Factor investing and analysis are a normal part of equity investing; however, it has not been generally implemented within the fixed income asset class. One, good data are harder to obtain and use. Two, the relative importance versus a benchmark has not been fully analyzed. Fidelity Investments in a white paper has started to do the empirical work and have provided some key insights. Apply simple factor definitions, they find suggestive outperformance especially for high yield bonds. Nevertheless, this work only scratches the surface and needs more careful work.

Using a simple value factor based on spread cheapness associated with a rating, it is found that both investment grade and high yield increase return to risk. The returns are high, but risk is increased so the next effect is limited.

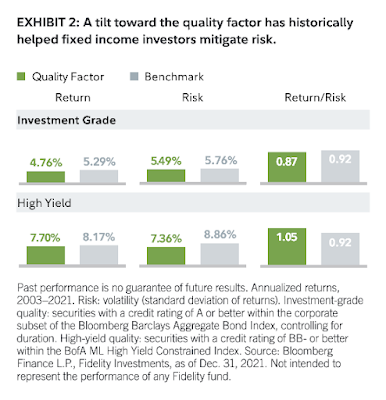

A tilt to the quality factor shows lower returns for both investment grade and high yield; however, there is also less risk. The net effect relative to a benchmark, at least for high yield is positive. Clearly, higher quality firms, lower leverage for example, show less return and risk.

The momentum effect is strong for high yield relative to investment grade. The dispersion of spreads as well as the opportunity for upgrade are greater for high yield so there is more potential return movement for junk bonds.

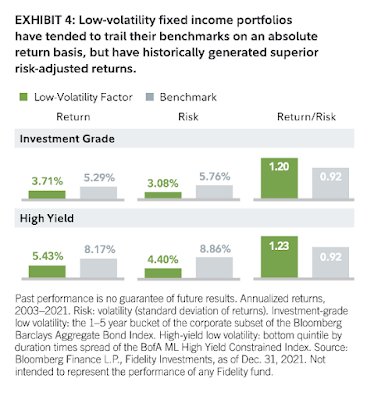

The strongest effect is for low volatility. This is the well-known effect that low duration bonds have a better return to risk. The focus of many managers is in shorter maturity sector.

The other strong factor effect is carry. High current yield will bonds provide more return and more cushion from interest rate changes. This is the case for investment grade bonds. High yield bonds with high carry have much higher risk than a benchmark.

When isolated for the interest rate macro factors, it is found that rate changes dominate bond returns, but if isolated as a floating rate note, credit spread changes dominate returns.

No comments:

Post a Comment