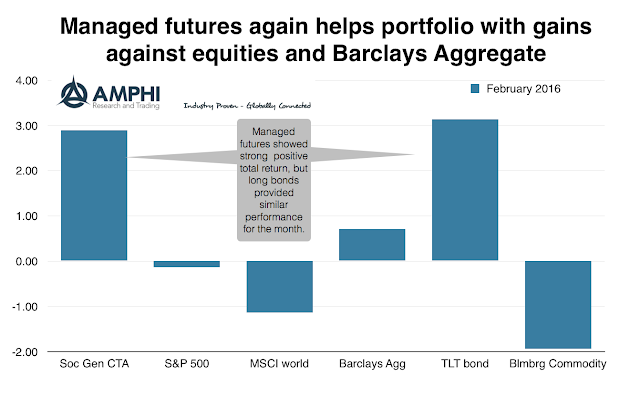

The SocGen CTA index gained 2.89 percent for February and the SocGen Short-term Traders index posted an increase of 2.88 percent for the month. Both indices are solidly positive with 7.19 and 6.47 percent gains for the the year. Managed futures were able to post gains in spite of a reversal in equities to the upside and a stalled bond rally near the end of the month.

Even with the reversal in equity fortunes based expectations of better US growth and continued monetary liquidity around the globe, US equities are down 5 percent for the year. The return differential between equites and managed futures is now double digit. This advantage is even greater for global equities. The Barclays Aggregate bond index is the most often used benchmark for institutional investors. Its returns are more muted than the long bond because of its heavy skew toward mortgages and credit. Managed futures is outpacing this key bond index by 5 percent.

Long bond exposure would have done better over the last two months, but investors would have been taking undiversified risk where the benefit is highly related to the negative correlation between stock and bonds. While the long bond has been the chief diversifier for most investors over the last few years, there is no guarantee that the negative correlation with stocks will continue. There may be further flight to safety, but that only pushes bond risk forward as rates move to lower levels.

Most managed futures funds were able to exploit opportunities across asset classes with gains in equity indices for the first part of the month, bonds, commodities, and selected currencies. Returns will become muted if major trends stall. There may be trend transitions in March but gradual slowing in momentum may allow traders to adjust portfolios. The March FOMC meeting will be a transition point for macro traders.

No comments:

Post a Comment