"Disciplined Systematic Global Macro Views" focuses on current economic and finance issues, changes in market structure and the hedge fund industry as well as how to be a better decision-maker in the global macro investment space.

Sunday, July 31, 2022

Sector and country risk repricing in July

The repricing of equity and fixed income risk in July

Thursday, July 28, 2022

This is not a recession - It is a banana!

Alfred Kahn, a top economic adviser to President Carter, learned that lesson [using the word recession] in 1978 when he warned that rampaging inflation might lead to a recession or even 'deep depression.' When presidential aides asked him to use another term, Kahn promised he'd come up with something completely different. 'We're in danger,' he said, 'of having the worst banana in 45 years.'" - from PRWatch (When United Fruit Co., complained about “banana,” Kahn switched to “kumquat.”)

No one in government wants to use the word recession. It is a new forbidden word. It is just a matter of time before the FCC puts it on the list of what cannot be said on TV or radio. This could be added to George Carlin's "seven dirty words". That may be an extreme, but creditability is lost when there is not a clear discussion. Language is important. Candor is critical.

What would be the harm of saying, "We are in a recession based on past technical definitions, but this cycle is unusual because the labor market is strong. This may cause us to revise our view of a recession." This is not far from current thinking, but there has been verbal gymnastics to avoid a clear discussion of the issue.

Let us say we are in a recession. What will change, given we are also at full employment based on labor market measures? If the administration says we are in a recession given conventional definitions, would the Fed change? Would there be a different fiscal policy? Would markets change?

What is the impact of a word?

Wednesday, July 27, 2022

The 40-70 Colin Powell decision rule

Colin Powell had a 40/70 doctrine for senior leader decision-making, which held that if you make a decision with only 40% of the information, you are making it prematurely, but if you still haven’t decided by the time you have 70% of the information, you are no longer in control of events.

-from WSJ 7.26.22

Of course, if you know how to calculate the 40% and 70% you know all the information that is necessary or available. The basic dictum is that you need some information but not all the information available to decide. Gathering more information takes time and money, so you must learn to make do with less than perfect information.

You will never have all the information you think you need. In fact, studies show that having more information will not improve accuracy but only confidence. Try and decide with less to take some action. However, plan to have an exit strategy if you are wrong. Make decisions faster, learn from your successes and failures, and repeat the process as a feedback loop. See More information does not lead to improved accuracy.

This decision framework is consistent with the Bezos Rule for planning. If you have 70% of the information you think is needed, decide. See The Bezos "70 percent rule" for decision-making.

Tuesday, July 26, 2022

Focus on precision in your thought processes to improve decisions

"I do not pretend to start with precise questions. I do not think you can start with anything precise. You have to achieve such precision as you can, as you go along."

“To teach how to live without certainty, and yet without being paralyzed by hesitation, is perhaps the chief thing that philosophy, in our age, can still do for those who study it.”

- Bertrand Russell

Good research should start with general questions and then add layers of complexity to be more precise. The original general question cannot be forgotten, but there should be a process of digging deeper and getting specific.

For example, is the Fed behind the curve? The is very imprecise. The process then focuses in on what it means to be behind the curve, how much it is behind the curve, and why is it behind the curve. The investor then needs to focus which assets have priced in this idea of being behind the curve, how will prices adjust, and when will it happen. From the general there is move to the specific. If the thought process only stays general, there will never be an effective decision.

Of course, we will never get the precision needed to generate certainty; consequently, we need to accept and live with uncertainty. Accepting uncertain means we will accept that decision will be made without full information.

“One of the symptoms of an approaching nervous breakdown is the belief that one’s work is terribly important.” - Bertrand Russell

Monday, July 25, 2022

The inflation regime matters when anticipating returns across the business cycle

Isaiah Berlin as an investor - Accept complexity but focus on simplicity

"Scholars are usually at greater risk of exaggerating how complex the world is then they are of underestimating how complex it is"

"I think politics is more cloudlike than clocklike ("cloudlike" meaning inherently unpredictable; "clocklike" meaning perfectly predictable if we have adequate knowledge."

"The more common error in decision making is to abandon good ideas too quickly, not to stick with bad ideas too long"

"To understand is to perceive patterns."

"Philosophers are adults who persist in asking childish questions."

