Investment and economic views concerning China are key to global market success in 2023 especially since there is the view that the US will likely be in a recession starting in the second half of the year.

There is a clear geopolitical risk based on the tensions with the US surrounding trade and Taiwan. This uncertainty slows long-term investment. Who will invest in fixed plant and equipment when the 5 to 10 year horizon is cloudy? This uncertainty only increases based on the unclear market and regulatory environment inside China.

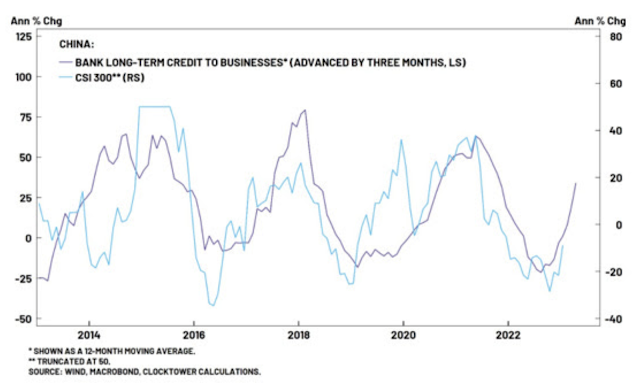

The cloudiness is embedded in stock prices, yet there is a more positive investment message for the short-term. One, COVID restrictions have been lifted. The November rally is clear. Two, there has been an increase in credit available for investment through looser monetary policy. The PBOC is not following the western approach of monetary tightening. Three, the economic data are stronger as presented by the recent PMI especially for non-manufacturing spending. An increase in Chinese consumer spending can be a strong factor for global growth if there is an increase in imports.

No comments:

Post a Comment