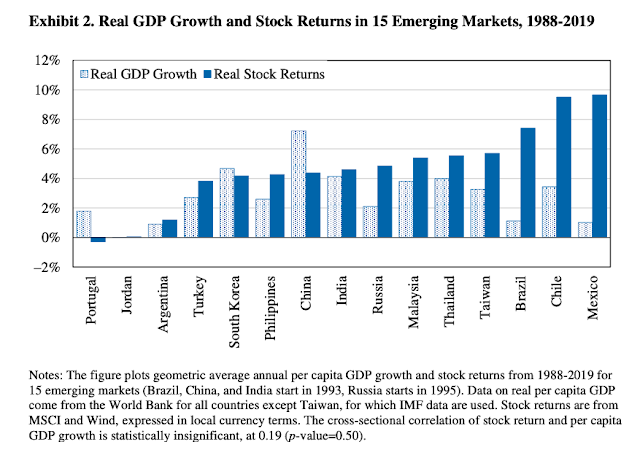

Are emerging markets equity returns driven by economic growth? On a simple level, there should be a link between growth and equity returns for a country, yet nothing is simple. The behavior and valuation of firms is not tied to economic growth as described in the paper, "What matters more for emerging markets investors: Economic growth or EPS growth?" The figure show that for both developed and emerging markets, real stock returns are not correlated with GDP growth. The drivers of stock returns will be tied to the fundamentals of firms within the country index.

However, country stock returns may not be immune to changes in the business cycle and short-term growth. It is important to link macro dynamics to firm fundamentals which will drive conditional returns in the short-run.

No comments:

Post a Comment