"Disciplined Systematic Global Macro Views" focuses on current economic and finance issues, changes in market structure and the hedge fund industry as well as how to be a better decision-maker in the global macro investment space.

Saturday, January 29, 2022

Machine learning, deep learning and creating an investment edge

The problem of "should" and "is" with investing

"Market should do X, therefore I will do Y."

"Market is doing X, therefore, I will do Z."

One word separates the difference between the two statements above, yet that makes all the difference in the world.

The "should" investor believes that he understands market dynamics and behavior better than the market itself. He has a view of value and believes that he has predictive behavior. "The market should reaction to the Fed." "The market should rebound." "This stock is overvalued and should decline."

The "is" investor believes that all key information is wrapped in the price. The trend-follower is the perfect "is" investor. "Prices are rising, there is a trend, and I should buy the trend." There is less analysis and more acceptance of what the weighted opinion of all market players is telling us.

The believer in efficient market falls within this class. The investor who can express behavior in probabilities can be an "is" an investor. However, there is a difference between saying there is a likelihood and saying the market should behave in a certain manner.

It is hard for many to always be an "is" investor. We would like to be a wise "should" investor; however, the should investor usually does not have a good track record. Hence, it is critical to understand and appreciate the difference between should and is.

Thursday, January 27, 2022

Equity investing - It is all about the timing of cash flows

Equity investing is all about cash flows - how large will they be, and when will they be coming. If you can get the guess on cash flow right, you will be a good investor. Yet, forming future cash flows is not easy. Extrapolation usually does not work because there will be fluctuations with the business cycle. Some industries will react quickly to a macroeconomic shock while others will see slow reaction. There will be industry leaders based on cash flow reaction and laggards. Given this differential timing, laggard industries can learn from leading industries, which is the view of researchers who have written the paper, "The Leading Premium".

The researchers find that those industries that are leaders receive a meaningful premium relative to lagging industries. This empirical result makes sense on two levels. One, industries that will reach strongly and immediately to macro growth shocks will price in a premium for the added risk. Two, leading industries tell us something about future risks for lagging industries. Leaders resolve uncertainty for laggards.

The authors do some heavy lifting to show the lead-lag relationships between growth and industries, but the story makes sense on an intuitive level. The difference in earnings (dividends) and thus pricing between leading and lagging industries is a forward equity premium. Industries that will have a strong and immediate reaction to a macro shock will have more risk than those that lag a macro shock. Sensitive industries will generate a premium and provide insight on the less sensitive industries.

Tuesday, January 25, 2022

Yes, there is opportunity for macro trading with equities

The macroeconomic regime matters. Regardless of style, if you tilt to industries that have historically had higher Sharpe ratios in different economic regimes, investors can add value to their portfolio. Call it industry business cycle rotation, but accounting for simple macro regimes to industry allocations will improve portfolio performance.

Industries will perform differently across the business cycle, but many have viewed that predicting the macro regime is difficult. A careful research paper takes a relatively simple approach to address this problem and show macro timing value. (See "Does History Repeat Itself? Business Cycle and Industry Returns".)

Industry Sharpe ratios can be categorized across business cycle regimes. Given this information, the researchers make a judgement of the macro regime based on the output gap at the end of the year for the next year. Sorting the industries between long and short portfolios, it is found that buying high Sharpe ratio industries conditional on regime will outperform the market portfolio and a short portfolio.

Monday, January 24, 2022

Limited upside for stock and bonds over the next 5 years

Equity markets are still overvalued, and yields are still at low levels. This combination does not look good for estimates of asset class return for the next five years. The simple approach of 60/40 stock/bond allocations will disappoint relative to the last five years.

From the AQR return estimates, which are similar to what is calculated from other firms, the expected real return for US equities is below 4% and real yields between credit and government bonds is at best zero. Surprise inflation or a recession will only make these estimates worse.

These poor return forecasts have been made for the last few years and they have proved wrong. The better performance than expected is associated with exogenous factors like strong fiscal stimulus and loose monetary policy which provided an offset to what should be considered normal conditions.

