There is a Gordian Knot with asset allocation as we move into 2016. The problem is simple but fundamental to all asset allocation this year. If interest rates are going higher, what happens if stocks do not go higher. Moving out of bonds and not stocks may not protect principal. The premise on switching between these two assets classes is based on the negative relationship between stock and bonds that have existed for a fairly long time albeit not guaranteed. Investors are in a difficult situation of the negative correlation does not exist in 2016.

The 2016 assumption is that the Fed will normalize rate and we will thus see higher rates across the yield curve. The higher rates are based on expected higher inflation and higher growth. If there is higher growth, there will be an expectation for higher earnings based on higher sales which will boost stock prices. Similarly, there will be higher inflation if there is a higher growth. Because earnings are adjusted with inflation, equities will be a better asset or hedge if there is inflation. The result is a negative correlation between stock and bonds. If you don't like bonds, you should like stocks. If you cut your bond exposure, then you should increase stock exposure. But what if this relationship does to hold?

How do you protection principal and reduce risk if the negative correlation between stocks and bonds does not hold in 2016. You are stuck in a horrible investment situation if rates rise and stocks fall. This is easily possible if the risk premium on bonds increases even though there is no further economic growth. It is possible the Fed raises rates in a bad economic environment. The only solution to this problem is to find non-correlated assets to stocks and bonds. You have to find alpha generators.

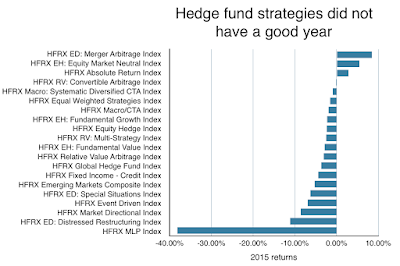

Alternatives serve as the solution to this two asset class allocation knot problem. This is why the recent JP Morgan Institutional Investors 2016 Survey shows the largest net change in alternative allocation decisions going to global macro. 16% of survey participants expect to add to this strategy. Unconstrained long/short beta can get around the problem of changing asset class correlations. This knot solution is why there has been continued interest in alternatives even though there has been significant under-performance relative to hedge fund return targets.