"Disciplined Systematic Global Macro Views" focuses on current economic and finance issues, changes in market structure and the hedge fund industry as well as how to be a better decision-maker in the global macro investment space.

Monday, February 3, 2025

The focus on the Eurasian continent

Tuesday, January 21, 2025

The different presidential ages and finance

The world of polar regimes impacts capital flows

Sunday, March 3, 2024

Disorder - Hard Times in he 21st century - Expansive read on current times

Helen Thompson, a professor of political economy at Cambridge, has written an expansive book, Disorder: Hard Times in the 21st Century, on the current disorder around the world through three histories. She looks at the geopolitics of the last century, the world economy, and the changes in western democracies. All are in disruption and face uncertainty. All are integrated and lead to a single story. Interestingly, all are tied to the economics of oil.

This is a dense book with an expansive vision of the world order. Do not expect this to be a fast read, but the result is a deeper understanding of how the world is connected.

Why is this critical for macro investors? The reason is simple, global uncertainty will lead to market disruptions. You need to know the drivers of disruptions. Why is this critical for quant investors? Regimes change and model sensitivities will change with regime switches. If you are not aware of the global disorder, you will be subject to forecast biases and losses.

Friday, December 29, 2023

Multipolar world and investing money - ambiguity drives down correlations

The key issue for international investing over the long run is whether the world is a single pole, bipolar, or multipolar set of interests and country alignment. Clearly, we moved from a bipolar world after the collapse of the Soviet Union to something closer to a singular pole. Some will say that we have a new bipolar world between the US and China, but the close interconnection between these two countries makes it hard to argue from a trade perspective regardless of rhetoric. Nevertheless, a bipolar world seems more likely as Russia and China have moved closer through trade and politics There is also a strong view that the world has turned multipolar with a broader set of competing interests across a diverse set of countries.

Is India in a single center of interest or is it something unique? Is the Middle East in two centers of influence or is it more ambiguous? Is Latin America a separate sphere of influence? The world is more complex and less clear-cut in 2023 than 1993 or 2013.

Trade lines especially with emerging markets are moving closer to a China-Asia focus than an US-EU focus. Financial flows are still dominated by the dollar, but these capital flows have been disrupted by political drama through growing sanctions. Countries want to become less dollar dependent even though it may be harder to do in practice because being on the wrong side of US policy can be harmful.

While we may not have insight on the changing tectonic shifts in geopolitics, we can say with certainty that the higher ambiguity of political relationships will place downward pressure on correlations across countries. A multipolar world will also create greater shock risk from alignment adjustments. EM risk higher in a multipolar world.

Monday, March 21, 2022

Reputation, cancel business, and sanctions

Even before sanctions, firms have been exiting their businesses in Russia. Importers have self-sanctioned and reduced exposures. Banks have stopped financing Russian trade. Some of these actions were under the expectation of sanction, but it also has been an attempt to maintain reputation. Especially in a cancel culture environment, it makes perfect sense to act first before shareholders and customers question or protest you lack of response.

Reputations has real effect on stock prices and risk premia. A declining reputation will cause investor exits and thus needs to be managed. Reputation can come in several forms:

- Marketing - Branding - Better perceived products will command premium pricing.

- Regulatory - fines, penalties, and lawsuits - A more reputation from regulatory issues will be costly.

- Quality - Poor quality and service will destroy firm value.

Notice that choosing who to source for firm inputs and have as customers is not usually thought of as foundational to branding, yet it is now critical. In the case of Russia, this type of branding has been front and center in the news. The size of Russia's raw material exports coupled with their active aggression on another country makes this reputation issue too hard to ignore.

Below we show a simple framework for categorizing at reputational risk. It can take the form of a reputation-reality gap, changing beliefs, and poor internal coordination. A loss of reputation is hard to regain and can have lasting damage. Reputation cannot be seen in the accounting numbers; however, a decline in reputation capital is measurable with share prices as investors cancel those perceived as engaging in questionable practices.