It cannot be assumed that governments can or will prop-up financial markets, so investors must look at other asset allocations to provide extra return. International diversification will help, but the only real alternative is to play style factor diversification. Even this diversification play will only 1-2% real return but that will add close to 50% extra return in the current unfavorable environment.

Saturday, January 22, 2022

Is this what a return to normalcy looks like in the stock market?

The SPY ETF benchmark has peaked. The Russell 2000 broader market has moved to negative returns for the last year, and the froth in the IPO markets as measured by the IPO ETF has moved this benchmark back to levels consistent with the SPX index. You may not like it, but it is a return to market normalcy. However, there is still a threat to something much worse.

Thursday, January 20, 2022

From just-in-time to just-in-case commodity markets

There has been a significant change in inventory management thinking around the globe. Businesses have moved from a just-in-time philosophy to a new just-in-case mentality. A just-in-case environment is rather simple, build and hold more inventory than previously viewed as optimal. Don't rely on the transportation system or better logistics to meet the threat of stocking-out. Across the board from raw commodities to finished goods, holding more inventory is the new normal.

For commodities, the traditional wording is that there is a higher convenience yield from holding inventory. Markets should show more backwardation in forward prices. 2021 was difficult supply year with excess demand versus expectation yet backwardation is found across most markets in 2022. Looking at March to December 2022 contracts, the higher March values as of January 19th are significant:

Corn 5.46%

Wheat 0.64%

Soybeans 6.02%

WTI oil 9.35%

NY coffee 2.07%

This is great news for long commodity holders; nevertheless, a measure of lower supply congestion will be a decline in backwardation. The last decade was a period of lower backwardation relative to the 90's. Commodity index holders were disadvantaged especially in the energy complex that saw strong contango. The long period of high market contango may be over.

Trend-following and crisis alpha - Style, timing, and market selection determines benefits

Wednesday, January 19, 2022

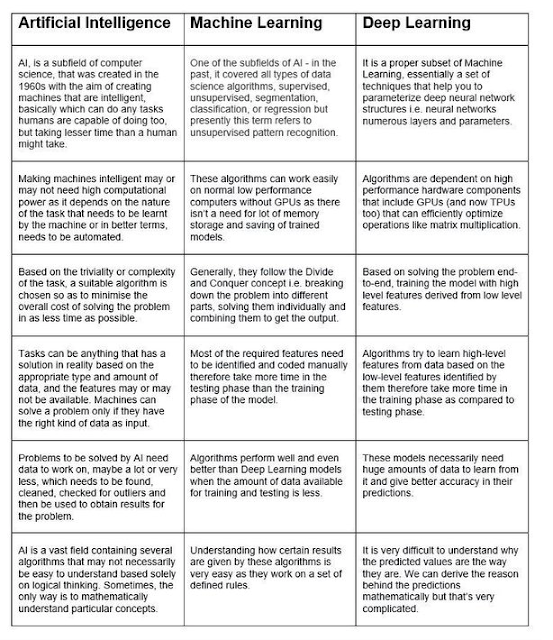

Machine learning provides significant value for asset pricing

Machine learning can add significant value for investors who employ these predictive tools as an alternative to traditional regression analysis. A comprehensive study of equity prediction using machine learning shows a significant improvement in out of sample R-squared.

This added predictive value is seen across a variety of machine learning techniques. Using machine learning also allows investors to identify the most informative predictive variables. Just as important, the more expansive list of predictors with different specifications and functional forms employed with machine learning allows for an improved understanding of the drivers for stock prediction. (See "Empirical Asset Pricing via Machine Learning")

