"Disciplined Systematic Global Macro Views" focuses on current economic and finance issues, changes in market structure and the hedge fund industry as well as how to be a better decision-maker in the global macro investment space.

Friday, December 31, 2021

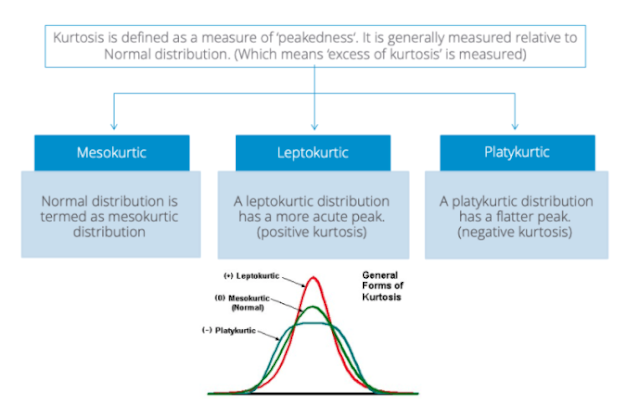

The shape of things to come -platykurtic

Thursday, December 30, 2021

Over-fitting and under-fitting and model building

Overfitting can be thought of as fitting the model to noise, while under-fitting is not fitting a model to the signal. In your prediction with overfitting, you'll reproduce the noise, the under-fitting will just generate something close to the mean.

Overfitting: Training: good vs. Test: bad

Under-fitting: Training: bad vs. Test: bad

One will expect that there will be more shrinkage or difference between training and test results for an overfitted model.

Under-fitting - missing parameters that are important with explaining some relationship or making a prediction. Under-fitting can be in the form of choosing an inappropriate specification. For example, a linear model will always under-fit a non-linear relationship.

Training error will decrease as more features are added which is good, but like many things too much of a good thing will have adverse consequences. Validation error should also decline with more features, but there is a limit to this improvement. If validation error starts to increase while training error continues to decline, then there is overfitting.

In the back of your mind, the modeler should always have the trade-off graph between complexity and error. More complexity and the training error goes down, but test error will be higher. For simple models, the training error is higher, but the test error may be lower. The same can be shown in a variance-bias trade-off graph.

Wednesday, December 29, 2021

Any fool can make a fortune, brains needed to hold onto it

Any fool can make a fortune, it takes a man of brains to hold onto it after it is made - Cornelius Vanderbilt

This quote is sticking with me as all the passive long beta investors laugh at the low performing hedge funds. I am not trying to be an apologist for hedge funds. They have gotten their flows and fees. However, there is the current investor belief that holding long beta portfolios indicates astute investment skill. It could be, but the more likely case is that inertia kept investors from further action. The fortunes of the lucky?

The question for 2022 is whether investment inertia will still be a winning strategy. Following momentum and maintaining a core allocation is still a good strategy, yet the issue is whether this is the best way to hold onto pandemic wealth. After the March 2020 crisis, the shift to pandemic-sensitive firms and a return to normalcy were the key trade themes.

Is the same pandemic/normalcy portfolio the best way to hold onto the pandemic equity bump? With higher inflation, less stimulus and a different pandemic risk, the portfolio of yesterday may not fit the circumstances of today.

Tuesday, December 28, 2021

Science and investment ideas progress slowly... death, retirement, and failure

Science progresses not necessarily through bright new insights but "through the old professors dying off" - Eugen von Bohn-Bawerk

"Investment ideas progress not through new ideas but through management retiring...."

"Investment ideas fall from favor through one major drawdown at a time only to return as the next style sees a major drawdown..."

This Bohn-Bawerk made his quote when referring to his precocious student Joseph Schumpeter, the other great economist from the first half of the 20th century, Keynes is the better-known name.

I have taken liberties to apply the idea to investments. Embedded investment ideas will only change when the old guard retires. Management must understand an idea before it is accepted which means it usually has to be learned at an earlier age in some MBA or business class.

If not retirement, investment ideas will fall out of favor with the first significant drawdowns. Drawdowns are failure signals which have to be replaced with a new idea. Idea chasing is ongoing with most money management firms. Failure will beget change which will be replaced after another failure.

