. A large drawdown does not signify a past bubble. Identifying bubbles requires deep knowledge of market structure. Hence, true bubble hunting is not often easy.

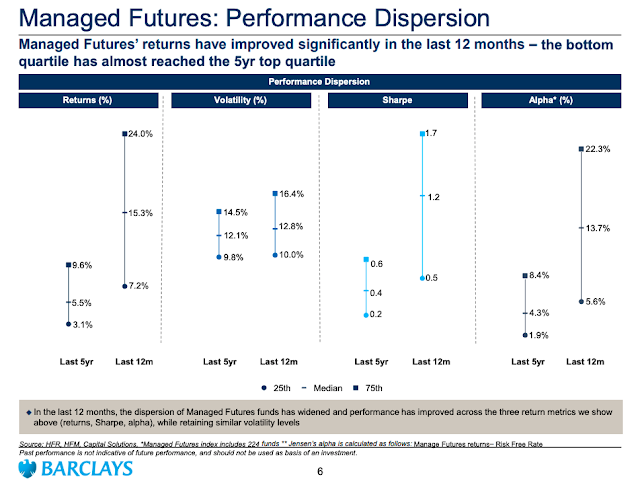

What have we learned about managed futures in the last year

What have we learned about managed futures in the last year?

We cannot say that this is applies to trend-followers since managed futures is a broader category than trend strategies bur the majority of AUM is trend-based.

Over the long-run, managed futures returns are similar to the hedge fund industry. The alpha is consistently higher given the low beta most of these strategies have relative to the hedge fund industry.

When there is a bear market or a market disruption that lasts for more than a quarter, managed futures will be significantly higher than hedge funds. They are supposed to both be diversifiers, but managed futures will have more concentrated returns during a crisis.

The volatility of managed futures funds will increase during a crisis, but given MF managers many target volatility, the range is close to historical norms. However, there is a significant dispersion in return and Sharpe ratios with the range multiples higher.

Hold managed futures for a bear market environment but diversify across several managers given the large dispersion during turbulent times.

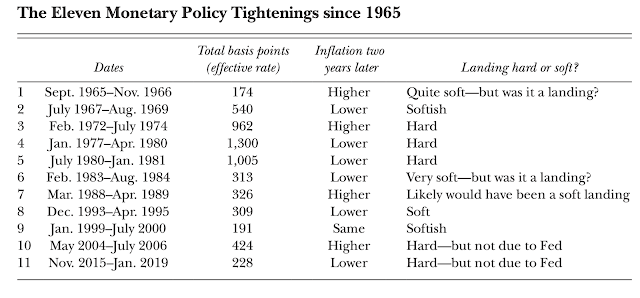

What is the likelihood of a soft landing? History provides some insights

Focusing on the 3 C's of commodities - Crude, Copper, and Corn

A good way to track commodities at a high level is to follow the three C's - Crude, Copper, and Corn. Each gives you a different look at the commodities markets. Crude provides an overall look at global demand and geopolitical risks.

- Crude moves with world growth and will be impacted by global political shocks.

- Copper provides strong look at cyclical demand and will follow the business cycle.

- Corn provides insight on food and weather shocks.

Of course, there are other commodities that can be added to the mix. In the case of foodstuffs, soybeans and wheat are the other key drivers. In the case of cyclicals, we can add other metals. An inflation and safety commodity is gold.

So what has happened to the 3 C's over the last year? The trend has been down for oil, lower for copper, and no change for corn. Right now, not much is going on since the fourth quarter of last year.

The market seems to be in a period of uncertainty on the direction of global demand. We can call this the "landing" problem. We don't know if we will have hard, soft, or no landing. Given the uncertainty, major commodity markets are in a holding pattern.

Sunday, February 19, 2023

Dornbusch - "Recoveries do not die of old age..."

“No postwar recovery has died in bed of old age—the Federal Reserve has murdered every one of them.” Rudiger Dornbusch

Something to keep in mind when thinking about the current economy. The Fed has it the power, through policy mistakes, to turn an economy into a hard landing. Yes, the Fed can support the economy when in a crisis. There is no doubt the being an effective lender of last resort generates significant good for the economy.

