"Disciplined Systematic Global Macro Views" focuses on current economic and finance issues, changes in market structure and the hedge fund industry as well as how to be a better decision-maker in the global macro investment space.

Monday, February 28, 2022

Fixed Income Factor Investing - Part III - The Factor Model

Wednesday, February 23, 2022

Fixed Income Factor-based Investing - Part II - The New Versus Tradition Approach

- Individual bond characteristics: size, age, time to maturity, coupon, carry, and premium

- Common characteristics: size of issuer sector, size of country, credit rating

- Group characteristics: Treasury, IG, HY, inflation-linked, subordination, zero coupon, currency, financial, supranational, Agency (government-related)

Tuesday, February 22, 2022

Factor Based Investing for Fixed Income - Part I

Risk factor investing is being applied to all asset classes. The application to fixed income has changed how fixed income managers think about risk and how they build their portfolios. This move to risk factor investing links bonds and stock through common factor definition and measurement.

At some level, the risk factor approach is not significantly different from more traditional bond investing; however, using risk factors allows for codification and commonality of thinking about across asset classes.

There is a size effect associated with total debt outstanding which is a proxy liquidity effect. Value is tied to price variation such as option-adjusted spread. Momentum is based on past return behavior. A low volatility effect associated standard deviation, and an interest rate and liquidity effect.

The strong advantage of risk factor investing is that it can effectively characterize the risks faced with holding any bond.

Monday, February 21, 2022

9, 7, 6, 4 - what is the right number for Fed rate increases?

There has been a new rate hike forecast from JP Morgan that there will be nine straight Fed hikes. This new forecast is greater than the Goldman Sachs 7 hikes, Morgan Stanley 6 hikes and the many forecasts for at least 4 hikes. The forecast targets are increasing quickly, but there seems to be a growing consensus for a hike at every Fed meeting in 2022. There are Fed meetings in March, May, June, July, September, November, and December with four Summary of Economic Projection meetings on the March quarterly cycle.

Treasury 2-year rates are hovering around 150 bps, about 50 bps higher than 1-year Treasuries. End of the year Fed funds futures are at 150 bps while eurodollar futures to March 2023 are at 200 bps and 175 bps for year end. Hence, the 9 and 7 forecasts are aggressive versus current market discounting.

These hike at every meeting forecasts seems aggressive even though the Fed is behind the inflation reality. Economic numbers will vary through the year and there does not seem to be a consensus to solve the inflation problem especially if growth starts to wane. The core Fed secret is that higher rates to tame inflation are also supposed to slow economic growth. Any success on the inflation front coupled with slower growth is likely to be met with Fed caution to delay action. The go-no-go Fed action will be the market trades driving fixed income.

International diversification - Depends on the business cycle

There has generally been the view that as global markets have become more globally integrated the gains from international diversification have diminished. The evidence supports higher beta from global integration, but data also suggest that there is still benefit from international diversification. (See "To diversify or not to diversify internationally".) The correlations are highly variable and business cycle dependent. The pairwise correlations will increase during global recessions and then move back to their older long-term relationships when the business cycle stabilizes. Hence, there will be breaks in the correlation relationships through time.

This relationship is consistent with a single global shock having a common effect on all risk equity markets. As the importance of a common shock declines, correlations will fall.

The correlation across country indices will also be related to the composition of the country index. When there are similar industry weights, there will be higher correlation. Generally, industry correlations are lower than country correlations and will provide greater diversification especially for less integrated EM markets.

While international diversification benefits have declined with market integration there are still opportunities to exploit differences for return and risk management.

Sunday, February 20, 2022

Goods versus services inflation and the transitory problem

Flows and bond ETFs - Derisking before the Fed

What has been happening with fixed income investing now that the Fed is ready to raise rates and inflation as continued to move higher? As expected there has been a flight out of nominal assets that cannot adjust to higher inflation and will decline in value with rate increases. Since the beginning of the year, billions have flowed out of LQD (the investment grade benchmark), HYG (the high yield benchmark), and EMB (the EM bond benchmark). The outflows have been a significant percentage of assets under management. Trading volume is higher and put option volume has also increased.

The somewhat odd investor behavior is that equity inflows have moved above trend while the cumulative bond flow peaked earlier in January. The Fed may be increasing discount rates, but investors believe that earnings may increase and or corporations will be able to control product prices in the face of inflation.