From HBS article "Reputation and Its Risks"

Monday, March 14, 2022

The New Globalization "Dark Ages"

We have entered the new "Globalization Dark Ages". Global trade is not done, but the golden age of globe trade is no more. It may have end pre-COVID. It was on the ropes during COVID. The globalization end has come through global sanctions and not COVID restrictions.

We should see a reversal in trade growth because the foundations of globalization have been destroyed. Sanctions of goods and finance are now a serious global tool of economic warfare that affects all countries, producers and consumers, exporters and importers. In a sanctions world, there is no free trade just allowed and not allowed trade. Free trade is now determined by government policy.

Cancel and isolation are the new means of global warfare. Trade war has been taken to a new level. We are not saying that these actions are unjustified, but the implications are profound and will not be reversed with a flip of a switch. Can we really expect trade and direct investment will return soon if the war in Ukraine ends tomorrow?

Multilateral trade driven by the rules and norms of WTO is no more. Companies are pulling back from global aspirations even without being told by governments to stop dealing with some bad actor countries. Trade is moving from multilateralism to bilateralism as sides are chosen.

Global financing of trade and foreign direct investment is not just in peril but has swiftly ended. There are no safe assets given a world of electronic money transfer isolation.

We are moving from low mercantilism to strategic country production as a protection against trade autarky and isolationism. National interests are served by isolation. There is a new Iron Curtain based on a wall of trade and finance limitations. Instead of keeping labor in, the curtain is keeping goods and capital out. Trade shunning.

The triumph of a multinational corporate model has ended and is reverting to a model of corporations serving the interest of states. There is no reason for multinationals to be everywhere if the threat of sanctions are real. The political threats are not just from the host country restricting behavior but the home country stopping corporate action.

Supply chain logistics focused on global cost efficiency will be replaced with supply chains based on national threats and the avoidance of sanction risks. Alternative sourcing is now a critical strategy.

The source of fungible commodities is now relevant. Oil is not oil. It is biased by being Russian oil. Wheat is not wheat but Russian wheat. Sanctions against commodities coming in and export restrictions on goods coming out of a country.

Every country will be an island or at best part of archipelago of countries not based on a region but on politics. Empires and commonwealths of similar interest will replace free trade. There will be a new equity risk premium associated with sanction risks. Investors will need a premium for multi-national firms.

Sunday, March 6, 2022

Ice-nine - sanctions and the international payments system

Ice-nine is the fictional material appearing in Kurt Vonnegut's novel Cat's Cradle. Ice-nine is supposedly a polymorph of water more stable than common ice; instead of melting at 0 °C, it melts at 45.8 °C. When ice-nine comes into contact with liquid water below 45.8 °C, it acts as a seed crystal and causes the solidification of the entire body of water, which quickly crystallizes as more ice-nine.

Restrictions in the international payments system and sanctions can have the characteristics of ice-nine. Assets and institutions that are sanctioned can freeze up the financial system because everything that it touches may turn into a frozen asset. If you hold Russian assets or currency and it cannot be transferred or uses as collateral, other assets will freeze or become illiquid. Banks, funds, or indices that hold or have Russian assets are impaired. If the Russian central bank cannot employ its assets, liquidity is frozen across Russia.

The situation will get worse if energy payments are included in sanctions. We are already having the situation that Western countries do not want to buy Russian energy products. Oil is selling at deep discounts and there are limited buyers for refined products.

So why hasn't the ice-nine effect fully kicked in? A close look is that there is a difference between sanction and bank restriction announcements and reality. There have been delays in implementations and carve-outs that reduce the financial freeze and allow banks and firms to get prepared for the freeze; nevertheless, it is happening and there are going to be repeats to what was seen during the GTC. Like the Lehman event in 2008, the ripple effect can be much greater than just the size of the obvious assets. Financial ice-nine exists.

Saturday, January 1, 2022

The big systemic risk - the need for stability and order

Systemic risk usually focuses on connectivity, technical details, and specific market failures and not broad failure of governing institutions. Yet, the stability of the global order provides an environment for other more micro issues to take center stage for investor concerns - which is a good thing. When the global order is disrupted, there will be less investment and. a flight to safety because the animal spirits of optimism are curtailed.

