The CBOE has been trying to develop a Treasury note volatility index to complement the VIX index. This contract market could be a good addition to the mix of exchange traded products although the chance of success is relatively low. Most futures contracts fail even if there is a good economic rational for its existence.There is no volume trading on the futures but that does not mean that the index is not useful for research.

There are two indices that use the same methodology in two different asset classes which we can use to tell us something about relative risk. The chart above from the CBOE covers the financial and post-crisis period. Most investors would be surprised by the size of the extreme moves in bonds relative to stocks. Treasuries are risky. Bonds are not always a safe asset. The volatility could be over than stocks but the change in volatility is very large. The swings in risk and uncertainty are large and when bond volatility moves, stock volatility may not see the same type of changes.

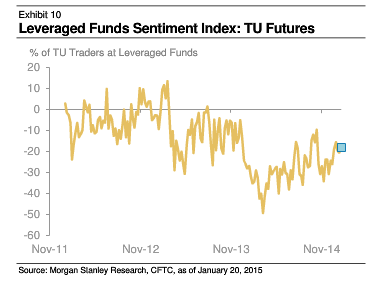

The first chart above shows the VXTYN index over the last year. It has been a clear uptrend with an increase of 26% for the year. There were three large spikes in the last four months starting in October 2014 with the bond flash crash. This is not the same volatility as a year ago. The end of QE has ushered in a new bond vol regime.

The second chart compares the VXTYN bond vol index with the VIX stock vol index. Both are on the rise and both had spikes at the same time. There seems to be a common factor which has driven volatility across asset classes. Sell one asset class and you may be buying another risky asset.

The relative differences in volatility and their changes provide a good foundation for thinking about the stock bond mix for any asset allocation.