Saturday, February 19, 2022

Market message - Fed behind the curve and needs to play catch-up

Credit performance masked by duration

Friday, February 18, 2022

Quality factor variables as diverse proxies

"Never bring data to a story fight..."

"Never bring data to a story fight..." - Prof Peter Dodds expert on narratives

This quote is a great commentary on the power of narrative and the buzz kill that data can do to disagreement across narratives. A significant amount of time and effort with investing is associated with telling good narratives. The narrative attempts to provide a clear mental and emotional story. Narrative drives sentiment and interest in stocks and other investments. Narrative serves as a means of condensing a large amount of information into a clear picture as simple as a few words or a long written commentary.

Phrases like "bear market", "correction", "tech rally", or "Fed behind the curve" are the simplest narratives that tries to convey a lot of information without any data. Data eliminate simple stories and closes discussions. Facts don't have feelings, so narratives are debated through alternative stories.

For the quant, data is more powerful in the fight because it is so precise and often without ambiguity. Of course, it needs interpretation which flows back to the issue of narrative, but facts are clarifying. Many would like to ignore the facts and keep the narrative, but in the precise world of quantitative investing, data remains supreme.

Thursday, February 17, 2022

“Science is the belief in the ignorance of experts.”

“Science is the belief in the ignorance of experts.” -- Richard P. Feynman

Macro investing is the belief in the ignorance of central bankers and policymakers...

I have always liked the quotes of Prof Feynman. His quotes have a universal quality and do not just apply to physics which is why I have taken liberties and applied his quote to macro investing. The great macro opportunity is not based on central bankers having the right monetary glide path, but bankers have ignorance with the facts surrounding them.

From the Fed's FOMC minutes we find there is no consensus on policy choices nor on the facts presented. The Fed has not ended their emergency QE4. It is only slowing and soon to end, so liquidity is still being added to the economy. Given all their staff economists there is no agreement on when or how much QT should be undertaken to return to normal.

There is not even agreement on the raising of rates. Is the economy so fragile that it cannot withstand a 50 bps hike? Is the economy so fragile that cutting $40 billion from their balance sheet each month for the next year will lead to instability? $480 billion from a $9 trillion balance sheet or approximately 5% of the total and 10% of the liquidity added since March 2020.

Assuming policy ignorance is what will allow many macro investors a chance at big money.

Sunday, February 13, 2022

Moscow Rules - Good for traders

- Assume nothing.

- Never go against your gut.

- Everyone is potentially under opposition control.

- Don't look back; you are never completely alone.

- Go with the flow, blend in.

- Vary your pattern and stay within your cover.

- Lull them into a sense of complacency.

- Don't harass the opposition.

- Pick the time and place for action.

- Keep your options open.

Saturday, February 12, 2022

Which investment factors are hard to measure? Risk factor measurement as art

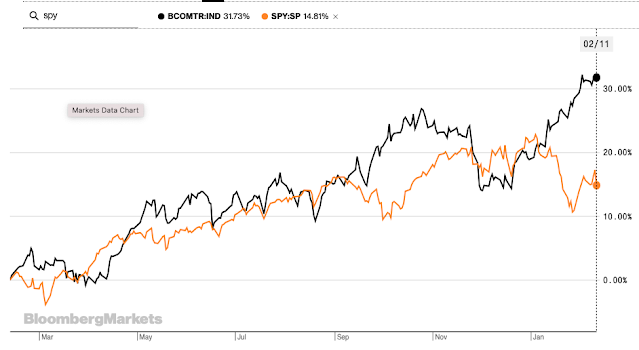

Is this a molecule crisis? Commodities continue to surge with backwardated futures

“I’ve been doing this for 30 years and I’ve never seen markets like this. This is a molecule crisis. We’re out of everything, I don’t care if it’s oil, gas, coal, copper, aluminum, you name it we’re out of it." - Jeff Currie Goldman Sachs commodity analysts

These markets can be described as super-backwardated with textbook shortages. If you cannot get inventory or believe there is a threat to your normal levels, you will pay a premium for convenience - the convenience yield with current prices higher that back month futures. There is no normal carry with these markets in the front month futures.

