The economy has now changed forever. It is an often-overused phrase, but in this case, it is true. Look at any macro time series and there is a multi-standard deviation shift down. Call it the COVID-19 recession or the Great Lockdown, it does not matter, the shift changes all forecasting given the size and speed. There was no trend lower. It has been a falling off of a cliff event. This shock is not just a low probability event conjured in our minds. It has happened and now forecasts, and the use of data have to be recalibrated.

Any forecast of the future that employs past data to extrapolate into the future is wrong and not rational. Moving averages on fundamentals are problematic. If you are doing that, stop now. Any data based on pre-March information, is irrelevant for near-term analysis. While assets prices declined with the fundamentals, the post shock links will be harder to calibrate.

There was a structural break that cut the link with past data and forecasts. The work on forecasting time series with structural breaks does not provide easy solutions. The focus of most research has been on finding breaks and regime changes and not dealing with how to forecast after the break occurs.

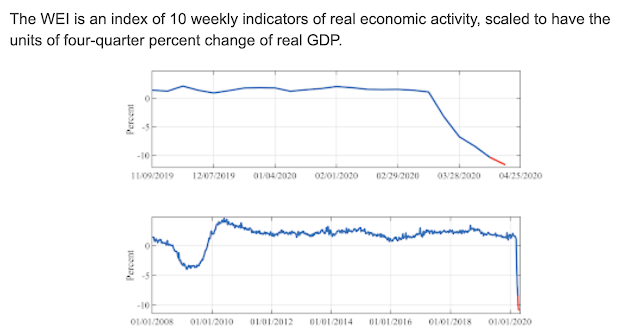

Look at the Jim Stock's weekly economic indicator index (WEI) that is a good example of nowcasting. It is forecasting a double-digit real decline in GDP. This forecast is useful, but the question is how to calibrate new information that can be mapped to asset returns. How do you effectively use the pre-March data?

Initial jobless claims have exploded, but what will be the meaning of a slight decline over the next few weeks. It will be good economic news, but can it be translated into a stock or rate sensitivity that has meaning versus sensitivities in a pre-COVID19 world. There is a significant shadow effect if one looks at say a 12-week moving average. After the last twelfth week rolls off, the new series has disconnected behavior with the past. We are dealing with a high degree of model uncertainty.

Expectations have to be forward looking and use all current information. Adaptive expectations will not cut it, but rational expectations seem somewhat vacuous. In rational expectations, economic agents know how the economy works and these expectations impact the future economic results. There will be mistakes but expectations, on average, will be correct. This sounds good, but what does it mean in a new economic reality. Expectations will impact markets, but it will not be based on knowing the economy. It will be related to rational beliefs based on competing models that may seem rational but cannot all be correct.

Some simple rules:

Any forecast of the future that employs past data to extrapolate into the future is wrong and not rational. Moving averages on fundamentals are problematic. If you are doing that, stop now. Any data based on pre-March information, is irrelevant for near-term analysis. While assets prices declined with the fundamentals, the post shock links will be harder to calibrate.

There was a structural break that cut the link with past data and forecasts. The work on forecasting time series with structural breaks does not provide easy solutions. The focus of most research has been on finding breaks and regime changes and not dealing with how to forecast after the break occurs.

Look at the Jim Stock's weekly economic indicator index (WEI) that is a good example of nowcasting. It is forecasting a double-digit real decline in GDP. This forecast is useful, but the question is how to calibrate new information that can be mapped to asset returns. How do you effectively use the pre-March data?

Initial jobless claims have exploded, but what will be the meaning of a slight decline over the next few weeks. It will be good economic news, but can it be translated into a stock or rate sensitivity that has meaning versus sensitivities in a pre-COVID19 world. There is a significant shadow effect if one looks at say a 12-week moving average. After the last twelfth week rolls off, the new series has disconnected behavior with the past. We are dealing with a high degree of model uncertainty.

Expectations have to be forward looking and use all current information. Adaptive expectations will not cut it, but rational expectations seem somewhat vacuous. In rational expectations, economic agents know how the economy works and these expectations impact the future economic results. There will be mistakes but expectations, on average, will be correct. This sounds good, but what does it mean in a new economic reality. Expectations will impact markets, but it will not be based on knowing the economy. It will be related to rational beliefs based on competing models that may seem rational but cannot all be correct.

Some simple rules:

- Models are now highly uncertain, so an ensemble of models which evolve will be useful. Those models that fail or reveal to be useless should be dropped.

- Work with survey data or data that has short look-back and not subject to revisions.

- Focus on nowcast across a number of variables and limit look-back on times series.

- Highlight structural regime changes from policy to maintain forward-looking forecasts. Use theory to extrapolate the policy impact.

- Conduct and place more weight on scenario analysis. Think of alternative policy and economic outcomes and then handicap.

No comments:

Post a Comment