"Disciplined Systematic Global Macro Views" focuses on current economic and finance issues, changes in market structure and the hedge fund industry as well as how to be a better decision-maker in the global macro investment space.

Thursday, September 28, 2023

The Rogers Diffusion Curve and Finance

Tuesday, September 26, 2023

Chronological snobbery in economics and finance

C. S. Lewis defines chronological snobbery as “the uncritical acceptance of the intellectual climate of our own age and the assumption that whatever has gone out of date is on that count discredited.”

This can be applied to current economic and finance research. Without a doubt our knowledge of the economy and finance has advanced over the last decade, but it is less clear that we know how to properly discount our current knowledge relative to what is known from the past. Current thinking about monetary policy and our wisdom about how to make policy choices may be worse today than twenty years ago. Current modeling techniques such as ML may seem to have an advantage versus older techniques; however, the benefit after empirical testing may be limited.

A conservative approach to economics or investing does not mean clinging to old ideas as always being better. It does mean that new theories and approaches should be viewed with healthy skepticism - "please tell me your new ideas and then let's determine whether they are truly better." The conceit of today may lead to ruin tomorrow, so always be careful with following the research fashion of the day.

The clouds over the economy - disruptors

- UAW strike - This strike can last given the wide disparity between parties. If it spills over to other suppliers, it will start to be an economic drag.

- A government shutdown - We have seen this before, but that does not mean there aren't risks. There was just an averted shutdown in June after which the Treasury issued well over one trillion dollars of new debt, so we are back in the same situation.

- The oil price shock - Production has been cut by Russia and Saudi Arabia and prices are unlikely to reverse in the near-term. With prices now solidly in the $90's, gasoline prices are higher, heating oil is higher, and there is new fuel for higher inflation.

- Student loan debt - The day is coming that payments will be due, and the cost will hit marginal households. Many households increased consumer debt during the student loan moratorium so new payments will reduce spending power for households that have a higher marginal propensity to consume.

The "impossible" triangle for managed futures (or any hedge fund)

The 'impossible" triangle is the combination of diversification (low correlation with an equity benchmark), stable positive return, and "crisis alpha" or positive excess gains in the face of sustained equity decline. Can it be achieved? You can usually only achieve two of the three. It may not be impossible, but it is hard to get all three. It. can just be what is your tolerance to give-up on one of the three.

Diversification can be achieved through trading different assets long and short from the main target or benchmark asset. If you want diversification from equities, trade commodities, currencies, and fixed income. Trade both long and short as well and you will achieve a low correlation with equities. The diversification will pull down returns during a strong equity bull market yet serve an investor well in a bear market. The diversification will cancel some of the more extreme returns, but there is a likely gain in Sharpe ratio.

If you want to have stable returns in all environments, you will have to trade a combination of styles to ensure that no one style will drive returns negative. Diversification of styles will smooth returns and help with diversification; however, there will be less convexity or excess returns at extremes.

If you want crisis alpha or positive convexity, you must have a high concentration of risk in trend-following; however, by doing this you will likely have lower returns during periods of stable markets. Hence, the convexity is only achieved through giving up the more stable returns.

So, an investor is going to have to focus on two at the expense of the third. The question is what you can live with or what is more important for your overall portfolio. This is the personal choice that must be made by investors.

What are "stylized facts" but just a narrative with numbers

Monday, September 25, 2023

Role of central bank and speculation

The central question is whether central banks can contain the instability of credit and slow speculation to avoid its dangerous extension. - Charles Kindleberger Manias, Panics, and Crashes

"It was the zero-percent era that made a 5%-plus rate dangerous." - Jim Grant of Grant's Interest Rate Observer

"If the invention of interest was the greatest invention in finance back five millennia ago, then negative rates are probably the dumbest idea in the entire history of finance and we’ve just been living through it." - Edward Chancellor with Grant Williams

Sunday, September 24, 2023

At some time, free money has a cost - the end of a bubble

The cycle of manias and panics results from procyclical changes in the supply of credit ... Money always seems free in manias.