Perhaps not so hidden in the pandemic is a turning away from experts and government institutions. Whether on the local, national, or international level, the lack of confidence in the current order will have an impact on financial investments.

How can rising systemic risk be the case when we just had equity returns (SPY) of close to 27 percent for the year? Fiscal and monetary largess with pent-up demand was able to mask declining confidence, but globally there is less confidence in governments being able to articulate and address crises. The institutional glue that will bind behavior in a crisis has weakened which increases systemic risk. The failure of order at the local level will then play-out across countries.

Unfortunately, this cannot be easily measured or isolated through some quant model. This is the essence concerning animal spirits and investment confidence. There is no easy measurement of optimism in the face of uncertainty. For Keynes in the 1930's, it was the role of government to prod aggregate demand and get confidence rising. However, if there is less confidence in potential solution providers, the threat of systemic failure increases. Yes, while this is pessimistic, discussing the systemic risk framework is critical for any 2022 predictions.

Friday, October 15, 2021

Geopolitical risk - Not getting enough attention?

Monday, April 12, 2021

Geopolitical risks - The spillover to markets is real

Geopolitical threats create risk and uncertainty. This seems intuitive and can actually be measured through tracking geopolitical risk indices. These threats can be linked to market reactions, so investors can measure and act on these evolving risks. Below is the widely used Geopolitical threat index developed and updated by Matteo Iacoviello. It uses key word searches from leading newspapers around the world to measures geopolitical threats and acts. In many cases, elevated threats will impact financial markets.

A common theme of my investing thesis has been to focus on the nexus between risk, uncertainty and pricing. If uncertainty increases, it will carry over to market risk as measured by volatility. This increase in market risk will add to market dispersion, change correlations, affect risk aversion and sentiment, and change risk premia. Even if market prices don't move significantly, there will be a change in the wings of return distributions.

Markets that engage in global trade in sensitive geopolitical area or have been perceived as a place of safety should be more sensitive to changes in these threats. Threats go up and there should be a flight to safety and a movement out of risky assets.

A causal link from geopolitical threats spillover to oil price volatility and gold moves has been found with recent research. Similarly, threats influence the capital investment decisions of companies. This alternative data index can help with global macro decisions.

See recent research:

“Are geopolitical threats powerful enough to predict global oil

price volatility?”

Environmental Science and Pollution Research https://doi.org/10.1007/s11356-021-12653-y

“Geopolitical Risk and Corporate Investment” Ruchith Dissanayake, Vikas Mehrotra, and Yanhui Wu

“Hedging geopolitical risk with precious metals” Dirk G.Baur and Lee A.Smales Journal of Banking & Finance Volume 117, August 2020,

“Forecasting realized gold volatility: Is there a role of geopolitical risks” Finance Research Letters Volume 35, July 2020

Thursday, December 24, 2020

Animal spirits, declinism, and policy choices that will impact asset allocation

For Keynes, markets are often driven by animal spirits, the optimism or pessimism that exists when the future is highly uncertainty. When uncertainty is high, the normal tools of valuation and analysis are ineffective. Investors just don't know and have to rely on their feeling of optimism or pessimism. In a depression or recession, pessimistic animal spirits drive decisions. A recovery occurs when sentiment changes to optimism. There is no question there is a current sense of financial optimism; however, this euphoria may not be matched in the real economy. More optimistic animal spirits will drive the US economy beyond catch-up to long-term growth.

Declinism, the belief that the United States is sliding irreversibly from its preeminent status, has been a major theme of the last four year and will be the key theme for the next four years especially if there is a desire for stronger long-term growth. Declinism talk started much earlier but has swept into the general political discussion in more tangible and extreme forms of political choice.

The declinism solution is centered between two extremes for policy. One position has been it can be arrested through unilateralism and a reversal of the liberal globalist order. The alternative position also believes declinism is caused by inequality and a lack of global cooperation that needs to be addressed through social and economic restructuring and the rule of international law and cooperation. Both argue for a change in the behavior and structure of the United States; nevertheless, the choice of direction will impact the longer-term pricing of financial assets and the potential for sustained growth.