We have referred to this as the switch from just-in-time to just-in-case inventory management. (See "From just-in-time to just-in-case commodity markets") It makes even more sense if price trends are going higher - a positive feedback loop. Hold inventory based on the threat of stock-outs and receive a gain from higher trends.

The cost of holding inventory is also insanely cheap if there are negative real interest rates. I don't want to use the word hoarding, but everyone who needs commodities want to stockpile in this environment which is one of the problems in an inflationary world - expectation start to adapt to a new environment.

Note that the commodities have underperformed over the last five years. The stockpiling mentality has taken hold in the last year. The upward trend accelerated with the surprise increases in inflation. Geopolitical uncertainty associated with Russia has only added to the stockpiling mentality.

These price increases are not likely going away in the current macro environment. Real rates are at extremes and a set of 25 bps Fed increases is not going to change this environment. While China is not on the same high growth path of the last two years, it is being offset with the potential for better growth in the rest of the world. Of course, this is more of a hope than reality given the declining growth estimates of the IMF last month (4.4% from 4.9% for global growth).

A greater long-term problem is the capital expenditures in extractive industries. These are not good industries in an ESG world. Traditional agriculture is also on the list of less ESG friendly investing. Commodity super-cycles are based on less capital expenditures in key commodity sectors.

Friday, February 11, 2022

"History is particular, economics is general."

"History is particular, economics is general."

- Charles Kindleberger

Economists love to generalize even if at the extreme when the sample size is one. Take any event and an economist will try and find some commonality with theory and past events. It is what they do. Behavior repeats and the job of the economist is to find the repetition and suggest predictions about future events.

Historians often look to the particular and unique facts about an event. Generalizations can be boring. Being able to find the unique catalysts is the exciting part of history. There is generalization but the focus is on getting the details right.

Some investors are generalists while others look for uniqueness. Quants are like economists who generalize to find repeatable patterns in past events to make predictions on the future. Deep value investors will act like the historians that are focused on the particular that cannot be generalized.

Tuesday, February 8, 2022

Playing the likelihoods during Fed changes

One of the big problems of macro investing is determining the odds when there are only a limited number of events. Macro investors often must make judgments when the sample set is well below the number thought appropriate by a statistician, the magic N=30.

It may not always be pretty, but you must extrapolate with what is available based on some theoretical foundation. Investors form rational beliefs, not rational expectations. Beliefs can differ based on the same data, but only one can be correct as events unfold.

Quantitative easing and tightening are a perfect example of the sample problem. We have four easing, two QE taperings, one quantitative tightening, and one QT tapering. This is little to work with, so reality has to be coupled with theory. Nevertheless, JP Morgan has provided a good visual as a guide. A single sample requires our theoretical intuition.

The general view is that stock returns will be weak and 10-2yr spreads will decline. The past is not destiny, but the market is already following a pattern of the past from the sample of one.

Saturday, February 5, 2022

Cryptocurrencies - What are factors are they related to?

The complex ecosystem for gaining crypto exposure

Friday, February 4, 2022

Is Bitcoin (BTC) "digital gold"? Ethereum (ETH) "digital oil"?

Bitcoin is mainly a store of value and has taken on the features of gold for many investors. Gold has been the alternative to fiat currencies. For many, the limited supply relative to fiat currencies make bitcoin a worthy substitute. It also has the characteristics of gold in that it is not easy and cheap to use as a medium of exchange. It can fill this exchange role given its dominance in the marketplace; however, other cryptocurrencies may do it better. The metaphor breaks down when the volatility of Bitcoin is compared with gold. A chart of the differences makes gold look like it has flat-lined over the last few years.

Ethereum is general purpose blockchain developed for smart contracts and Decentralized apps. As a network and platform, it allows for innovation and other alternative uses within the crypto ecosystem, smart coins; consequently, it has characteristics of a "fuel". The platform allows for conversions at low cost. This ability to be used as a platform for other medium of exchange activities suggest that it may surpass BTC as tool for crypto growth.

To further push this metaphor, holding BTC and ETH is like holding a basket of commodities. Both have unique value.

Thursday, February 3, 2022

Crypto correlation - no clear relationship with hedge funds and equities

Cryptocurrencies and crypto hedge funds have a return performance life independent of other asset classes and strategies. This is one of their clear benefits but also the reason for why many investors have a problem with crypto. It is not clear what are the drivers for return. Certainly, crypto has moved higher with the stock market and has gained from the excess liquidity across global markets; however, finding independent drivers for price has not been easy. Some simple analysis from FactorResearch tells the story.

