"Disciplined Systematic Global Macro Views" focuses on current economic and finance issues, changes in market structure and the hedge fund industry as well as how to be a better decision-maker in the global macro investment space.

Friday, December 31, 2021

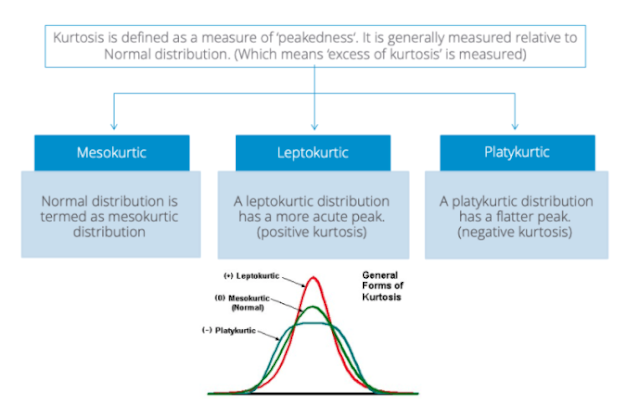

The shape of things to come -platykurtic

Thursday, December 30, 2021

Over-fitting and under-fitting and model building

Overfitting can be thought of as fitting the model to noise, while under-fitting is not fitting a model to the signal. In your prediction with overfitting, you'll reproduce the noise, the under-fitting will just generate something close to the mean.

Overfitting: Training: good vs. Test: bad

Under-fitting: Training: bad vs. Test: bad

One will expect that there will be more shrinkage or difference between training and test results for an overfitted model.

Under-fitting - missing parameters that are important with explaining some relationship or making a prediction. Under-fitting can be in the form of choosing an inappropriate specification. For example, a linear model will always under-fit a non-linear relationship.

Training error will decrease as more features are added which is good, but like many things too much of a good thing will have adverse consequences. Validation error should also decline with more features, but there is a limit to this improvement. If validation error starts to increase while training error continues to decline, then there is overfitting.

In the back of your mind, the modeler should always have the trade-off graph between complexity and error. More complexity and the training error goes down, but test error will be higher. For simple models, the training error is higher, but the test error may be lower. The same can be shown in a variance-bias trade-off graph.

Wednesday, December 29, 2021

Any fool can make a fortune, brains needed to hold onto it

Any fool can make a fortune, it takes a man of brains to hold onto it after it is made - Cornelius Vanderbilt

This quote is sticking with me as all the passive long beta investors laugh at the low performing hedge funds. I am not trying to be an apologist for hedge funds. They have gotten their flows and fees. However, there is the current investor belief that holding long beta portfolios indicates astute investment skill. It could be, but the more likely case is that inertia kept investors from further action. The fortunes of the lucky?

The question for 2022 is whether investment inertia will still be a winning strategy. Following momentum and maintaining a core allocation is still a good strategy, yet the issue is whether this is the best way to hold onto pandemic wealth. After the March 2020 crisis, the shift to pandemic-sensitive firms and a return to normalcy were the key trade themes.

Is the same pandemic/normalcy portfolio the best way to hold onto the pandemic equity bump? With higher inflation, less stimulus and a different pandemic risk, the portfolio of yesterday may not fit the circumstances of today.

Tuesday, December 28, 2021

Science and investment ideas progress slowly... death, retirement, and failure

Science progresses not necessarily through bright new insights but "through the old professors dying off" - Eugen von Bohn-Bawerk

"Investment ideas progress not through new ideas but through management retiring...."

"Investment ideas fall from favor through one major drawdown at a time only to return as the next style sees a major drawdown..."

This Bohn-Bawerk made his quote when referring to his precocious student Joseph Schumpeter, the other great economist from the first half of the 20th century, Keynes is the better-known name.

I have taken liberties to apply the idea to investments. Embedded investment ideas will only change when the old guard retires. Management must understand an idea before it is accepted which means it usually has to be learned at an earlier age in some MBA or business class.

If not retirement, investment ideas will fall out of favor with the first significant drawdowns. Drawdowns are failure signals which have to be replaced with a new idea. Idea chasing is ongoing with most money management firms. Failure will beget change which will be replaced after another failure.