Monday, December 27, 2021

Inflation narratives vary across groups - The reason for markets

Inflation forecasts vary because there are different implicit models used by the forecasters. Put differently, different groups have different inflation narratives or stories. This is what makes markets move. As narrative change, markets change.

The stories matter with determining the forecast. These forecasts are rational because they are based on a set of rational explanations, yet all forecasts cannot be right at some end date. You can have rational beliefs but still be wrong.

A recent study (Inflation Narratives) looks at inflation forecasts and finds that there are significant difference in views especially between households and experts. experts place more value on demand factors and less on non-market factors.

These differences show up in one and five-year inflation forecasts. Households have higher forecasts than managers and experts. This issue is not trivial because it shows a dislocation between the real and financial economy. Some group will be wrong, and mistakes will create market adjustments - real and financial.

Sunday, December 26, 2021

Money matters, but credit counts - Follow credit and not just central banks

Money matters, but credit counts - Henry Kaufman

There is significant focus on Fed monetary policy - quantitative easing, tapering, the balance sheet, rate increases, forward guidance, and objectives like FAIT, but these all should tie back to credit.

How much credit will be extended, what will borrowers need, and what will be the risks to creditors? These are all the questions that must be addressed when thinking about the real economic impact of monetary policy. Simply put, does monetary policy facilitate the extension of credit for productive growth?

There is a wealth effect, but the credit effect, the use of borrowed funds to provide future growth, moves economies. Right now, whether total outstanding debt or C&I loans, there is not demand for credit and not of loans being made relative to the growth in the Fed balance sheet.

Tuesday, December 21, 2021

We forgive humans but not machines - Bias against algos

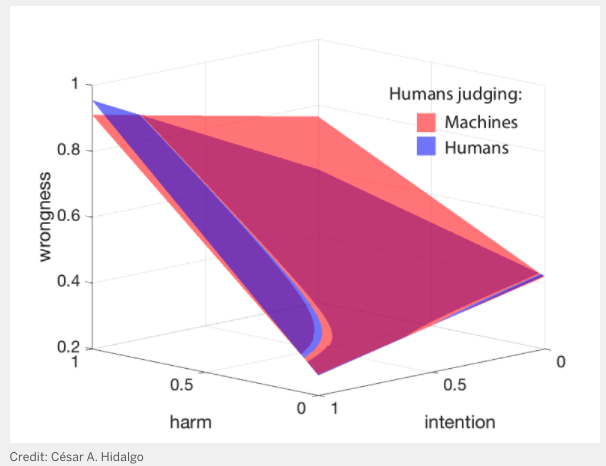

“People judge humans by their intentions and machines by their outcomes.” - César A. Hidalgo

Why aren't we more accepting of systematic models and algos for our investment decisions? We have talked about the interesting research on algo anxiety - even if a model is a better predictor many are willing to go with the discretionary forecast. Discretion always adds choice and flexibility if there is new information or situations, even if modeler may get it wrong. Users feel constrained and don't want to be limited by a model.

Philosophical and ethic thinking concerning machine decisions have focused on the chasm between how we accept algo decisions versus those by humans. For example, humans can do a good job of appreciating the nuances between broad terms like good and bad. For example, was the weather bad today? Nevertheless, more AI is being used to make decisions about who is extended credit or who should be given parole. Judgment by machines is encroaching on what used to be human decisions. This encroachment can be for the better given a machine can make consistent decision albeit there is still the issue of biases in the modeling process.

This can be a big investment problem - should you prefer machine decisions or human decisions? Many will not care - the proof is always in the returns, yet those who have studied human and machine decisions find that the criteria for judgment are different. See "Why We Forgive Humans More Readily Than Machines"

Research has found that humans judge on three criteria, wrongness, harm, and intentions. In the graph below, humans judge machines differently from machines. The researcher looks at the trade-off plane from humans judging humans and humans judging machines. When judging machines, the harm is the key criteria - what is the results of the decision. For humans judging other humans, there is a clear bias toward the intentions of the decision maker. There is a forgiving of harm based on a judgment of the intentions.

In the portfolio management space, humans may be forgiving of the discretionary trader who fails if his intentions were good. He tried to make money and had a good narrative of what he was trying to do. Unfortunately, that is a poor way to judge trading - the focus should always be what are the results. Knowing the process is critical but not an excuse for poor performance.

