The ETF revolution has expanded beyond core benchmarks to smart beta products which represent specific factor exposures in a liquid fund form. As the market moves beyond simple benchmarks, there are more choices that have to be made by the fund creator and investors. While rules-based, these smart beta ETF offerings both require and offer some structuring skill by the issuer.

Structuring flexibility within ETFs creates back-testing issues. Rules are generated and tested to create strong performing benchmarks, yet more conditional rules increase the likelihood that performance of the past will not be repeated in the future. Conditional rules optimized for a specific past market environment or date test set may not be robust to future environments.

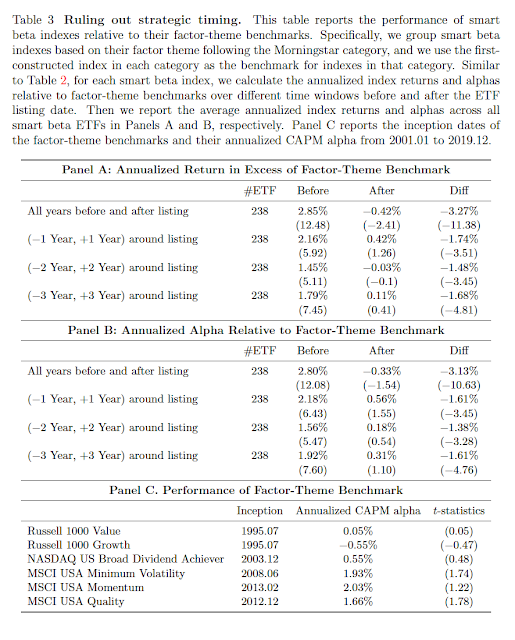

A close look at smart beta ETF performance after launch shows that post-launch returns have not matched their pre-launch return hype. Behold, fund offerings suffer from back-testing bias. See "The Smart Beta Mirage".

One could argue that this problem is just a matter of timing or subject to just some style categories. In reality, the smart beta return decline is pervasive. Others could argue that the decline is related to a declining trend in risk premia returns. Again, the data do not support this argument. We are left with a data mining problem, and a more customized the smart beta offering has a greater post-launch decline.

This represents the dangerous intersection between marketing, asset raising, and research. Firms want to launch a successful product that has value versus some benchmark. Rules are explored and tested until the product shows outperformance over some past history. The marketing department loves it. The potential gains in AUM could make this new product profitable. If there is no successful value-added in the back-test, the launch will never occur. The product is marketed based on those back-tested numbers only to see poor live performance. Call it product structure risk, but the investor is left with not smart but dumb beta.

One could argue that this problem is just a matter of timing or subject to just some style categories. In reality, the smart beta return decline is pervasive. Others could argue that the decline is related to a declining trend in risk premia returns. Again, the data do not support this argument. We are left with a data mining problem, and a more customized the smart beta offering has a greater post-launch decline.

This represents the dangerous intersection between marketing, asset raising, and research. Firms want to launch a successful product that has value versus some benchmark. Rules are explored and tested until the product shows outperformance over some past history. The marketing department loves it. The potential gains in AUM could make this new product profitable. If there is no successful value-added in the back-test, the launch will never occur. The product is marketed based on those back-tested numbers only to see poor live performance. Call it product structure risk, but the investor is left with not smart but dumb beta.

No comments:

Post a Comment