"Disciplined Systematic Global Macro Views" focuses on current economic and finance issues, changes in market structure and the hedge fund industry as well as how to be a better decision-maker in the global macro investment space.

Thursday, February 29, 2024

The power of the big 10 market cap names - over 30%

Wednesday, February 28, 2024

Is there a consumer credit problem?

Nowcast still looking good

The New York Fed produces a weekly nowcast which provides some insight on the latest economic data in a simple form. The forecast number still is at around 2.5% which suggests there is little reason for real economic concern. It also tell us that there is little reason for the Fed to cut rates based on a slowing economy.

Monday, February 26, 2024

Simple measure of market breadth - SPY / RSP

Reverse splits explode in 2023 - Playing with investors?

Reverse splits will allow stocks with low prices to increase in price to make the stock more attractive to investors. The value of the stock is the same. Instead of having more share outstanding, the firm will cut the number of shares which increases the price per share. If stock prices especially fall below one dollar, which may demand a delisting from an exchange, the reverse split will jump the price and provide some protection from the structural issues associated with low prices.

The consolidation of shares does not change value, only the price, but may signal a firm in distress. Stock splits which lower the price of stock should be considered bullish, albeit there is again no change in valuation. Corporate actions do matter, but as a signaling mechanism not a sign of increased valuation. Do not be fooled by reverse splits.

Sunday, February 25, 2024

Risk management and risk measurement

I had an interesting discussion concerning how to present information to investors on a fund's risk management. What became clear from this discussion is that providing risk measurement is not the same as risk management.

You can provide a lot of information on the risk of the fund. This information is very useful, yet it is only an indicator of what will be done during a specific risk event.

Risk measurement does not translate into what action will be taken. Measurement is a result of risk action. It is a window into risk action. Measurement is a snapshot, but risk management is a philosophy or a set of behaviors which will say something about how to protect principal. Risk management deals with market uncertainty while risk measurement focuses on what is countable.

High yield spreads and equity volatility

The focus for most investors has been on equity markets. Equities have had a nice run especially with the decline in recession expectations. Rates have been confusing for investors. The expectations were for a strong decline as the Fed changed gears towards a looser policy. The market is adjusting to a more cautious Fed. The critical issue is with credit given the strong demand for credit funds especially in the alternative investment space.

There are clear indicators that can be used to help with assessing the credit arena. Economic growth is one for the macro environment. Earnings is a key indicator for micro credit investing. However, a clean simple indicator is the VIX index. If equity volatility, a proxy for uncertainty, is on the rise, there will be an increase in credit risk. In general, if the VIX is below 20, they're low likelihood of a spread increase. If the VIX index is above 20 and rising, there is greater credit risk regardless of what rates may be doing. Of course, facing rates make it easier to refinance, but the compensation for holding corporate risk can still higher. There is little current credit spread risk.

NVDA - Is this a bubble?

There has been a lot of ink spilled on NVDA which is not worth going over. Money has been made by a lot of investors who know nothing about the chip market but have followed the bandwagon over the last year. The earnings release was explosive and the react was consistent with an exceptional report, yet the key question is always the same. What will happen next?

Whenever there are market extremes, there is a word that often thrown around which sends chills up the spine of many investors - bubble. Is the gain in NVDA, a bubble?

There is now a few that any extreme market move should be called a bubble, yet this is simplistic. A new technology, an innovation, a positive outlook, a supply problem, or host of other reasons can create a large increase in return over a short time horizon. Similarly, a change in the fundamentals or a reassessment of the fundamentals will create conditions that may reverse the increase. The bubble could be popped. Yet, this may only represent a change in market conditions. It can be seen as extremes, but does this constitute a bubble? Does a large change in a short period represent a bubble?

If the answer is that extreme prices are driven by fundamentals, then there is not a strong reason to see a decline in NVDA until we have evidence of a market reversal.

Recent research on market extremes suggests that crashes are not guaranteed after a strong run-up. See "Bubbles for Fama". Be careful with assuming that all bubbles will lead to a strong crash.

Nikkei 225 hit a new high, so what?

The Nikkei 225 has hit an all-time high, so what. You will have to go back decades to get to the current level so there is nothing special about this level other than it shows what an investment wasteland Japan has been for this period. The Topix index which is a broader representation of the Japan economy is still below previous highs. A bubble crashed, an economy slowed, policy did not work, and we can see the results.