Monday, December 20, 2021

Performance curves - Still says that simple works relative to complex

Machine learning is taking over the modeling process in many fields including asset management. Out with the old modeling and in with the new modeling. With cheap computing, there has been a bias to adding more complexity to models, but over-parameterization does not mean that performance will improve. More is not better. Using extensive testing of different model types (random forests, XGBoost, and deep neural nets) and a wide set of parameters, a recent paper, "The Shape of Performance Curve in Financial Time Series", looks closely at financial time series tests.

The paper's overall conclusion is that there is a flat lining of estimators for mean squared error and accuracy. However, it is always the case that MSE and accuracy are lower during training periods over test periods. Adding more is not always better but rest assured models will do worse outside the training period.

It is always the case that modelers should follow the KISS method, Keep It Sophisticated Simple. Adding complexity is not a substitute for a good simple model.

Sunday, December 19, 2021

Trusting the rating agencies - A global problem

For debt investors, 2021 is year of nervousness - what don't we know about the debt we hold? More specifically. what are the risks in China fixed income? What is underneath the Evergrande iceberg?

Evergrande was declared in default by S&P on December 16th, a week after Fitch. Moody's gave Evergrande a C rating in September which is typically applied to default firms and is its lowest rating. Chinese rating agencies have kept Evergrande at much higher ratings than the big three international agencies. There really was no choice but the real question is why rating agencies took so long to see the problems of Evergrande

There is a home bias that works against international bond investors and the bankruptcy process now falls into the political. Two of the most important elements of an efficient capital market are trust and certainty with the rules of the game.

There needs to be trust in accounting numbers. Auditors have to be a frontline defense for investors. There needs to be trust in those who evaluate firms, yet we know that brokerage firms can have biases withe their evaluations. We look to third party firms to provide unbiased advice, the rating agencies, yet these firms also may have biases. Regulators must ensure that firms follow the rules and push for maximum transparency. Still, we always must ask the simple question, "Cui bono, who benefits?".

Certainty is needed to know that the rules of the game are stable. This applies to contract and bankruptcy law. It is a fluid concept based on the interests of the powerful.

There is no question that every investor should do their own analysis, but rating agencies should provide a useful signal weight of relative credit worthiness versus the set of all possible credits.

Unfortunately, only under stress do we find out that there are clear biases, and the system has biases. Only under bad times are the flaws of the system evident but by then it is too late.

Thursday, December 16, 2021

Monetary policy, inflation, and FAIT

Flexible Average Inflation Targeting (FAIT) is the name of the Fed game, but that does not give us much guidance on what will be the activity of the Fed nor are markets playing as expected.

Inflation is higher than expected - There is no transitory inflation albeit the trimmed core PCE is still close to target at 2.6%, but there are some statistical gymnastics to get to this number. Top-line PCE inflation is at 5%, CPI is higher, and PPI is even higher.

The taper has been increased to double in December and another doubling in January 2022. The taper will be pushed forward to end in March and three hikes are planned for 2022. The dramatic change is present in the dot-plot changes from September.

Tuesday, December 14, 2021

Tail risk - shocks and systemic failure

All systemic risks will be tail risks, but all tail risks may not be systemic. There is a sequencing of events before there is a systemic failure, so investors may have some warning albeit the speed to systemic failure may be very quick.

Can you see it coming? It is unlikely you can predict a tail event but they will usually have specific characteristics. They can be firm-specific or macro in nature, but will have to be a surprise to existing expectations. Tail events will not be a confirmation of existing views. The news event must be strong enough to change consensus judgment and consensus will most likely have large, levered capital positions. An exogenous event can lead to endogenous trading events like the February 2018 volatility debacle. We will note that some tail events cannot be directly associated with specific news event. The October 1987 crash comes to mind.

What is the speed of failure from a tail event to a systemic risk event? Ex post, there will be clear warning signs that could have been seen, but these will usually not be the focus of the market. There will usually be heightened volatility before a systemic risk shock, but the time to a systemic failure risk can be measured at most in days not weeks. The failure in March 2020 was within days of pandemic news fears albeit pandemic warnings were already building in February.