The correlation between crypto hedge funds, the S&P 500 and the top 50 hedge fund index shows both negative and positive correlation over the last six years. The correlation has ranged between -.6 and .8 with more recent numbers again closing in on zero.

Applying known investment strategies to crypto asset makes sense, but it cannot be expected to have the same return patterns.

Wednesday, February 2, 2022

The continued search for yield - You cannot have everything

I’ve never heard such a chorus of repeated phrases such as “fixed income replacement” and the “new 40.” - John Bowman CAIA comments at Miami hedge fund conferences

The drumbeat continues for changes in the 40% of the classic 60/40 stock/bond mix. Dump the fixed income and get some alternative investments. This alternative theme has been around for years but has increased in intensity - don't think of hedge funds as high-performance strategies but as substitutes for the low performance bond portion of an asset allocation.

Some have taken this anti-bond view to an extreme, see "Endowments and equity factor - Just too much exposure?", yet there is still an inertia with many concerning fixed income. It has been a good hedge and many think it will continue to be a good hedge. The facts suggest otherwise as the stock/bond correlation has turned positive.

The problem is that investors cannot have everything with their fixed income. Real rates are negative and there is little near-term improvement. Inflation may revert from current highs, but without a significant increase in nominal yields, real yields especially for short maturities will be unattractive.

A combination of low yields, negative returns, and a positive correlation to stocks make alternatives much more attractive, but there still needs to be a focus on the switching of risks.

Hedge funds need to show positive real returns if they are to be an effective alternative. Right now, there is a five percent inflation hurdle for alternatives. This seems like an easy threshold to beat; however, alternatives still must deliver. If there needs to be a real return as compensation for risk, the nominal returns should be well north of the 5% level.

Fixed income Treasuries are usually a liquid investment. That assumption has been tested in March 2020, but generally it still holds. Moving to alternative investments will have a liquidity cost that needs compensation.

By most definitions, moving out of Treasuries or liquid bonds will require taken on more volatility and increase investor risk. Anything other than Treasuries will require taking credit risk.

There is a continued search for yield, but investors should not just look for close substitutes. The search for yield must include appropriate compensation for risk and liquidity.

Tuesday, February 1, 2022

Equity duration and the current sell-off - all about timing and discounting cash flows

There has been some compelling research work that focuses on the timing of equity cash flows, or equity duration, to explain some of the recent movement in cross-sectional stock behavior. The basic investment idea is that the concept of bond duration can be applied to equity cash flow timing. If cash flows are backloaded, an equity will have a longer duration from stocks that have cash flows more certain and clearly defined in the near-term. The implications are clear from the classic formula for duration which accounts for the timing of cash flows.

The equity that has longer duration will be more sensitive to changes in the discount rate and changes in the distant cash flows. Hence, if there are rising rates, these equities will see a greater negative impact. Of course, these stocks have benefitted more from low rates in the post GFC period and during the most recent decline in rates. (See "Equity Duration" for a recent example. The equity duration idea has been kicking arounds for more than two decades but has recently been given new focus.) Nevertheless, there is compelling evidence that low duration stocks should do better than long duration stocks.

Determining the timing of cash flows for equities is not an easy problem. Equity duration can be measured through several unique but justifiable models: cash flows, growth forecasts, and bond-beta approaches. It certainly is more difficult than any calculation of a bond's duration where the cash flows are well-defined. The idea of an equity duration can be contrasted with other risk factors, but the true value comes from the primal nature of focusing on cash flows.

Equity duration can account for the wild swings in price of growth stocks that will be affected by expectations of long-term cash flows. Long duration will be more sensitive to cash flows volatility and changes in the business cycle and will be more susceptible to stock mispricing.

The low duration stocks have the same characteristics as value, high profitability, low investment, and low risk stocks; however, the link between duration and value is not one for one. Both have value for measuring differences in stock risk.

Equity duration is intuitive and can provide another way to look at factor risks that are helpful with explaining some of the differences cross-sectional stock behavior.

Factor performance in bull and bear markets - Diversification in bear market is valuable