The only thing interesting is the size of the move over the last year which has shown strong returns, up 44% in a one year despite the current changes in BOJ monetary policy which is titled to tightening and the current slow growth.

What is notable is the strong weight on information technology which suggests that the Nikkei is being pulled by the same forces as large cap US indices. The behavior is different, but the underlying story is similar, so we are seeing a gain and almost a doubling of the IT sector weight. Japan is a tech side play.

Cocoa market- Just crowded or a bubble?

You can't have a bubble without an initial catalyst. There usually must to be a fundamental story to start prices moving higher, but then expectations have to takeover. Narrative drives price extremes. The narrative is grounded in truth, but the reality reaches for extreme.

From Barchart, "The Ghana Cocoa Board cut its 2023/24 Ghana cocoa production estimate to a 14-year low of 650,000-700,000 MT from a previous forecast of 850,000 MT, citing smuggling and unfavorable weather." This is a big move down. There is a supply problem with El Niño weather, strong demand, and just poor crop management.

We will note that there will be stages to market extreme. From shock, there needs to be a trend, from trend there needs to be crowdedness, and from crowdedness there needs to be extreme, the bubble. Yet, is it a bubble if there is a fundamental narrative? When is a crowded trade a bubble trade? Hard to say.

The market is in backwardation with current cash prices at 6,651 and one year futures at 5220 which is a decline of over 20 percent. For those who want to get on the chocolate bandwagon, think again. Noncommercial long have actually decreased and commercial net trades have reduced shorts. Higher volatility has made the long trend trade less attractive albeit still profitable. Cocoa futures are up 55% since the beginning of the year. The prices are at decade extremes, yet the extra stretch may be limited.

Friday, February 23, 2024

Global valuation - Will the US still be special?

US equities have gained significantly relative to the rest of the world since the GFC. Valuations based on price to book have remained stable since the GFC for the rest of the world while the value of US stocks have exploded higher. This clearly due to tech explosion that does not have high book values, yet it does suggest that the future of US equities may be more suspect especially of tech comes back to earth. A US virus the rest of the world is a tech versus all other industries bet.

Corporate America is dynamic - Constant change

It is worth looking at this chart which shows the age of companies. The S&P 500 is highly dynamic with many young companies and few old ones. The life expectancy of many companies is surprisingly short. If you buy an index today, the composition over the long-term may very different. There is nothing special about being in the index with respect to longevity. Nothing is stable. Nothing is fixed. Change is all around us.

Tuesday, February 20, 2024

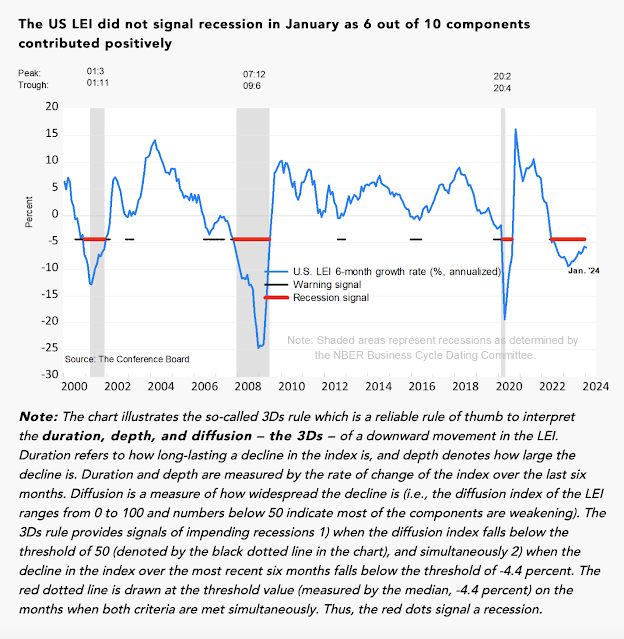

Conference Board LEI says no recession

China cutting long rates will not help balance sheet recession

China cut its five-year prime loan by 25 bps while keeping 1-year loan rates the same. The 5-year rate is the key mortgage rate. The PBOC cut reserve requirements by 50 bps on February 5th.

All of this is being done to improve the real estate market which has been languishing with developers facing an ongoing credit crisis. This cut may not solve the problem because China is dealing with a balance sheet problem not a cost of borrowing problem. The cut will not help banks which are already facing a problem of lower net interest margins. Home prices are falling. Investors are not interested in buying given the structural problems that developers may not finish projects. The cost of capital does not matter when you don't think the principal will hold value.