- Charles Kindleberger, Manias, Panics, and Crashes

Follow the credit cycle for longer-term investing. Tracking credit cannot be traded over short horizons, but you better darn know whether credit is rich or cheap and whether it is changing. The credit train will follow a cycle, so always know when it will stop and whether it will speed up. Money was free until last year. Of course, there was the attempt to raise the price of credit near the end of the Yellen Fed term and the early Powell term to 2.5%, but it was snuffed by politics and the pandemic.

The last year changed the credit cycle with rates now reaching 5.5%, so any bubbles are set for transition. We have not seen panics, but the bond market last year saw the worst performance in decades. This year may also end of negative.

The current investment problem is not finding where to put your money for upside success, but determining what areas to avoid. At current money market yields, there is value in avoiding risk even with double digit stock returns for the SPX. Currently holding cash is better than holding small cap indices.

Know the credit cycle and fear when the cycle turns to tightening.

Investing reacts to narrative not facts

- D McCloskey Scientific American February 1995 "Once Upon a Time There Was a Theory"

What is it that Wall Street analysts do? They tell stories, and they are rewarded for telling better stories not making better forecasts. The forecast is a number or a probability, but that number does not stir action. It is the story.

The Fed provides a number and a SEP forecast, but it is the story from Chairman Powell that moves markets. The retelling of the Fed story provides a new model and differentiates one analyst form another.

The data are all the same. It is the narrative that makes for differences. Trades are based on differences in narrative.

Saturday, September 23, 2023

15 years post Lehman - What has changed?

As we "celebrate" the fifteenth anniversary of the Lehman failure, it may be good to look at what may have changed since that time. This is not exhaustive, nor does it try and tell a complete narrative, but I make some observations that jumps out at me.

- The too-big-to-fail issue has not been addressed. Banks are more concentrated than before the Great Recession. Are they less risky, hard to say. There is clearly more regulation, but the linkages and points of potential risk still exist with the largest institutions.

- The systemically important label is being broadened to include more non-bank institutions, yet it is not clear that this will help the financial system. As regulation increases, no structures are developed to avoid regulation. More debt and leverage are managed through private markets as opposed to regulated banks. Banks risks may be less, yet debt risks are not lower.

- Monitoring has gotten better through the Financial Stability Oversight Council but it is unclear the goals of this monitoring other than getting more information. Regulators are watching but that is different than acting. The bank failures in 2023 is a perfect point. The information was available, but action was lacking.

- The debt problems still exist. Debt excess has switched from households to governments although Treasuries are viewed as safe assets.

- The Treasury market is less safe given the size of dealers relative to the Treasury debt outstanding. The Fed is the biggest player in the Treasury market, so it tries behavior.

- The Fed has less flexibility and has generally overreached after crises. The lender of last resort is now a long-term lender for all situations.

- The Fed has created the foundation for a new financial crisis. By holding rates low for too long, and now taking rates to 5.5% they have created a problem for debt holders. Markets are processing and adjusting to the new rate market, but that means that losses will have to be taken. Firms and households will have to pay more for debt. This is still working through the financial markets.

- Excesses in policy lead to market distorts which then need new policies to stop the resulting pain. It is a treadmill that cannot be easily left.

- In the heat of the moment action was taken to not support Lehman. It may have been the right action. It could be argued as the wrong action. However, we do know that the subsequent actions are still being felt throughout the economy.

The stages of bubbles - They may follow a pattern that form a narrative

Thursday, September 21, 2023

Fed watching - All about the SEP

The Fed governors and bank presidents do a good job of giving speeches with some indications about what they will do at a Fed meeting. These comments are still too noisy, but the market can handicap the immediate actions of the Fed. Nevertheless, it is much harder to handicap the comments by Chairman Powell during the press conference and forecast what the quarterly SEP forecasts will look like. The action is in the SEP (Summary of Economic Projections) which now show that one more hike is likely but two cuts in 2024. The rates will be higher for longer and this is what is driving the markets. Tight money is not going away and that is not what was expected. The market sell-off was quick once it was understood there would be no magic liquidity bullet later this year. The difference between the old and new SEP is a market driver even though the construction is a just an average of dot-plot forecasts.

