Most investors have heard about Black Swans over last decade. Now we have investors seeing Black Swans all over the market, but there are others in the animal kingdom that may be as dangerous. I refer to Grey Rhinos and White Leopards. These risk animals are more likely to be encountered than a Black Swan. Nevertheless, some of these other animal metaphors can be better controlled than a Black Swan. First, let's define some of the animals in the risk kingdom.

Black Swans are unknown events that are not obvious to most investors. Their very trouble comes from the fact that they are unknown unknowns that can have a sizable impact on an investment portfolio. By definition, you cannot predict or handicap these events although you know that they are possible.

Grey Rhinos are a very different beast. They are big and obvious. You will see them coming but often we choose to ignore the risks they represent. We under estimate their size and their speed. You may not think they are close, but with a running speed of close to 40 mph, a Grey Rhino can be next to you before you know it.

The White Leopard is a stealthy creature that stays hidden through effective camouflage. Its risk is out in the market wilderness. You know it exists but it remains hidden until it is almost too late. It is not a true unknown, but something that could be in plain sight if only you knew how to identify the risk.

For Black Swans, the strategy is to maximize diversification to protect from the unexpected. The other alternative often discussed for dealing with Black Swans is a barbell strategy of holding limited risk that you can lose and use the rest of the assets for principal protection. For Grey Rhinos, you have to act on these obvious risks and tilt exposures away from these potential problems before they arise. The White Leopards require more work. These risks are not obvious but they are only a surprise if you are not prepared. Think of all of the investment fraud cases as clear examples. The risks were present just hidden from those not looking for them. If an investor does not do his homework, he will be subject to surprises from ignorance.

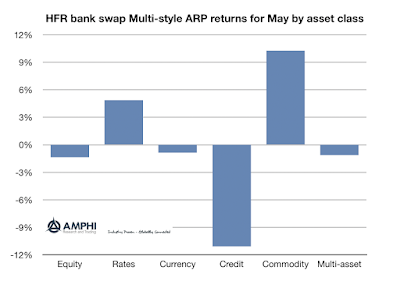

The zoo can be expanded but there are some simple dangerous risk animals. A simple review of the current investment world suggests that we can face all three of the animals described. There is the Grey Rhino of the credit markets. There are the White Leopards associated with some of the fund surprises we are seeing in Europe with illiquid assets, and there are the potential geopolitical surprises that can hit at any time like a Black Swan. An investor going out in the investment jungle needs to be prepared for almost anything on their journey.