The combination of trend-following and global macro seems to have significant merit. These two strategies complement each other because their signal generation is different. The work of Aidan Vyas in "Evaluating the Performance of Systematic Trend-following and Global Macro Strategies" develops two strategies and the shows their distinctions and areas for benefit.

Vyas looks at a broad set of countries and asset classes across stock indices, bonds, currencies and commodities and employs GDP growth, inflation, interest rate as a policy indicator, and real exchange rates as key economic indicators within a risk parity framework. Trend signals are based on risk -adjusted cumulative return for three different timeframes (1, 3, and 12 months). The global macro signals are based on the trends in the global macro indicators.

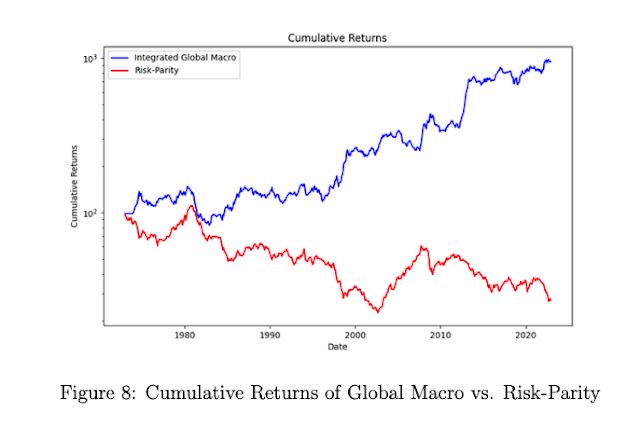

Global macro alone is not much better than a risk parity, but if you add trend and macro, you get a better Sharpe ratio and lower volatility. The macro approach is simple, but it does suggest that diversification of strategies works.

No comments:

Post a Comment