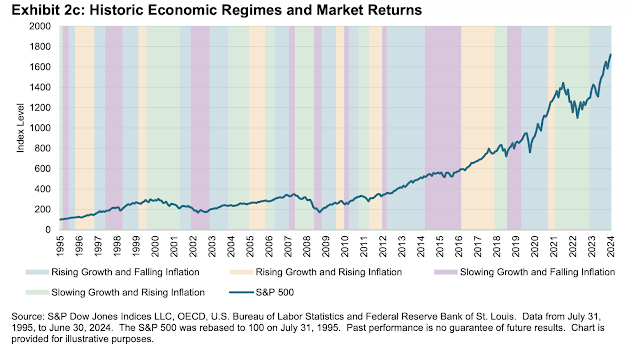

Factor risk premiums are time varying and a simple approach of breaking the economy into a four quadrant macro regime world will have significant benefit. The mayor regime is based on rising or falling inflation and the composite leading indicators for the US. Both are easily obtained, and the four quadrants can be easily generated using monthly information. Based on the factor premium indices from S&P Global Intelligence, we can identify changing factor return profiles. For the full story, see "A Historical Perspective of Factor Index Performance Across Macroeconomic Cycles".

Specific regimes may last for long time periods only to see significant uncertainty as regime shifts come frequently. These factor returns will vary significantly. Clearly falling growth and rising inflation is worst environment followed by falling growth and falling inflation. The best environment is when growth is rising and falling inflation.

The quality factor index shows the best returns overall returns followed by the low volatility strategy. While outperformance and hit ratios are clear during different regimes, the gains may seem small relative to transaction costs, yet a simple strategy of regular rebalancing will lead to significant gains over the longer run.

No comments:

Post a Comment