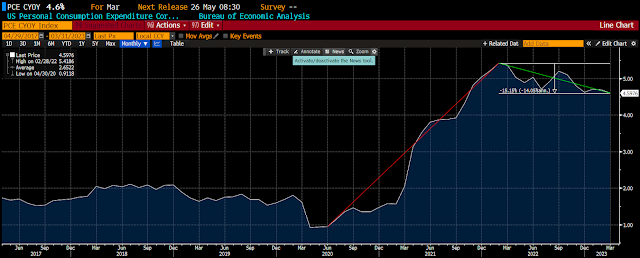

The core PCE YoY is falling, and the trend is lower, but the speed of the decline in not as fast as expected by many economists and investors. This number suggests that the Fed will still have to raise rates. A recession and falling prices are still expected at the end of the year, but investors still need to focus on balancing their inflation/deflation strategy.

The focus must still be on balancing strategies to account for inflation and hold exposure to dynamic strategies like trend-following, global macro, and commodities. Strategy diversification is still critical because the inflation story does not seem to be ending. While from an older piece of research from AQR, the story is the same, diversify. See Fire and Ice: Confronting the Twin Perils of Inflation and Deflation.

A surprise decline in inflation will be good for both stocks and bonds but a surprise increase will be negative for both main traditional asset classes. Commodities will give you protection if we have more inflation, but the decline in a falling inflation environment will be severe. Trend and macro momentum are two places where there is protection from either upside or downside inflation surprises. Given the amount of uncertainty, it is not too late to consider either strategy to reduce downside risk. The current gains in equities and bonds offer investors a chance to rebalance and prepare for any next move in inflation.

No comments:

Post a Comment