- Isaiah Berlin, the 20th century philosopher may have something to say to investors. He is best known for his work on describing intellectuals as either hedgehogs or foxes based on the Ancient Greek proverb.

You can substitute the word investor and markets for scholars and politics and get a good idea of Berlin's thinking. Many investors exaggerate the complexity of the world which makes it hard to generate predictions. Yes, the world is complex, but it is good to start with a simple view and then add complexity. If the complexity helps explain reality, add it. If it just adds noise, forget it.

The markets are often cloudlike and not clocklike. We must live and accept the cloudiness of markets. There is a "fog of war" with markets that cannot be eliminated when making decisions. The fog may lift after the decision is made and an assessment of success is undertaken if you are lucky.

Investors will abandon good idea because they are not patient enough to let them work. Markets will often focus on a bad idea that seems to make sense in the moment. Understanding allows us to find patterns.

The great investors will persist in asking simple questions.

Sunday, July 24, 2022

Isaiah Berlin's hedgehogs and foxes - Why be a top-down investment hedgehog and a bottom-up investment fox

Sherman Kent - The analyst's analyst - Be precise with your forecasts

Sherman Kent - My guy for precision in forecasting language

Sherman Kent - the godfather of precision in forecasting language

Friday, July 22, 2022

Greenspan puts are now Fed calls, and a likely collar

We have gone through decades of what was originally called the "Greenspan put". The market perceived that the Fed would step-in and arrest any major market decline to maintain financial stability and stop any potential financial crisis from spilling over to the real economy. The finance channel was viewed as a key area that the Fed could control as the lender of last resort. The Fed accepted a rising stock market as a channel for growth.

However, we may now be in a new era of the "Powell call" which will cap any gains in the stock market. The Fed's key worry is that a hawkish fight against inflation will lead to a hard landing. The key signal for a hard landing will be negative signals from the stock market. If the stock market crashes, the financial stress will lead to the hard landing the Fed would like to avoid. If the market declines slowly or the market rallies, the Fed has a signal that it can raise rates higher and faster. An up-market move will give the Fed the latitude or flexibility to be more hawkish which will cap any equity gains. Hence, the Powell call is born.

We could go further and say there is a Powell collar. If there is a financial crisis, the Fed will protect the market, but the strike is much lower than 20%. The calls are close to being at the money. If the market stays flat for the rest of the year, the Fed would be comfortable with a continued policy of raising rates.

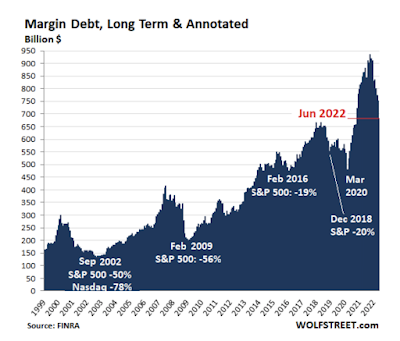

Declining margin, leverage, and big unwinds - A result of rising interest rates

Thursday, July 21, 2022

Let prices (trends) speak for themselves - It is a good base forecast

In an uncertain world, the question is always the same - whose opinions do you trust? Where do you put your forecasting faith? Is it a person? a model? specific data?

Clearly, forecasting is always hard with the potential for error increasing with uncertainty. Hence, there must be some place or base that can be used for starting the forecast or forming a null of what may happen in the future. For those who focus on market efficiency, the base is always the current price. Your best guess for tomorrow is the price today.

I try and make this simple with a core rule for any prediction discuss. Let prices (trends) speak for themselves. The direction in prices is the null or base for any for forecast, not the current level. If prices are moving higher (lower), then our base case is that prices will continue to move higher (lower). Of course, this single direction cannot continue forever. That is not the point. The point is that any forecast other than the trend needs to have a strong justification.

Trends can take prices away from fair valuation, but the first view is that trends are pushing prices to a new valuation. If they continue to trend, then the market has not taken it to this new valuation. Prices move toward the new fair value not back to an old fair value as measured by a past price level. You may forecast that the speed of adjustment is faster or slower, but the first pass is that prices are telling you something about the aggregate behavior of investors or the weighted opinion of speculators. There will be deviations from a base for fair value, but a sustained price move is forecast for a new valuation. The fact that a trend-follower uses a longer-back test is just a process for eliminating short-term noise.

Let the data speak first, then adjust forecasts only if you believe you have an edge with incorporating new information.