Investor allocations will be making a choice on whether declinism can be reversed and the policy form necessary for the reversal. The success of risk-on asset allocation will be determined by the declinism solution accepted by the public and how that path forward will improve both the US and the global economy. Any end of declinism will be coupled with a sense of optimism that problems can be overcome and that investment will be rewarded and productivity enhanced; however, the policy choices will impact the form and placement of the optimism. Investor should consider alternative declinism solution paths.

This discussion may be an abstraction, but sustained financial gains needs to be coupled with a robust economy that moves beyond a story of COVID recovery.

Wednesday, October 14, 2020

Political Risk Assessment - Big exposures are often under evaluated

Sunday, July 5, 2020

Biggest long-term threat in 2020 - Deglobalization

Everyone talks about the economic wall of worry, and the wall seems to be getting taller. Pandemic. Recession. Credit issues. Lockdowns. Nevertheless, these worries will pass. They are cycles, shocks, and bumps. They do not define our global system of trade and benefits. Policy-makers can see the immediate harm and are using their set of policy tools to dampen and reverse the negative effects.

Unfortunately, the longer-term worry that will stick with all economies is our trend to cut connectedness, globalization. This worry does not have a set of voices or policy prescriptions to offer as solutions. There are no current advocates against deglobalization, yet trade and the broader term of globalization has been the key generator for world economic growth.

The free movement of labor, capital, ideas, goods, and services across time and space has created enhanced economics opportunities for most and explosion of a middle class in emerging markets. These flows have driven global growth in spite of the financial excesses and shocks over the last few decades.

If the current globalization era ends, all economies will suffer, and no localized or national policy will solve the problem. There is a need for worry because globalization is not something that just happens. It is not inevitable. It takes work. Mercantilism is often viewed as a natural policy when countries think trade is a zero-sum game.

History has shown surges in world economic growth when there has been more freedom of global trade and financial flows. The great globalization surges include the pre-WWI period, the Bretton Woods period, and the China-WTO period. All were associated with national and global structures open to international flows, technology that allowed for low flow costs, and organizations that could coordinate economic activity.

Globalization has been under assault for some time. Some of the arguments against globalization are relevant, should be heard, and require adaptation, but the fundamental premise of globalization is being questioned. This generalized globalization assault is misplaced. Globalization is disruptive and will thus create both winners and losers. The wins will often be dispersed while loses will be focused. Hence, reaffirming the benefits of globalization requires constant reinforcement, yet also requires an appreciation that competitive trade may need localized support for those most disrupted

Barriers to trade are being erected with tariff growing as a normal tool. Pandemic has restricted travel and the flow of labor. Regulations impeded the flow of capital. The global institutions of cooperation have failed at their mission. New and longer-term geopolitical tensions further erode the desire for cooperation and increased national competition.

None of these trends toward deglobalization will be reversed without a conscience choice for global integration and cooperation. There needs to be champions for globalization that provide advocacy with candor; however, there first needs to be a recognition that deglobalization is a problem that needs to be solving.

Wednesday, March 18, 2020

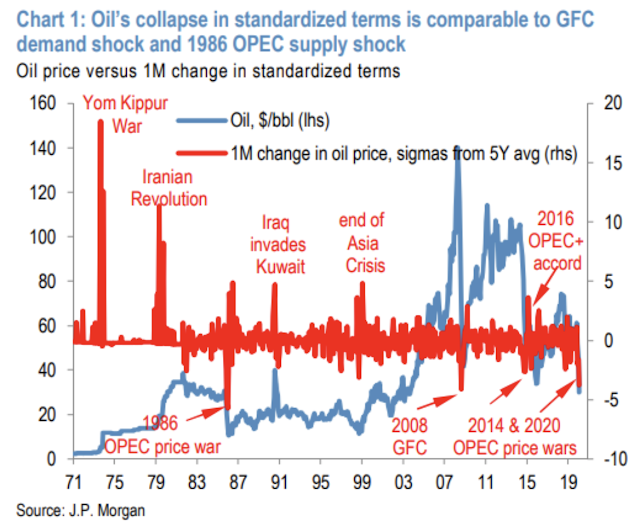

Geopolitical battle for oil - The other shock

Private companies through US frackers are now the dominant producers of oil, and the state-run companies don't like it. Private firms are not innocent in this fight but as small firms they are driven by marginal cost considerations and the demands of their shareholders and lenders. State firms are bigger players, yet they cannot bend the will of global oil consumers when they lose market share.

