Axioma has a new factor-based risk decomposition that may surprise investors. The conventional view is that high yield returns can be broken into two factors an interest rate component associated with Treasury moves and a spread component that will be related to corporate risk. The corporate risk will be related to a number of factors like the market beta and industry-specific factors.

The Axioma factor-based model uses cross-sectional regression on thousands of issuer duration adjusted spread returns to account for global and regional factors, as well as currency, quality, sector, and style factors.

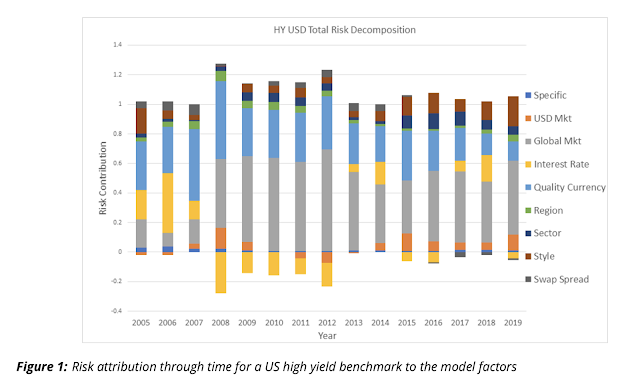

The more detailed analysis provides a more nuanced view of the changing risks with corporate bonds. For example, the risk contribution from interest rates can flip between positive and negative. Global markets were a small contributor to risk in the pre-crisis period but has dominated the high yield market since 2008.

The Axioma factor-based model uses cross-sectional regression on thousands of issuer duration adjusted spread returns to account for global and regional factors, as well as currency, quality, sector, and style factors.

The more detailed analysis provides a more nuanced view of the changing risks with corporate bonds. For example, the risk contribution from interest rates can flip between positive and negative. Global markets were a small contributor to risk in the pre-crisis period but has dominated the high yield market since 2008.

The decomposition shows that global market risk is still the key driver of risk and seems like a good proxy for spreads. In some sense, high yield spreads are just a different proxy for market risk. The risk decomposition does identify a more complex set risks which may not be obvious to investors. The idea that holding credit as an alternative to market risk should be reviewed carefully.

No comments:

Post a Comment