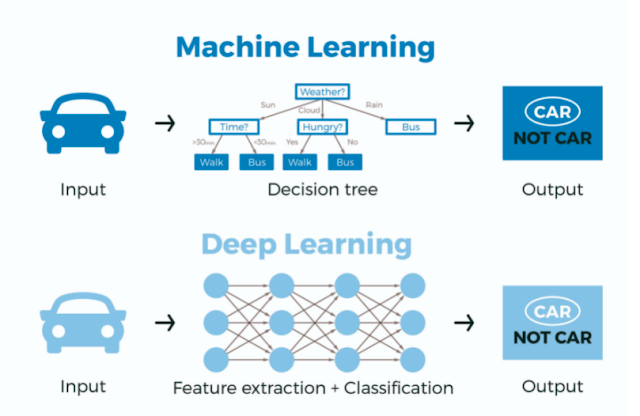

The authors provide a good three-part definition of machine learning:

- A diverse collection of high dimensional models for flexible statistical prediction.

- Regularized methods for model selection and overfit minimization to ensure high out of sample performance.

- Efficient algorithms for searching among a large set of model specifications to control computation costs.

Monday, January 17, 2022

Dispersion heralds the ascent of stock-pickers and active managers

Valuation dispersion heralds a new era for stock-pickers and active managers. If there are greater difference in valuation across firms, there will be a greater opportunity for stock-pickers to find cheap and rich equities.

Clearly, some of these opportunities have already presented themselves during the transition from tight to wider dispersion. Tight stock dispersion suggests that there is a single factor that may be driving all stocks. Notice the tight dispersion during the GFC, when the focus was on the recession and financial crisis. Dispersion has increased during the pandemic because COVID has not had a single effect on the market but has had a differential impact across industries.

Differentiation between sectors will reduce correlation across stocks and will allow those who can effectively identify stock differences to generate excess return in a way that cannot be found with passive indexing. Dispersion does not guarantee excess returns, but the set of opportunity will improve.

Saturday, January 15, 2022

Completion portfolio investments - A fad or something worth considering

A relatively new area of investment research focuses on portfolio completion. Given investors have a target or reference portfolio based on asset classes and style exposures, the completion strategy or manager will find gaps between the reference and actual portfolio that can be filled with asset or strategy mixes by a completion manager to close the gaps. If this is done as an overlay, the adjustments can be made without disturbing the existing portfolio mix. This will reduce transaction costs and manager adjustments.

Recent interest in completion strategies has increased with the rise of factor strategy risk identification. In an older world that only focuses on asset classes the completion manager would only have to look at actual allocations against the target and then use futures or index products to close the gap.

When investors focus on style risk, the completion problem becomes more difficult. First, there are more degrees of freedom or choices that must be managed. Second, the instruments that can be used to close gaps and complete the portfolio are more complex. Third, investors must think through the appropriate target levels for style risks and then determine whether any style gaps should be closed.

Is this a fad? I don't think so.

1. Investor should have a target or reference portfolio. No surprise here.

2. The target should consider risk or factor exposures. Again, this should be done regardless of any completion strategy although style exposure analysis is not easy process to manage in practice. This becomes more difficult when the investor has a high exposure to alternative investments.

3. Measuring and determining the deviations from target is the core asset allocation job of the investor.

4. Using completion specialists to manage this process and providing guidelines for how this job should be done is where there is room for discussion.

There is commonality between the overlay and completion manager. Both exist to cut specific risk exposures. Perhaps the fad is in the naming convention between overlay and completion. There is a place for the completion manager to get the actual portfolio back to target quickly and efficiently at low cost. The value for completion increases when there is a higher exposure to illiquid private and alternative investments.

Friday, January 14, 2022

Endowments and equity factor - Just too much exposure?

- Endowments are well diversified across managers but their overall high stock allocations with limited alpha suggest that underperformance is driven by high fees. Reduce fees and returns will go up.

- US endowments have a high home bias / US dollar bias. If something goes wrong in the US, there is limited diversification benefit.

- Endowments have an extraordinary high risk exposure to equities, much more so today than in the past. Stocks and a small allocation to cash are their current version of the endowment model.

- Risk tolerance has increased significantly given this high stock allocation. An endowment may not even be fully aware of its more aggressive tendencies given the trustees have not likely changed.