Monday, September 18, 2023

The dollar dominance is our choice not the choice of others

The dollar has fallen from a peak in 2022 and has rebound from loses earlier in the year, but the talk of dedollarization have continued given the rhetoric from other countries.

The BRICS have begun to have discussion on a new common currency to avoid dollar dependence, but there is a long way to go for anything to become operational. China as the major economic and trading partner around the globe is at odds with the US and would like to see greater Renminbi usage as a dollar substitute but this is unlikely without full convertibility. Investors need to know that they can freely trade their currency exposures.

The dollar dominance ultimately is the choice of the US. However, this does not mean the US will take the steps necessary for continued dominance. Dollar dominance is a US policy choice on how it would like to act with other countries, the choice of monetary policy, and the choice of fiscal deficits.

Those who have studied currency dominance like the economist Barry Eichengreen believe that the dollar did not take dominance from sterling but was more likely given its dominance position because British sterling was not able to maintain its stability. The US was the dominate economy after WWI, but sterling was supported to maintain its dominance at the expense of the internal economy. WWII caused a second wave of British deficits, but this time the government decided not to protect sterling. It could not without suffering domestic turmoil. Hence, the US was the only major currency for finance.

The dominance was baked into the Bretton Woods Agreement despite the best efforts of Keynes to find a different alternative. The combination of two world war against a smaller economy that needed to run huge deficits caused a change currency dominance which could not be stopped. Dollar dominance inevitable given the size of the US economy but choices were made which sealed the fate of the sterling and the dollar.

Mexico is now our top trading partner

Sunday, September 17, 2023

Get the direction right not the precise forecast

"I'd prefer to be approximately right rather than precisely wrong." - Keynes

Of course, I would like to be right with precision who wouldn't? However, precision is a false goal. The first job of a good forecast is to get the hit rate right. Is the market going up when you say the market is going up. Nevertheless, an important part of modeling is getting the probability right with respect to direction. I cannot give you a point estimate, but I would like to know what the probability of the direction.

Precision allows for variable sizing, but this only works if you get the direction right. So, I will follow the preference of Keynes.

Watch for false narratives and stick with the facts and numbers

"The [narrative] fallacy is associated with our vulnerability to over-interpretation and our predilection for compact stores over raw truths. It's severely distorts our mental representation of the world". - Nassim Taleb

Focus on the facts, not the story. Stories are great and play a roll, but often the market narrative does not let facts get in the way of the good story. Start with the facts first and then construct the narrative, or better yet just state the facts and then discuss what happens when these facts have occurred in the past.

Trend-following is not narrative worthy or narrative necessary. You buy what goes up because it is going up. You buy what is going down because it is going down. There is nothing more needed. There is no requirement for a neat story. there is no need for a discussion about what the market is thinking or what the Fed may be doing. It is boring and is supposed to be boring. These same could be said for other quantitative strategy. It is because the conditions exist not because of the story. You may like a story to embellish, but it is not necessary.

Keep it simple with any investment strategy

1. Valuation - Is this stock seriously undervalued?

2. Balance sheet - Is this stock going bust?

3. Capital discipline - What is the management doing with the cash I'm giving them?

Jean-Marie Eveillard of First Eagle

Some will refer to the KISS method - "Keep it Simple, Stupid". I would like to say, "Keep it Sophisticatedly Simple". It is the same thing. Keep the moving parts of the model simple, minimize the features. If you do have use more features, make sure that they can be grouped or categorized into a simple set of market drivers.

Put differently, can the model be explained to simply to a less sophisticated investor so it will make good intuitive sense. There can be a significant work with data arrangements and analysis, but the core strategy should be driven by just a few simple features.

