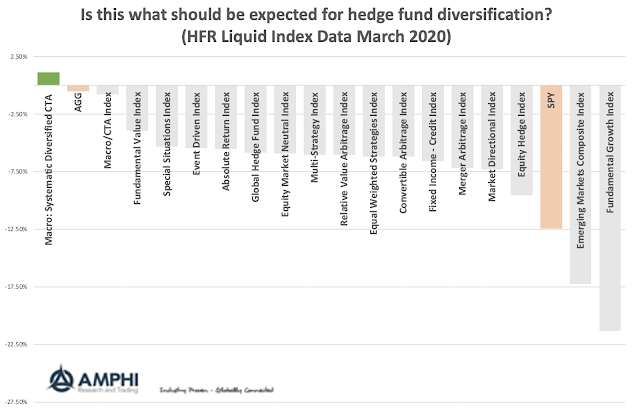

What returns should have been expected from hedge funds during March? There was a wide range of performance across styles. Systematic CTAs generated positive returns and beat all alternatives while emerging markets and fundamental growth indices did worse than the benchmark equity index (SPY). Most hedge fund indices underperformed relative to the Bloomberg/Barclays Agg bond index (AGG).

Given that most hedge funds have equity betas that are between .3 and .7, the average performance numbers from the HFR liquid indices are somewhat consistent with a quantitative estimate, albeit not what investors may have expected.

No comments:

Post a Comment