How do you protect against systemic risk? Beyond being diversified, the simplest answer is measuring the time to cash liquidation. If you must convert all positions to cash, how long will it take? Can you risk bucket all assets by liquidity? Have you identified safe assets? Where are the exits in case there is a fire? Are their secondary primes, brokers, and liquidity providers that can be called upon in a crisis? Of course, having secondary liquidity providers requires regular usage otherwise they will not take your business when asked. Have all liquidity provider operations been reviewed for crisis conditions? if you don't ask now, you will not get any answers during a systemic failure.

Central banks and government regulatory may be looking at macro-prudential policies but there are no guarantees that any government can provide appropriate policies at all times. Safety is still the burden of the individual investor.

Fed's current tapering by the numbers - A long way to go to normalcy

Monday, December 13, 2021

Looking beyond risk factors and focusing on basics like economic profit growth

Friday, December 10, 2021

Blending traditional research and ML processes - There is a lot of overlap

- There is first data analysis and feature extraction - What are the inputs for any model? Features can be simple price-based systems or include exogenous variables like fundamental macro or firm specific data.

- From the feature selected there is alpha modeling, the method of stacking or ranking the set of opportunities. Alpha modeling can look at times series or cross-sectional data to assess each investment or pick high and low performance deciles.

- The set of alpha choices then have to be placed through a portfolio optimization process which determines size and distribution of allocations. The optimization process finds the mix of alpha choices from which to target return and risk.

- Output then has to be converted into executable orders. A model has to be deployed through specific order processes that signal what is to be bought and sold.

- Performance has to be assessed and learning generated to adapt or change models. An effective system has to include a feedback loop to learn from mistakes.

Monday, December 6, 2021

Explainable and Interpretable AI - Looking inside black boxes

Machine learning is the darling of data science and rightly so. It has truly advanced our ability to make accurate predictions but there is still an issue of how ML procedure make their predictions. There is more complexity than traditional tools such as linear regression. For asset management, ML creates two problems: (1) understanding how result were generated and (2) explain how decisions were made for both compliance and investors.

There are solutions to these problems through advances in interpretable and explainable AI. One of the key findings of the work in these two areas of ML is that accuracy does not have to be forsaken by choosing processes and models that may be less complex.

Interpretable AI, also called symbolic AI (SAI) employs less complex ML procedures which are easier to read interpret. Interpretable AI will focus on traditional techniques like rules-based learning in the form of decision trees. Because there are rules, it is easier to provide some story about how forecasts are made. Each rule can be examined, and rules can be added or dropped to find the marginal value of any change.

Explainable AI, also called XAI, will use more complex ML but attempt to explain it. More complex ML systems that are not rules-based have to rely on explainable AI where there is a focus on the value of features and outputs used in a black box. With XAI, tools like Shapley Additive exPlanations (SHAP) values are used to associate the importance of features with the explanation of a forecast. See "Machine Learning: Explain It or Bust" for more details.

Interpretable and explainable AI represent an age-old problem for all systematic managers. Even simple models have to be explained and provide context. For example, trend-followers can have very different return and risk profiles. The burden is on the managers to explain why they differ from others and when they will or will not make money. There is always interpretation and explanation issues.

See also:

Sunday, December 5, 2021

Shipping - Markets excesses gone or something different?

P-hacking - maybe our concerns are overdone

P-hacking is an important concept for understanding the value or failure of financial research. Whether called data mining or data snooping, the process of searching for significance can lead to results that are spurious and will not follow in out of sample analysis and trading. What was significant for a back-tested sample will not be replicated out of sample or in real life. There is now a zoo of factors that have showed significance in financial research which begs the question of whether there really are so many unique factors in an efficient market. There is also the question of what are the drivers for these significant factors.

P-hackling is real, but the question is whether it applies to all factor tests. A recently published paper "The Limits of p-hacking; some thought experiments" takes a step back and focuses on the likelihood of a p-hacking problem for all of the research results in the factor zoo. He focuses on the likelihood of p-hacking with factors that have t-stats close to 6.

This p-hacking problem may be especially present on the margins for t-stats around 2. While there are hundreds of studies on unique risk premium, the field of studies that show high levels of significant are limited. The author of this study states that the likelihood of p-hacking for high t-stat factors is low. There would have to be millions of tests to find these levels of significant.