When predictions go wrong - the defensive responses

Predictions will go wrong. The likelihood that any forecaster will be better than a flip of a coin is rare, yet most predictors will come up with some reason for their failure. It is not me; it is the market that got it wrong. Here are some of the key defenses for why a forecaster will say it is not him that is the problem.

1. The "if only" defense - If only the Fed did what I said they should have done, I would have been right. Those players are not being rational or at least not the way I think they should be acting.

2. The "ceteris paribus" defense - All things equal, I would have been correct, but there was an event that was not included in the model. Those unforeseen events caused the problem. It was not my model.

3. The "I was almost right" - what I predicted did not occur, but I was close enough. Yes, I was wrong, but it was close to what was expected. It was within a range of tolerance albeit it was still wrong.

4. The " It just hasn't happened yet" defense - I am correct, but it is taking longer than expected. You can get the direction or timing right but not both. Take your pick. Most will not get both right.

5. The "single prediction" defense - Ok, I was wrong, but this is just an isolated event. Mistakes were made. We are only human, so I will get it right the next time.

-paraphrased from James Montier

Saturday, September 16, 2023

Forecasting and knowledge - These two can be in conflict

"Those who have knowledge don't predict. Those who predict don't have knowledge"

- Lao Tzu

"The greatest obstacle to discovery is not ignorance - it is the illusion of knowledge" - Daniel J Boorstin

So, what is someone to do, predict or not predict? How can you make judgements in financial markets without some predictions. The crux is that most investing should not be about predicting but counting. Count the likelihood of events and then follow the odds. The counting approach is not creating a narrative about what will happen in the future, but thinking about the numbers that may occur if a given event occurs. This is inherently reactive, but it can provide an edge. The count may change, and other facts may contribute but it is not the same as a prediction of what will happen. There is no illusion of knowledge other than what has happened in the past may occur again if the same conditions exist.

Never trust Wall Street research

Rule 1: All news is good news (if the news is bad, it can always get better).

Rule 2: Everything is always cheap (even if you have to make up new valuation methodologies).

Rule 3: Assertion trumps evidence (never let the facts get in the way of a good story).

- James Montier

"Never ask a barber if you need a haircut."

- Warren Buffet

Wall Street research is biased. Most recommendations are buys, then holds and finally sells even in a down market. You can use Street research to gain facts and information especially about an industry, but the actual buy and sell should be suspect other than to know what the Street is thinking. No one is too negative and expects to keep their jobs. It is the nature of the business. It should not be considered shocking. Do your own research and you control all the inputs and weights. You have full transparency of the framework. Of course, you must learn to be your best critic.

Rational investing through rules - Seth Klarman

One of our strategies for maintaining rational thinking at all times is to attempt to avoid the extreme stresses that lead to poor decision-making. We have often described our technique for accomplishing this: willingness to hold cash in the absence of compelling investment opportunity, a strong sell discipline, significant hedging activity and avoidance of recourse leverage among others.

-Seth Klarman head of Baupost

From a quant perspective, there are simple rules that can be applied from Seth Klarman.

- Make conditional bets.

- Set a threshold for expected return - beat a cash return

- Form a strong exit strategy - Know when to get out.

- Minimize directional risk or pure beta.

- Control leverage.

The common thread for good discretionary and quant traders is discipline. Follow a set of rules and play the odds. Know the count.

Tuesday, September 12, 2023

Noise and daily price fluctuations impede finding value in markets

"It is largely the fluctuations which throw up bargains and the uncertainty due to the fluctuations which prevents other people from taking advantage of them" - John Maynard Keynes

Trading the noise for advantage is what many investors should do but don't. Whether trading trend or trading fundamental value, the core issue is learning how to address the daily fluctuations or noise to form an advantage. For trend-followers, it is a signal extraction problem, separate the noise from the underlying direction. For the fundamental value investors, the problem is separating what the market is saying through price versus what the firm may actually be worth.