Rates have been falling for years. Prices are declining not just seeing slower inflation. China is an economy that is sick and the cure is not going to be just lowering rates. There is now a real estate confidence problem which is not a credit pricing problem.

Reversible and irreversible decisions - know the difference

Jeff Bezos has often talked about type 1 and type 2 decisions and how to address these decisions.

A type 1 decision is one that is hard to reverse. The type 1 decision is like a one-way door. If you go through the door, you will not be able to go back or the process of going back will be hard and painful. A type 2 decision is reversible. It is like a two-way door, easy to go through and easy to back again.

First you should always think about the type of decisions that is to be made. Is it reversible, or not? If it reversible, then don’t spend too time on it. Make the decision and move on. If you are wrong, you can get out without too much cost. On the other hand, if it is an irreversible decision, then make sure that you are very careful on your choice. It could be a one-way door.

A trading hedge fund is a reversible decision. A private equity investment is like a one-way door, or at least it is going to take some time before you can go back through the door. In the case of private equity, take your time with your decision.

This idea came from Farnam Street (Brain food), a great blog and newsletter.

Plan that your plan will not work

"Everyone has a plan until they get punched in the mouth." I love this insightful quip from Mike Tyson.

There is also the variation that may sound loftier, "Man plans, and God laughs".

You should always plan that you plan is usually not going to go as planned. The foundation of risk management is the appreciation that what you may think will happen with your portfolio will not happen. Most engineering problems plan for any contingency and then assume that the design will work. There are stress and calculations that can be made, but the solution is scientific. The behavioral aspects of finance, people make mistakes, creates a clear situation that plans will fail.

Saturday, February 17, 2024

YOLO credit bubble - is that a thing

There has been talk about the YOLO credit bubble - the You Only Live Once effect of spending money as if there is no tomorrow or tomorrow, when the bill is due, does not matter. I am skeptical of this story, but there should be some concerns about consumer credit. First, consumer loans are still high but have come down from its highs. The growth in the economy has been fed by consumer spending after major retrenchment during COVID. Second, the delinquency rate for credit card consumer debt is now at highs not seen since the post-GFC period. If there is a slowdown in the economy, this rate will only go higher.

Credit has grown after a retrenchment. Delinquencies have grown after a period when there was credit forbearance. Some of this is normalization. Some of this is also a sign that more consumers are using credit; however, we are not at a bubble stage.

PPI up - pushes Fed rate cuts into future

Friday, February 16, 2024

Family offices and asset allocation

Good company not the same as a good stock

"A great company is not necessarily a great stock." - An old investment maxim

Thinking about this in the context of business learning is very interesting. Management classes will focus on the quality of the company. Do you have good products? is the firm well run? Is the company true to its mission? Does it make money? Investment classes will focus on the cash flow implications of a company, but there is usually the premise that firm is fairly priced. If it is not fairly priced, there is a market inefficiency.

The idea that a good company can be expensive and lesser quality companies can be cheap is a critical part of the the investment game albeit a smaller part given the focus on indexing and passive investing. Unfortunately, separating good from cheap is not easy to discern.

Thursday, February 15, 2024

Funds in money markets is a wild card

Friday, February 9, 2024

Know your market regime - we are at an extreme

The regime of the market matters. If the markets are in an extreme of crisis or euphoria, there will be higher volatility and a chance for reversal. Extremes cannot last, so investors should be ready for market change. We are currently in a state of euphoria which is unlikely to continue. 2023 was a difficult year because we moved from euphoria to normal and back again to euphoria.

The SSGA market regime indicator which is scaled between 0 and 100 and uses volatility and market spread information as the key indicator forms a set of five states to describe the market. The states seem to match well with market behavior and can serve as an early warning system of market extremes.

Thursday, February 1, 2024

Skill and lucky - You usually need more luck

“My favorite formula was about success, and I wrote success equals talent plus luck and great success equals talent plus a lot of luck.” Moreover, “[t]alent is necessary but it’s not sufficient, so whenever there is significant success, you can be sure that there has been a fair amount of luck.”

- Daniel Kahneman Nobel Prize Winner

Luck can occur without talent. You can have talent and just not be lucky. Always think about this with investment management. There are a lot of smart money managers, but only few are able to generate strong returns in any year. Even fewer can do it through time. So if you are a good manager, try and assess where luck drove your success. It will be a humbling experience.