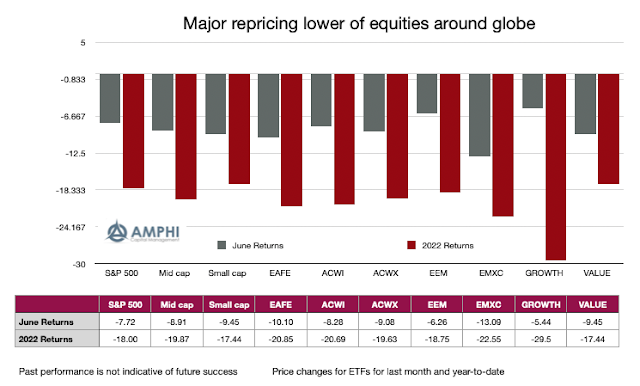

There was no place to hide as assets repriced given the combination of higher inflation and threats of recession. Growth stocks did better than value, but small cap stocks underperformed large cap names.

The real downturn for both stocks and bonds occurred with the FOMC move to increase rates on Jun 14th by 75 bps. The market reacted earlier given the telegraphing of the larger move earlier in the week. The big difference between stock and bond performance is that bonds clawed back loses from the Fed shock under the view that a recession is more likely given the Fed's hawkish tone.

The Fed is not the only central bank pushing rates higher. The exception is the BOJ which is continuing its YCC policy. Bank of China is currently neutral. Consequently, the decline in equities is a global shock. The correlated effect of central banks makes equity repricing a common factor.

The fixed income credit markets continued to fall as expected if equities have a large decline. Treasuries and short duration indices showed modest declines; nevertheless, the fixed income asset class year-to-date returns on a risk adjusted basis are the worst in decades. This may not be easily reversed even if there is a global slowdown.

No comments:

Post a Comment