Noise can come from many sources. It can be passive rebalancing, or short-term speculation, but the result is uncertainty between price and value. Those we stay too fixated on the market price will be hurt by the fluctuation in price. The daily movement creates uncertainty which leads to delay in action and missed opportunities.

Sunday, September 10, 2023

John Stuart Mill - On Libery and Utilitarianism

During times of change, it is often good to go back and reread some of the great thinkers of the past to get a different perspective that is independent of current events.

Walking back to the 19th century, one of the greatest philosophers and political economists was John Stuart Mill who developed the philosophy of utilitarianism, the idea that an action is right if it promotes happiness, and the greatest happiness for the greatest number should be a guiding principle for conduct. This approach tries to answer the simple question that has been a core issue for western civilization ethics, "What ought a person to do?" This is not just a hedonistic question but one associated with what is good and how one should act. Some have viewed this philosophy as one of common sense. Do what has positive intrinsic value and avoid that which does not have intrinsic value for happiness.

This is closely associated with Mill's work, On Liberty, "The only freedom which deserves the name is that of pursuing our own good in our own way, so long as we do not attempt to deprive others of theirs, or impede [obstruct] their efforts to obtain it." From liberty, we can pursue our happiness.

Fidelity's Joel Tillinghast simple message - use checklists

1. Does the stock have a high earnings yield - that is a low P/E? Buy companies which may show value.

2. Does the company do something unique that will allow it to earn super-profits on its growth opportunities? Does it have a moat?

3. Is the company built to last or is it at risk from competition, fads, obsolescence, or excessive debt?

4. Are the company's finances stable and predictable into the extend future, or are they cyclical, volatile, and uncertain?

Sounds boring. There is no secret except for following the rules.

Another checklist, Tillinghast will not buy an asset unless it is:

1. Safe from rash decisions.

2. Safe from misunderstanding of facts.

3. Safe from foreseeable fiduciary misuse.

4. Safe from obsolescence, commoditization, and over leverage.

5. Safe when the future doesn't turn out as imagined.

These rules should always serve as a good first pass for investing. Even if I focus on quantitative investing, a good rules road map will always make investment decisions easier.

Thinking about the yield curve (term spread) and the equity premium

Recent research suggests that the term premium can be decomposed into different frequencies as wavelets to provide useful information. See "The yield curve and the stock market: mind the long run". Using wavelet analysis on the 10-year / 3-month term premium, the authors isolate three free frequencies, a short-term (less than a year), business cycle (a few years) and long-term wave (approximately a decade). Get rid of short-term noise and the term premium is a good predictor of equity premium. The low frequency term premium provides useful information on the future discount rate which supports equity premium predictions. The long-term shape of the yield curve does matter for making long-term equity allocations.

Economic Revision Hell -

Monday, September 4, 2023

Yield curve inversion is bad for stocks - Not so fast

The inversion of the yield has proven to be one of the best indicators for a recession, but that begs the question of whether it is a good indicator about the stock market. It would seem on the surface that if an inversion forecasts a recession and a recession is an indicator of lower equity returns, there should be a link between the shape of the curve and equity returns.

Unfortunately, the evidence is not very convincing. Of course, there are not that many inversions, so the sample is small. Additionally, it is not easy to say what is the appropriate time horizon. The yield curve may lead the recession forecast by more than a year and by the time the recession hits, it is time to buy equities.

Some research has looked at the pre- and post-inversion time period (the time after the market first goes into inversion) and finds that small and mid-cap stock underperform, large cap stocks, but the difference is not statistically significant. There are poorer returns once the curve inverts but again the difference may not be significant.

When looked at across countries, the Dimensional funds group found that in 10 of 14 cases equity returns were positive in home markets after 36 months. This no different than any 3 year period; 71% versus the null of 77% for 5 different markets.

Bond markets do well after an inversion as reported by PGIM.