Machine learning and portfolio optimization

The core problem of mean-variance optimization is not with employing an optimizer but choosing the expected return for the stocks to be selected. The optimizer will do a good job of selecting stocks given the expected returns, correlation, and volatility provided. However, if you get the expected return wrong, the optimizer has limited value. Using past returns does not work. Forming some expected value using linear regression may provide some improvement, but the variation explained through most of these models is low. These approaches may have theoretical validity, but their predictive power renders poor results.

Instead of throwing out optimization completely, machine learning can be employed to improve the expected return predictions. Different machine learning (ML) techniques have been compared with linear regression predictions and it has been found that these ML tools will often beat the traditional finance techniques. By ranking expected return using ML tools, the optimizer can then form portfolios that have a better chance for success.

ML focuses on prediction and optimization techniques focus on building diversification with constraints. The division of tasks allow for specialized skills and allows for a clear breakdown of value-added between tasks. The success of the ML can be measured by accuracy predictions. The success of the optimizer can be measured through portfolio efficiency. The two can be used to build better portfolios.

Thursday, January 13, 2022

Narrative drives return - even if stories do not generate measurable risk

Wednesday, January 12, 2022

Trend-followers - A multiple naming convention problem

Not all trend-following strategies are the same. This is well known, but there is a naming convention problem for this style. A trend-follower in name is not always the same as being a trend-follower. Truth in advertising - those who call themselves trend-followers many not solely use trend strategies. There is no standard to say how much percentage of risk capital needs to be associated with trends to be called a trend-follower.

Trend-followers can trade futures, but do not have to use these instruments. There can be non-futures trend-followers. Most trend-followers are CTAs, but all CTAs are not trend-followers. Most trend-followers are involved in managed futures, but all managed futures managers are not trend-follower.

The largest CTAs are trend-followers. The oldest CTAs are trend-followers. The largest and oldest managed futures managers are generally trend-followers. Many interchangeably use the words trend-followers, managed futures, and CTAs. Some say trend-followers are part of the momentum style which creates another area of confusion.

I don't think there is another alternative investment style that has this naming convention problem. Poor classification and definitions lead to confusion and misperception. There are still many differences in trend-followers between the markets used, the timing horizon for trend identification and the style of risk-taking and trend measurement. This style does not need further complexity through mixing non-trend investment decisions.

Tuesday, January 11, 2022

Systematic investing - Reducing the noise from discretion

Monday, January 10, 2022

Cheers for plain English in investment management

It’s too much to expect the people who run big Wall Street firms to speak in plain English since so much of their livelihood depends on people believing that what they do cannot be translated into plain English. - Michael Lewis The Big Short

Quantitative analysis has generated major improvements in our ability to trade and make better investment decisions, but quantitative work that cannot be easily explained is detrimental to good investing and can lead to greater market failure. Models will fail, but for investors there is a second level of failure from surprise. The model you thought would work doesn't at critical times.

All quantitative analysis (in fact all investment work) should explain in plain English:

- How it will potentially add to return or reduce risk

- How it works at a level that can be understood by an average investor not just CFAs, MBAs, or PhDs. To say it is understood means that the average investor can explain it to another investor and field questions.

- Why it is needed - the investment problem that need to be solved, what is being counted or measured in the case of a quant model, and why a level of complexity or specific technique is needed over a simpler approach.

- When it will work and when it will not; no surprises for a model breakdown.

Friday, January 7, 2022

No drag from commodities - now bonds are the drag for risk parity portfolios

One of the great advantages and problems with risk parity portfolios has been the cyclical differences between commodities, credits, equities, and bonds. The different cycles for major asset classes are one of the key drivers for diversification. The problem is that an equal risk-weighted long-only portfolio will suffer from the switching in cycles.

Thursday, January 6, 2022

Asymmetric globalization - at the country level closet mercantilism

A current systemic risk is the continued asymmetric globalization between the US and China. Remember the "Chimerica" meme that was the rage in the post-WTO period. That is over. Asymmetric globalization may not be shock threat, but it is a risk that drive markets lower.

