The "soft landing" meme has taken over the language of the business cycle. The word recession is not used. An economic slowdown below the long-term trend, albeit a mouthful, is not used. We have types of landings, hard and soft.

So how has the Fed done at engineering a soft landing? According to Alan Blinder in "Landings, Soft and Hard: The Federal Reserve, 1965-2022", the Fed has been able to engineer these soft landings in the past although the odds still show a hard landing is possible.

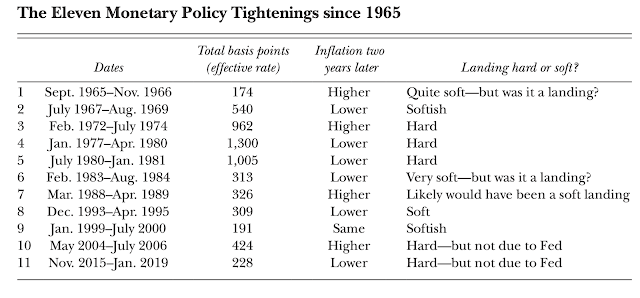

Blinder looks at Fed interest rate increases and then matches with the combination of whether inflation is higher or lower and whether there was a recession. The table shows the size of the rate increase, the direction of inflation, and the landing as measured by whether there was a large or small recession. The figure shows the move in nominal interest rates. We are now pushing 5%.

For the eleven episodes identified by Blinder, five were hard landings but two were not due to the Fed by Blinder's assessment. Seven were soft landings. The odds favor a soft landing but if you condition on the rise in rates, the likelihood of a hard landing increases.

No comments:

Post a Comment