Nevertheless, the Fed, even with good intentions, can create the problem. There is a cyclical, nature to the financial cycle, so by raising rates too fast or for too long, it can kill a recovery. Of course, we cannot say for sure since we cannot run a real experiment, but this notion requires a sense of caution from policymakers as their policies become restrictive.

Human mind is like a human egg...

[W]hat I’m saying here is that the human mind is a lot like the human egg, and the human egg has a shut-off device. When one sperm gets in, it shuts down so the next one can’t get in. The human mind has a big tendency of the same sort. And here again, it doesn’t just catch ordinary mortals; it catches the deans of physics. According to Max Planck, the really innovative, important new physics was never really accepted by the old guard. Instead a new guard came along that was less brain-blocked by its previous conclusions. And if Max Planck’s crowd had this consistency and commitment tendency that kept their old inclusions intact in spite of disconfirming evidence, you can imagine what the crowd that you and I are part of behaves like.

Charlie Munger (from fs.blog)

Once we get an idea in our head, it is hard to be open to a new idea. This is a clear bias that cannot be easily solved. This has been called the belief perseverance bias which includes several variations and is closely related to cognitive dissonance.

Belief perseverance biases can include conservatism, confirmation, representativeness, the illusion of control, and hindsight. We could also include information biases like anchoring within this group. Do not think for a second that you can just will not to have this bias. It takes a lot of discipline to offset this bias, so quantitative decision-making may be the best way to avoid it. There are no easy solutions to the closed mind.

However, even a quantitative model may have a problem as a human egg. Markets change and a model that is based on old data is like a closed mind. This why models have to be retrained and recalibrated with new data.

Saturday, February 18, 2023

Confusion matrix and forecasting

The core for performance forecasting is getting the forecasts right. It not about the model albeit the model should have a strong economic foundation. However, getting it right is not always simple, nor can it be assessed through a single number. The sense of being right should also account for the false positives and false negatives, type 1 and type 2 errors. It should account for such numbers as the likelihood of success as well as accuracy.

The best approach is to use the confusion or error matrix, a 2x2 contingency table that compares forecasts with outcomes. Analysis of errors is critical to good decision making, and if forecasts can be measured and success and failure counted, a number of measures can be used to determine the quality of forecasts. Below is the set of statistics that can be generated from the 2x2 matrix.

A simple tool like the confusion matrix is often overlooked yet for any quant trading firm engaged in forecasting, the ability to get the direction right may be more important than the size of the move. Of course, getting a few trades wildly right is more important than just having the odds of success correct. Knowing how to size bets is critical, but at the forecast stage, the confusion matrix is critical.

Friday, February 17, 2023

A scary thought - what if no one responded to economic surveys?

Macro investment decisions are based on timely economic data that is produced by the government. The value of good economic data is foundational for strong developed economy and may be a key role of government - the measurement of what happens inside an economy to help with allocation decisions of consumers and investors.

Much of this data is not generated from counting goods or bodies, but employing surveys to sample different sectors of the economy. What would happen if no one answered the surveys? Responders are busy. Business staffs are often lean and many may just think of this as a burden that has little benefit. This is becoming a real problem as reported by the BLS with significant declines in survey rates.

Jobs data survey responses have been falling for years, but the declines are becoming increasingly alarming. This will mean more noise in any survey. Noise will mean that the variation from one month to the next will be greater and the signal about trends in the jobs market will be less reliable. There will be more surprises or greater surprises relative to expectations because of sampling error. By construction, surveys are not hard counts so there will not be revisions. It will be harder to undertake seasonal adjustments. We will be stuck with bad numbers.

Data will just not be useful, so there will be a premium with finding new data sets and new ways to attract macro signals through the government or through private source, but all of this extra effort will cost money. Who will pay for this private information? Only those who can exploit it through their trading will gather and they may not share all of their private information. There will be more costs in gathering and measuring information which will make the markets less efficient and more exploitable.

There is value with governments collecting and refining information as a serve for all those making economic decisions whether it is a stock trade or an investment decision.

