Several good graphics places the current Fed tightening in perspective.

First, the current tightening cycle has a long way to go when we look at the actual inflation levels. The tightening cycles over the last 30 years have all been at inflation rates below 4 percent.

Second, the amplitude of this tightening is now near all-time highs, but it has been achieved much quicker than any other tightening cycle. This speed may suggest that the Fed may slow increases so that it can determine the impact of policy.

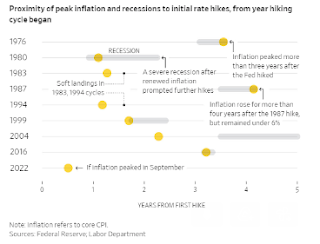

Third, there is often a long delay between the first price hike and the peak in inflation and a recession. It is hard to link fed action with what may happen in the real economy.

Investors should accept that high rates from the Fed may be with us for some time.

No comments:

Post a Comment