Classification is static in most sciences. An animal or plant is classified and unless there are some clear mistakes in identifying the species, it will maintain its classification. New species will be added as discovered but there will not be switching. Of course, we have some significant counterexamples like the controversy as to whether Pluto is a planet.

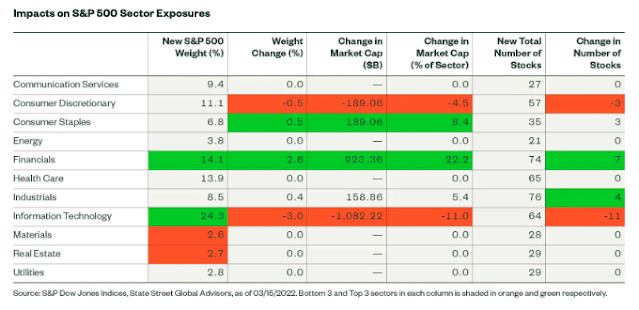

In the case of financial indices, there are dynamic adjustments based on the changing nature of businesses and firms. S&P released classification changes this spring to be implemented in 2023. Below is a list of the new classifications and the impact on S&P 500 sector exposures. There is enough time for firms to adjust, but it is important to realize that classifications are man-made constructs and not a function of some statistical properties.

Correlation differences within an industry may have everything to classification and not opportunities for trading pairs of securities.

No comments:

Post a Comment