Thursday, February 16, 2023

Words have meaning - Fed and "sufficiently restrictive"

Sunday, February 12, 2023

The rhetoric - "soft landing with transitory inflation" is the story

Framing of economic narratives matter. Discussion will them focus on tilts around the core story. In the case of macroeconomics, the focus has been the "soft landing - transitory inflation" story. This narrative is what the Fed wants and what it is trying to manage.

In the summer and early fall of last year, the story tilted to a "hard landing and slower decline in inflation". Now with inflation slowing, the focus is back towards a transitory inflation story. With labor markets still showing strength, the hard landing or any landing is being pushed further into the future. There is even talk of no landing. The "landing-transitory" combination impacts investment decisions and how we frame what the Fed will be doing. Transitory inflation suggests that the Fed will be able to peak sooner which will feedback on the possible landing choice.

The switch to soft landing and transitory inflation has been the driver for an equity rally. A bump in inflation or data which suggests the economy is slowing will take us back to the harder landing - sticky inflation story.

Is this the right way to frame the macro environment? It is a nice shorthand story, but a simple approach may not allow us to prepare for the changes ahead. It is more likely we will get a slowdown in the inflation decline and a softness in the labor market that will drive bear market thinking.

Friday, February 10, 2023

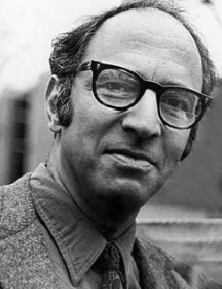

Kuhnian thinking and investments

Steve Eisman of "Big Short" fame invoked Thomas Kuhn and The Structure of Scientific Revolution to discuss paradigm shifts in the investment world in a recent "odd lots" podcast. Does Kuhn make sense with respect to thinking about investing? Absolutely, but we don't usually think about Kuhn in terms of revolutions of thinking about investments.

With finance research there has been strong shifts in thinking about investing. The switch from efficient markets to a behavioral markets perspective is a simple example. The switch in thinking about factor risk over just market risk is another. The switch to ML over traditional econometrics is a third. These all follow the classic structure of scientific revolutions. The old paradigm does not work and cannot explain the facts, so a new paradigm has to take hold and replace the old.

Investing takes a different approach from the traditional revolution but has some of the same characteristics. There may be a theme or thinking that is used by investors that can no long fit the facts, so a new story has to be developed as a replacement.

Paradigm shifts are not changes in the business cycle, but something more radical which is a new way of thinking about valuation and pricing. A shift away from cheap money could be considered a paradigm shift. The old ways of thinking about leverage and the cost of capital are changing. A move away from tech-based themes is another shift.

However, this is not a new finance model but a change in emphasis. Is this a paradigm or regime shift? This is a definitional issue, but investors are thinking about how they form a portfolio differently and these new approaches to thinking about themes will impact performance.

Sunday, February 5, 2023

Mega-threats, poly-crises, and the "confluence of calamities"

- The GFC was a global problem because of the global savings glut that moved too much capital into the US housing market.

- Oil shocks are closely tied to geopolitical crises and wars and not an inability to find oil.

- Pandemics are worldwide problems given globalization and travel. Solving a pandemic has economic consequences.

- The growth in China is exacerbated given political ambitions which limit policy coordination.

Rethinking Adam Smith - More than the "invisible hand"

Saturday, February 4, 2023

Sector behavior and inflation regimes - A regime switch is happening

The difference between economics and politics

the old joke -

"The first law of economics is, scarcity is real; the first law of politics is, ignore the first law of economics."

from George Will

It used to be that economics and politics were closely intertwined. There were departments of political economy not economics departments. Economics developed from those studying philosophy like Adam Smith.

Nevertheless, the joke focuses on some fundamental differences. Economics is often worried about what is the size of the pie while politics is focused on how we get slices with the promise that all slices will be bigger. Economics focuses on how pries are used to solve the scarcity problem while transactional politics is focused on promises today that may not be kept in the future.

This funny truism suggests that tempering politics and economics is important. For politics, it is learning to control through constraints. For economics, it is loosening controls through productivity and technology.