Do you want stable or variable market betas from your hedge funds? This may seem like a simple or even a trick question. Of course, an investor should want stable betas. If you have a stable beta, the gains from diversification can be well-defined and easily measured. Portfolio structuring is relatively easy in a stable world. However, there may be a good case, under certain conditions, for a variable beta.

Adding hedge funds to a portfolio may center around three questions. One, how much return do you want? Two, how much diversification would you like? Three, how much convexity will you get?

A stable market beta below one will provide diversification. Under a stable environment, the return alpha can be measured. A variable beta (regression coefficient) makes it harder to measure the diversification gains or determine the true alpha production, but it does provide the potential for positive convexity. A hedge fund that can generate more beta when the market returns are increasing and less beta when market returns are falling has some very useful properties.

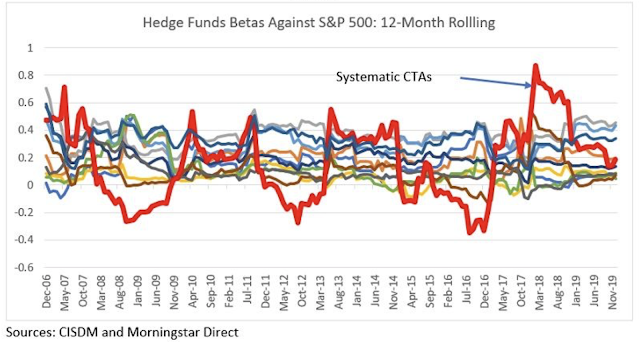

It looks like systematic CTA's, especially trend-followers, may have this property. Generally, CTA's have a long-run low correlation with the market beta, but it also can have positive convexity through its trend-following models. If the CTA adds more relative long exposure to equity indices during rising stock prices, the beta for the fund will increase. The hedge fund generates is positive convexity. In the example, a variable beta is the benefit from trend-following with exposure to equity indices. The variability and sensitivity to market factors is critical for hedge fund selection.

The graph, which highlights systematic CTA's, shows falling and low beta during the GFC and during other periods of equity weakness. It also shows a wide range between .8 and -.3 during the post-GFC. Beta variability is desired if it is tied to correctly taking advantage of the market direction.

Chart and table from All About Alpha:

Adding hedge funds to a portfolio may center around three questions. One, how much return do you want? Two, how much diversification would you like? Three, how much convexity will you get?

A stable market beta below one will provide diversification. Under a stable environment, the return alpha can be measured. A variable beta (regression coefficient) makes it harder to measure the diversification gains or determine the true alpha production, but it does provide the potential for positive convexity. A hedge fund that can generate more beta when the market returns are increasing and less beta when market returns are falling has some very useful properties.

It looks like systematic CTA's, especially trend-followers, may have this property. Generally, CTA's have a long-run low correlation with the market beta, but it also can have positive convexity through its trend-following models. If the CTA adds more relative long exposure to equity indices during rising stock prices, the beta for the fund will increase. The hedge fund generates is positive convexity. In the example, a variable beta is the benefit from trend-following with exposure to equity indices. The variability and sensitivity to market factors is critical for hedge fund selection.

The graph, which highlights systematic CTA's, shows falling and low beta during the GFC and during other periods of equity weakness. It also shows a wide range between .8 and -.3 during the post-GFC. Beta variability is desired if it is tied to correctly taking advantage of the market direction.

Chart and table from All About Alpha:

No comments:

Post a Comment