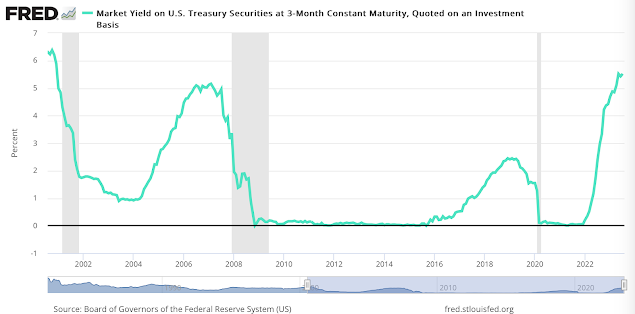

When will we have a normal yield and yield curve environment. First, we lived in a zero interest rate environment that created perverse incentives for investors. There was movement out of cash and bonds - the reach for yield. Now, we have another unnatural yield environment, the strong inverted curve. An inverted curve creates a different set of incentives, the reach for cash. Instead of investing out the yield curve or buying risk assets, there is an incentive to hold cash.

The natural yield and yield curve environment is a nominal yield that is equal to the long-term growth rate plus the expected inflation. The normal yield curve is upward sloping where longer maturities provide investors with higher yield. If there are large deviations from normal you must ask the central bank; what the heck are you - overreacting with loose and tight policies.

No comments:

Post a Comment