Monday, July 18, 2022

Ensemble models - A form of forecasting risk management

"Preponderance of metrics" approach to investment forecasting - A simple approach

Wednesday, July 13, 2022

Financial stress - Different Fed measures provide warnings for investors

Tuesday, July 12, 2022

Global macro decision choices - A binary world?

- Inflation - Persistence versus transitory. The transitory inflation crowd was absolutely destroyed in the first half of the year, but the choice is still present. Commodity prices have declined from extremes in the spring and goods congestion has fallen. The goods market inflation is likely to fall, and it is now a question of service inflation.

- Inflation - Anchored or unanchored. Inflation expectations as measured by breakevens have fallen from highs in the spring. The question is whether markets believe the Fed can raise rates and show resolve at getting ahead of current inflation.

- Recession likelihood - Hard or soft-landing. We are now seeing a soft landing recession with GDP likely to show another quarter of negative growth. Labor markets are still strong, so the impact may be mild. A harder landing is being priced in 2023 given the strong Fed rate increases.

- Recession length - Short or long. The soft crowd believes that any recession will be short and not last more than 6-9 months. The other extreme is that we will be in a long recession with a slow recovery that will last for well over a year.

- Monetary policy - Resolve versus cave. The choice is between an unconditional resolve to beat inflation versus the Fed caving some time at the end of the year or first half of 2023.

- Policy shocks - There has been little change in fiscal policy nor has there been any discussion of alternative monetary policy. QT has begun, but it has not received much attention.

- Geopolitical risk - War or peace. The Ukraine-Russia War is not going away and if it continues into winter, the global economic cost will be significant. Of course, a quick resolution may not result in oil flows moving back to 2021 levels.

- COVID - The never-ending pandemic - There is talk of further lockdowns in China, and a new variant, BA.5, is now taking hold. The question of whether we will be in another lockdown this winter is real.

- Equity bear market - The choice is more a matter of degree. If earnings are adjusted downward, the bear market will continue. A controlled slowdown with inflation falling will allow for market stabilization.

- Bond bear market - The bond market performance for the last six months is still one of the worst recorded. Further contraction is function of inflation persistence. A bond rally may be related to a recession.

Why are trend-followers having a good year - A rationale, not a description

Trend-followers are having a very good year with many generating double-digit gains and almost all beating a classic 60/40 stock-bond portfolio. Any investor who had trend exposure would have seen stronger performance this year as well as in 2021. Trend-followers have done what has been expected of them - strong diversification and returns during a period of market turmoil.

Many managers have written about their strong returns this year but have focused on performance contribution - an analysis of market gains and losses. For investors, the key question is why are trend-followers doing well now? What are the characteristics of markets or the environment that now make trend-following successful? We will provide context on this question with some broad conceptual thinking and then move to some specifics.

We start with the simple investment framework that there are two types of traders or strategies, convergent and divergent. Divergent traders make money when markets move away from current equilibrium prices while convergent traders profit from prices moving back to equilibrium after some disturbance. Trend-following is a divergent strategy because it capitalizes on dislocations or tail events. It is long volatility.

The cause for trends are clear in hindsight although not apparent in real time. Unexpected changes or surprises in fundamentals will lead to price changes. However, because changes in fundamentals are not always obvious, the process of price adjustment may take time. The market does not wake-up one day to a recession risk or a Fed change. Changes in fundamentals occur slowly one data announcement or adjustment at a time. Not all traders discount information the same way or at the same time. One investor's interpretation of an inflation report may be viewed as transitory while the next suggests persistence. Smart money thinking is not always immediate or sizable. Market beliefs evolve over time.

Trend-followers will do better when there are a sequential set of fundamental shocks generally in the same direction as opposed to a single large shock. The sequence of small shocks will lead to a sequence of price changes from which trend direction can be extracted.

Large unanticipated shocks, big moves like March of 2020, are not always good for trend-followers if the shock is reversed quickly or the shock leads to an immediate new equilibrium where investors all agree on new valuations. If the trend-follower is wrong-footed going into the shock, loses may mount and if the shock is truly a surprise, gains are not obtained from prior price information. The trend-follower may be luckier than right.

If information is revealed slowly through time, then prices will adjust slowly. The fact that there is disagreement on whether inflation will be transitory is good for creating price trends. If there is no agreement on price direction, the price discovery process and move to some equilibrium will take longer. The trend-follower will extract all necessary information from the slow adjustment as opposed to trying to decipher the fundamentals.