P-hacking is real and should be feared, but data snooping cannot be the explanation for all the results on pricing anomalies. There is a continuum of market efficiency. The bar for finding unique factors, risk premium, and anomalies is high, and the null should be that markets are likely to be significant, but that does not mean that markets will always be efficient. Mispricing, pricing anomalies, structural opportunities, and limits to arbitrage do exist. Be a skeptic, but sometimes the results from testing are real.

Saturday, December 4, 2021

Prospect theory can explain many stock anomalies

One of the problems of behavioral finance research is that there is no unified approach or model that can explain all the anomalies that exist in the stock market. Some behavioral models can explain one or two anomalies, yet they may contradict other anomalies. I accept that this is a part of the scientific process, but it limits the usefulness of this research.

It looks like we have a model based on prospect theory that can explain many stock anomalies. See "Prospect Theory and Stock Market Anomalies". This exhaustive paper means that prospect theory should be at the forefront of thinking about how investors behave.

Prospect theory was developed by Kahneman and Tversky to explain decision-making under risk. Prospect theory states that investors will evaluate risks based on gains and losses with a kink at the origin. Investors will be more sensitive to losses than to gains. The sensitivity is concave over gains and convex over losses; risk aversion for gains and risk seeking over losses. There is loss aversion and narrow framing.

The price of an asset in a prospect theory world will be dependent on (1) asset return volatility, (2) skewness, and (3) the average prior gain or loss since purchase, the capital gain overhang. Investors require (1) higher average return for higher volatility, (2) lower average return for positive skew, and (3) higher average return for assets with larger prior gains.

According to the author's testing, prospect theory can explain: momentum, failure probability, idiosyncratic volatility, gross profitability, expected idiosyncratic skewness, return on assets, capital gain overhang, maximum daily return, z-score, external finance, composite equity issuance, net stock issuance, post-earnings announcement drift, and difference of opinion anomalies.

Forming deciled portfolios for each of the tested anomalies, the authors find the same pattern, the extreme decile with lower returns has higher volatility, more positive skew, and a lower capital gain overhang relative to the other extreme decile. Prospect theory cannot explain the size and value anomalies.

The research provides powerful evidence for thinking about investor behavior in a prospect theory world. The null should be that investors will follow the expected behavior embedded in prospect theory - loss aversion, kinked behavior around the purchase price and capital overhang.

Price-based and fundamental systems - Trusting data structures

This is an important concept to remember with any systematic model. Where are data coming from? What data are used? How are the data manipulated and adjusted before it enters a model? How are data cleaned? If there is fundamental data, are the taken from the original announcement? Are times series properly aligned with announcement times?

It may not be garbage in and garbage out, but the quality of the ingredients will affect the cake that comes out of the oven.

A price-based system has a lot of database trust - the source for decisions is well-defined and easy to manage. Yet, even in this case, there needs to be a review of database structure. There are differences between closing and settlement prices, and I have found differences in price between vendors for exchange traded prices. For equities there are issues with how to handle adjustment for dividends. For futures prices, there are issues with handling rolls.

The problem of databases increases greatly when non-price data are added. Employment data are revised. Fed announcements may occur before the close. Earnings announcement usually have other information embedded with the accounting data.

It is possible that small data differences can create a different return series for the same model. You are not investing in just a model. You are investing in a complete data management process.

Friday, December 3, 2021

Stay, double down, double up, and walking away decisions

What you do after a trade has been added may be as important as when the trade was initiated. There are four choices: maintaining existing positions, adding, subtracting, and walking away.

The choices are a matter of mark-to-marketing your ideas and trade conviction. Many systematic investors will view this as an easy decision. For. discretionary trader, this process will be more complex.

If you run a trend model that uses daily data, the model will be marked for adjustment every day, yet variations on how you mark a trade for adjustment create a wide set of choices. The simplest choice is a digital marking, if above (below) trend go long (short). The digital choice is fully invested at a predetermined position size at all times; however, there can be other variations from a digital choice. Trades can be scaled by volatility so that there is price above (below) trend against volatility that change position sizes. If the return to risk falls, positions will fall.

In the case of discretionary trading or trading that uses exogenous information, investors can think of mark-to-marketing as mark-to-information. Positions sizes and risk will change as new information concerning the trade enters the market. Because information quality varies, the mapping between position and action will be less clear. Hence, positions are not switched on and off.

Investors should think about how decision action is updated - what is the information or factors necessary for position changes.