Dispersion - an important dimension for trading

Dispersion is a measure of the average distance between the return of a set of assets usually against an index. Dispersion can measure the opportunity for stock selection. If there is no dispersion, there is no difference in stock returns, so an investor is not paid to make a distinction between these stocks. If there is wide dispersion, then there is a significant difference between stock returns. There is more uniqueness.

Dispersion is not the same as correlation although they are related. Although a negative relationship, dispersion and correlation do not have a linear relationship. The relationship between dispersion and volatility is ambiguous.

If the market is in a high correlation period, there is likely to be less dispersion because all stocks are moving together. Similarly, if there is a low correlation, there is likely to be higher dispersion. There will also be a difference during market upturns and downturns. Correlation and volatility will tend to move higher during a downturn and lower in an upturn.

Trend-followers should like greater dispersion since there is an increase in opportunities and should also like increasing dispersion. Wider dispersion should also lead to more diversification. Counter-trend traders will dislike rising dispersion but like falling dispersion.

Sunday, September 3, 2023

The worry between GDP and GDI - it could be more than statistical discrepancies

GDI = W[ages] + R[ental income] + I[nterest income] + P[rofits]

Saturday, September 2, 2023

Peter Lynch - Making macro predictions is hard

“There are 60,000 economists in the US, many of them employed full-time trying to forecast recessions and interest rates and if they could do it successfully twice in a row, they’d all be millionaires by now. As far as I know most of them are still gainfully employed which ought to tell us something” --- Peter Lynch

Let's say it less elegantly, it is hard to make money using macro forecasts. Whether large econometric models, discretionary approaches, rules of thumb, aggregating forecasts, or use some form a market extrapolation, it is hard to make a forecast of a recession and then determine what investments to buy. The recession forecasts have been pushed into 2024 but that does not explain the strong performance of 2023 through the last eight months.

We move between good news is bad news to bad news is good news environments which creates huge market uncertainty. We need to follow the trends in the macro environment but need to be care with any forecasts.

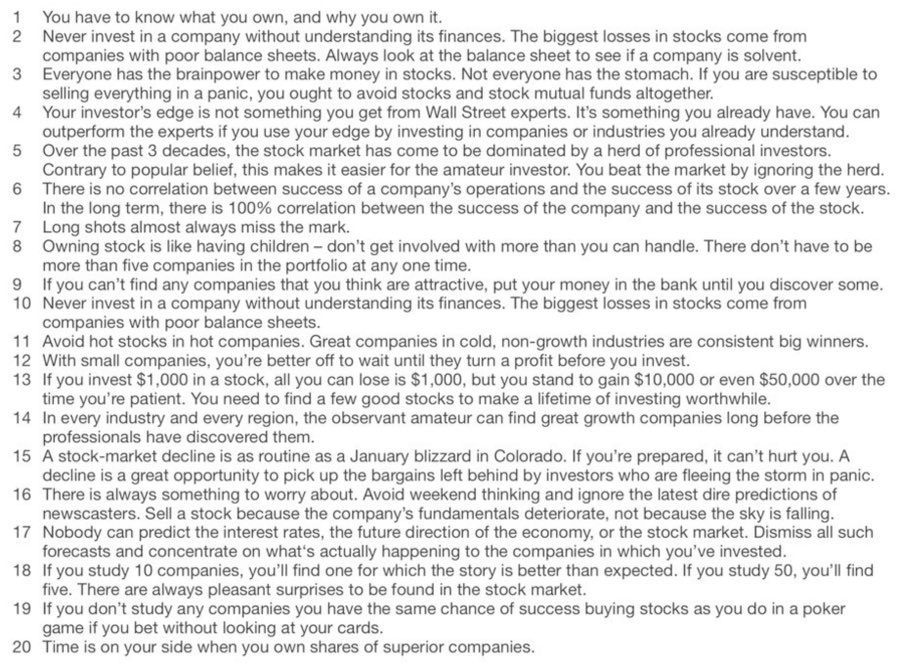

Peter Lynch's investment rules to follow

Countercyclical risk aversion - Feeling fear or boom