While this is a Saudi-Russia quarrel on the surface, there is private firm fall-out. With a demand shock forcing prices lower, the state-run firms have an opportunity to grab market share and put the private producers out of business through using their lower marginal costs and higher financial pain thresholds. Although this may not have been conceived as a master plan earlier this year, the situation has evolved. Russian intransigence on production cuts has caused a Saudi production increase response to teach Russia a lesson on market power. The collateral damage but added benefit from the view of both Saudi Arabia and Russia is fracking shutdowns. A combination of higher marginal costs and high leverage make these firms vulnerable even if they have engaged in aggressive hedging programs. Forcing prices lower in the short run is possible through having deeper cash reserves and the ability to borrow. Those refinancing and funding in the high yield market will be casualties.

Sunday, December 15, 2019

Use the BlackRock Geopolitical Risk Index as a substitute for year-end reviews

The index is worth watching for any investor that focuses on risk-on/risk-off (RORO) factors. The index is especially helpful when in transition. Rising (falling) geopolitical suggest a time to move from risky to safe assets.

Thursday, November 7, 2019

Geopolitical risks have fallen - Another good sign

Is the world safer or less risky? That question cannot be answered, but a normalized measure of geopolitical news narratives can tell us something about whether these risks are a focus for investors.

Friday, September 8, 2017

AllianzGI Risk Monitor survey - Geopolitical risk on the rise, requires special thinking

Saturday, April 30, 2016

Structural checklist for investment headwinds

A structural headwinds or tailwinds checklist groups or categorizes issues that may provide a tilt to returns. These tilts on expected returns may lead investors to make a tilt or base adjustment to asset class allocations. Instead of starting with a base allocation of zero, there could be a negative or positive base allocation.

There could be more categories to this checklist, but these eight may get any discussion started. Some of these issues can be quantified, but we believe they often cannot explain short-term variation except if there is a shock. These factors can have an impact on returns through impacting the risk premiums in markets but only over long horizons.

Structural headwinds - A checklist

- Demographics -

- The era of aging is upon us and it has an impact on capital flows and savings rates; just ask Japan or Europe. Demographics may include issues like the flow between rural and urban areas in China. It will drive return patterns even though it will not affect short-term volatility.

- Government -

- The type of government that is in place will affect investment options. Government impacts could include gridlock. Venezuela is a perfect example for where government matters. The same can be said for Argentina or Russia.

- Regulation -

- The Dodd-Frank regulation has an impact on returns but it is hard to model the impact directly. All of these rules on banks impact credit and the financial sectors. More regulation will have a greater impact on small cap stocks.

- Elections -

- BREXIT will impact all of the globe. The US presidential election may have a profound change on trade and global relations. The election dates are well known and may outweigh other model factors.

- Geopolitical risks (war - terrorism)-

- These risks usually lead to shock effects, but the changing probabilities of geopolitical risks will impact all returns; nevertheless, it is hard to include in any model.

- Global trade -

- This factor refers to the overall integration of capital, labor, and good around the globe and not the trade balance of any one country.Globalization will impact capital market integration will effect the correlation across markets.

- Climate - weather-

- While there has been much talk about climate change, the impact on investment returns is less clear-cut. Obviously, there are weather events that impact returns, but these can be diversified.

- Technology -

- Technology can provide a boost or a drag on specific industries. In the global macro arena, the impact of technology is less clear but the impact of technology on finance is real and does affect liquidity which is being priced in the markets.