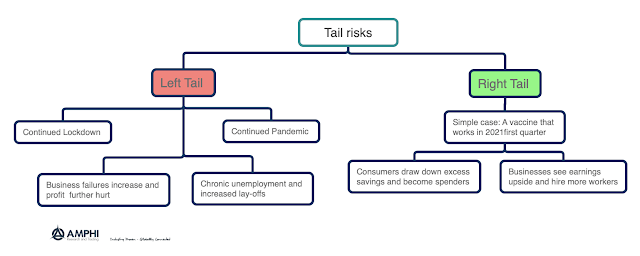

Most of the talk from market analysts has been focused on left tail events. Protect your portfolio against those left tail events. The harm is coming. We need more fiscal stimulus because there will be a left tail economic event. We need dovish monetary policy until 2023 because there will be a left tail economic event. We need to be aware of a second COVID wave, another left tail event. Business are failing and workers are not finding jobs, a left tail event is developing. All of the focus has been on the downside. From a macro-prudential policy perspective, this makes perfect sense and is warranted. An investor should always anticipate the downside; however, an investor should at least consider a right tail event especially with vaccine predictions rising.

What if there is a vaccine in the first quarter of 2021, and most lockdown measures are lifted? What if current positive testing moves decidedly downward? What will happen with the markets and policy? Even a vaccine may not turn everything around immediately and a lockdown lift will not create an immediate reversal, but a positive right tail event will be a game changer that perhaps has not been fully discounted.

Both left and right tail ends are real and have to be considered. A bias too strong toward the left tail scenarios may be painful for the overly conservative investor.

1 comment:

Nasdaq at 10,600 + and S&P at 3200+ are both HUGE right tail events!!!

Post a Comment