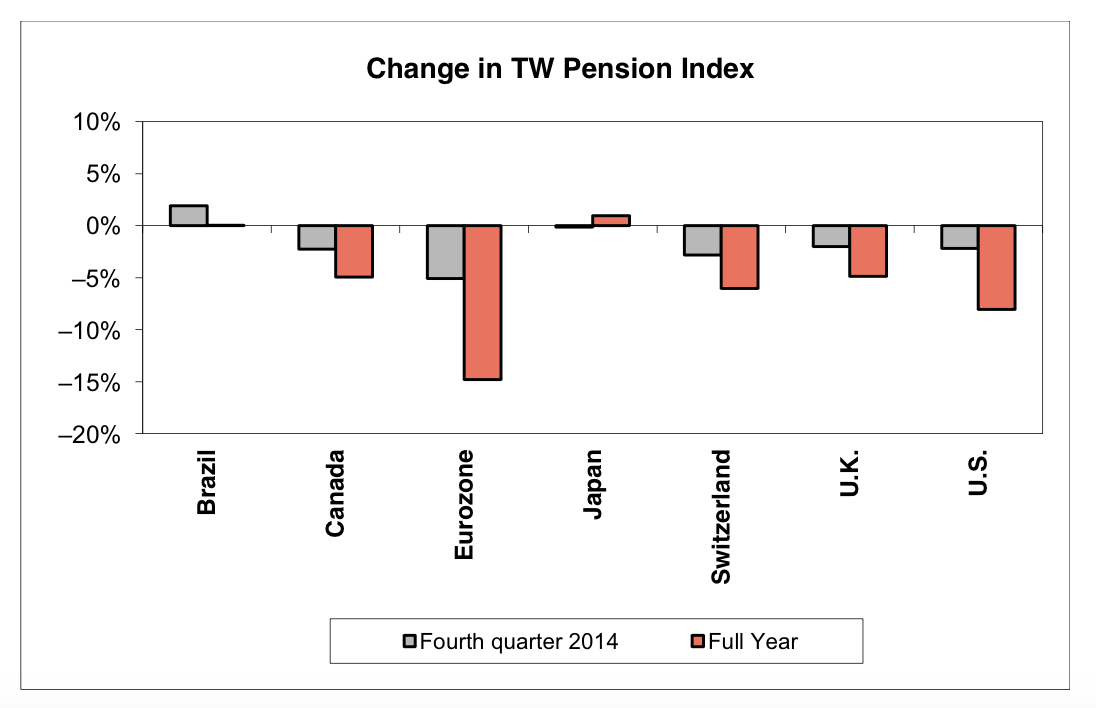

The Towers Watson pension index is the ratio of the market value of assets to the project benefit obligation for a benchmark plan. It tells us the amount that is funded or covered by the pension versus its obligations. One minus the index tells us the shortfall. The markets had a good year in 2014 but that does not mean that pension have closed their gap against obligations. If rates fall, the current value of future obligations increases. Pensions have to add more money to cover the shortfall or get higher returns to offset the interest rate decline. Now the value of bonds increased in most portfolios but if the assets did not match the liabilities, there will be a shortfall.

The decline was especially pronounced in Eurozone, but the other major countries in the survey also showed increased shortfalls. The chart for the US shows the index approaching 70% which is 10% lower than what was seen pre-crisis.

Pensions need assets that can generate returns that are close to their discount rate but also provide diversification benefit. If hedge funds want to grow assets, they have to provide a solution to this problem.

No comments:

Post a Comment