The transition of policy is another reason for trends. The slow adjustment in central bank action will lead to slower adjustment in prices. A central bank that is behind the curve is good for trends. If policy is up to date with the current environment, trends will not exist. If the central bank will make a strong immediate adjustment, prices will move but trends may not provide signals.

Trend-following needs uncertainty in markets. Trend-following needs volatility. Trend-following needs ambiguity and complexity. A lack of market clarity concerning the current and future market environment will generate slow price adjustments; an environment for the trend-follower to exploit.

Look at the current environment. The lack of consensus and clarity make for a better trend environment especially for macro markets like rates, indices, and currencies. The same applies with markets hard to value like commodities, currencies, rates, and indices. The link between inflation and markets is hard to measure. The threat of global economic slowdown is hard to discount. The price of money across two countries is difficult to forecast. The best way to track the impact of fundamental changes to price is through following the price action.

So, what kind of market environment have we had over the last year?

- Unprecedented moves in inflation relative to the last 40 decades and little understanding of cause and effect. A divergence.

- A growing threat of recession as the Fed starts a tightening cycle. Another divergence.

- A truly uncertain geopolitical environment marked by a war that may not have an immediate winner. A market dislocation.

- Ambiguity on economic growth after a pandemic. Unprecedented.

- A high level of complexity in commodity and market logistics which create demand and supply chaos. A truly infrequent environment.

Saturday, July 9, 2022

Commodity super-cycle decline - Looking at individual markets

The BCOM commodity index is in a 15% drawdown from its high, but that does not tell the real story of price destruction for many individual commodity markets. The index is a basket of commodities with a weighting based on usage, production, and liquidity. It has a heavy energy weight and is structured to be tradable. It has been in a major up cycle for the last two years. See "Is the commodity super-cycle over or just a correction?"

Trading the individual commodities show commodity markets in transition and not representative of a run-away inflation story. It is hard to argue for persistent inflation story when many commodity markets are in double-digit declines.

A representative sample of commodity declines from 52-week high as of July 1 tells a messy story, (from @macroalf). Of course, the last two years have been one of the best bull markets in commodities since before the GFC.

Looking at the last few months tells a story of major repricing in commodities since the beginning of the Ukraine War. It is notable that oil and RBOB gasoline are both below the Ukraine War spikes in early March. The same applies to wheat where supply is blocked from moving out of the Black Sea. NYMEX natural gas is down over 35% since its high last month.

Is the commodity super-cycle over or just a correction?

Sunday, July 3, 2022

Normal versus Cauchy Distribution - Trend-followers as traders against normalcy

I want to fit the world into normality, yet it could be a Cauchy distribution and have properties that exhibit extreme risk, tails. The Cauchy or Lorenz is stable and has a probability density function that can be expressed analytically like the normal distribution, but as some would say, it is pathological with extreme oddities. The tails of the distribution are heavy, show slow decay, and can go to infinity. There are other heavy tailed distributions, but the Cauchy is the extreme.

However, there are some distributions that are not well-behaved. The Cauchy distribution looks fairly normal but is actually the evil cousin of the normal distribution. It is more peaked, and does not dampen in the tails of the distribution. Hence, the mean and standard deviation cannot be calculated. Anything is possible in a Cauchy world, and it is not measurable.

What does this mean for a trend-follower? If you believe the world is not normal and may exhibit fat tails like the Cauchy distribution, you will want to hold a large portfolio of assets awaiting the chances that a fat-tailed event will occur. With the Cauchy, the center of the distribution will be very peaked and the general returns will be close to zero, yet evidence suggests that non-normality is a reality, fat tails do occur. To capture these heavy tail returns, the trend investor has to hold positions in long-term trends even if it seems odd under the assumption of normality.

Because there is a higher likelihood that some assets will move to the extremes and those moves may not be capped, the divergent trend-follower holds a well-diversified portfolio and waits to exploit these big moves. Their implicit assumption is that a non-normal world with fat tails will generate outside returns much greater than anything likely in a normal world. Expect and trade (hold the trend) for these heavy tails. A belief in heavy tails is an underlying assumption for many trend-followers.

Credit spreads and corporate bond distress - A non-linear relationship