China would like to disconnect with the West but still accept capital, western institutions, and technology on its own terms. China would like sell goods to the West and only import capital goods that will further improve their terms of trade or technology. China would like to control commodity imports to ensure that they are not dependent on other countries. Trade will have to be strategic. The US would like to be more strategic with China trade, but the particulars are less clear.

A key tension between countries is the move to globalization versus a form of modern mercantilism. In the case of the US and China, there is often globalization rhetoric and mercantilist behavior. The producer country wants to have open markets but also control its internal positioning against multinational control. The importing country would like more control over imports but realize the cost of import limits in the short run are high.

The asymmetric globalization becomes more obvious when culture and political systems clash, but it exists in many countries - a desire to be export globalists but import mercantilists. Asymmetric globalization is also played-out at the class level. Rich countries or rich educated individuals are clearly more pro globalization than poor countries and less educated classes where the benefits may not seem as clear.

This asymmetry affects all global and EM equity and fixed income benchmarking. It also affects all companies that have China revenue and capital exposure or China companies that have listed in the US. How should you allocate capital when this country threat exists? If you have not addressed this question, you are behind the curve in your asset allocation.

Sunday, January 2, 2022

The negative bond/positive stock return of 2021 - will it continue?

There is a trade-off between stocks and bond returns. For the entire post-GFC period, the return correlation between these two has been negative, yet generally, both assets generate positive returns in any given year. The stock-bond asset allocation mix provides diversification with limited cost - the pain from holding bonds is limited.

While negative returns for both asset classes have been the exception (2015, 2018), there have been a few years when stock returns have been positive and bonds negative. The poor bond performance in 2013, 2015, 2018, and 2021 has a lot to do with the low yield for bonds in a zero-rate environment; however, except for 2021, these years were also low inflation periods.

Gold, oh so old school - no interest in the precious metal

Saturday, January 1, 2022

The big systemic risk - the need for stability and order

Systemic risk usually focuses on connectivity, technical details, and specific market failures and not broad failure of governing institutions. Yet, the stability of the global order provides an environment for other more micro issues to take center stage for investor concerns - which is a good thing. When the global order is disrupted, there will be less investment and. a flight to safety because the animal spirits of optimism are curtailed.

Perhaps not so hidden in the pandemic is a turning away from experts and government institutions. Whether on the local, national, or international level, the lack of confidence in the current order will have an impact on financial investments.

How can rising systemic risk be the case when we just had equity returns (SPY) of close to 27 percent for the year? Fiscal and monetary largess with pent-up demand was able to mask declining confidence, but globally there is less confidence in governments being able to articulate and address crises. The institutional glue that will bind behavior in a crisis has weakened which increases systemic risk. The failure of order at the local level will then play-out across countries.

Unfortunately, this cannot be easily measured or isolated through some quant model. This is the essence concerning animal spirits and investment confidence. There is no easy measurement of optimism in the face of uncertainty. For Keynes in the 1930's, it was the role of government to prod aggregate demand and get confidence rising. However, if there is less confidence in potential solution providers, the threat of systemic failure increases. Yes, while this is pessimistic, discussing the systemic risk framework is critical for any 2022 predictions.

Long-run commodity prices - it is all about cycles

Inflation is high relative to past few decades, but there will be mean reversion and many commodities which have risen significantly will revert to the mean. While many think of commodities as an inflation hedge, it is important to review the long-term cyclical nature of commodity prices. For many commodities, the increases over the last two years are market specific.

We can focus our attention on three commodities, crude oil, copper, and wheat. The three charts are in log scale. The speed of the oil increase was unprecedented, prices are well below the extremes even after the GFC, but these increases are related to returning demand and some production constraints. Copper prices are near all-time highs, but these levels are associated with the current demand for copper for the green revolution and the great build in China since 2000. Wheat prices are near highs from a decade ago based on weather shocks for key growing areas.