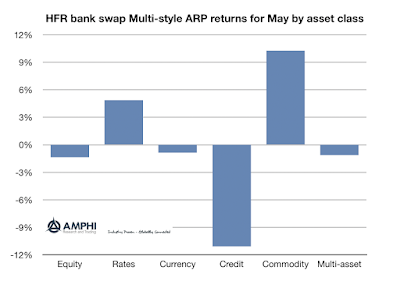

Returns for alternative risk premia for multi-style swaps which include a bundle of different risk premia categories like carry, momentum, and value have performed well this year, but these swap portfolios showed mixed performance across asset classes in May. Equities styles, as measured by the HFR indices, were down slightly with value and carry declining but low volatility and low beta strategies doing well in the declining market beta environment. Rates did well based on the strong bond rallies around the world. Currencies styles were mixed. Momentum strategies did well, but currency carry was a drag. Currency carry has shown to be correlated with equity market beta. Credit was hurt as spreads moved with the decline in equity beta. There is more dispersion with credit risk premia in these indices because there are less bank swap products. Commodity multi-styles were positive; however, many strategies underperformed based on the wide return variation in different commodity sectors. Overall, the multi-styles strategies were negative for the month.

Alternative risk premia have low correlation with market beta, yet that does not mean that there is no correlation with the market. There is good diversification but when there is a large market decline, ARP returns for a number of strategies will be pulled lower. The composition of the portfolio makes a difference when there is a large market move. As expected, more defensive strategies like momentum/trend and low beta did better in these environments. Our overall impression is that ARP portfolio returns were consistent with expectations.

No comments:

Post a Comment