"Disciplined Systematic Global Macro Views" focuses on current economic and finance issues, changes in market structure and the hedge fund industry as well as how to be a better decision-maker in the global macro investment space.

Thursday, June 30, 2022

Case-Shiller city price tiers - Low-end (cheaper) homes are riskier than high-end homes

Tuesday, June 28, 2022

Case-Shiller housing price index and city price betas - Each city has a different risk profile

Monday, June 27, 2022

Beware, but use investor sentiment to help with hard to value stocks

Investor sentiment, defined broadly, is a belief about future cash flows and investment risks that is not justified by the facts at hand. Sentiment has a market impact on longer-term fundamentally based investors because betting against sentimental investors can be costly and risky. Smart traders and arbitragers may not be able to offset the flows from sentiment in the short run. You can call sentiment traders, noise traders that introduce volatility associated with different use of information. Hence, sentiment can cause deviations from fair value. Some stocks will be more sensitive to sentiment than others, so sentiment can be incorporated in investment decisions. See "Investor Sentiment in the Stock Market".

Sentiment measures can either be top-down or bottom-up. Given our macro focus, we will discuss some top-down conclusions. Top-down sentiment focuses on aggregated reduced form measures. Bottom-up sentiment uses or tries to measure investor biases. Some categories of stock are more sensitive to sentiment: low capitalization, younger, unprofitable, high-volatility, non-dividend paying stocks, growth stocks and firms in financial distress. Stocks that are harder to value or more difficult to arbitrage will be subject to more sentiment risk because investors will try and use other measure to form expectations and create a perceived edge. Sentiment is associated with the propensity of marginal investors to speculate on non-fundamental information.

High (low) sentiment will push speculative stocks above (below) fair value. Easy to arbitrage or value will have less variation from fair value based on sentiment. These speculative harder to arbitrage stocks will have higher (positive) sentiment beta while more bond-like stocks will have negative sentiment betas. As information is revealed, prices should move back to fundamentals.

What can be used for macro sentiment:

- Investor surveys - Consumer confidence correlates with small caps and stocks with strong retail interest.

- Investor mood - Some researchers have found a mood associated with weather and daylight.

- Retail investor trades - Retail investors herd and can push speculative stocks.

- Mutual fund flows - Flows are often tied to retail sentiment and will drive speculative stocks.

- Trading value - Volume changes represent differences in opinion and especially impact stocks when short selling is difficult.

- Dividend premium - Given more "safe" bond-like returns, there will be a premium difference.

- Closed-end discount - The deviation from net asset value can proxy for retail sentiment.

- Option implied volatility - Option flow trading will impact volatility and describe speculative and hedge trading.

- IPO first-day returns - Serves as a measure of speculative fever.

- IPO volume - Bring new firms to market is based on perceived market optimism.

- Equity issues over total new issues - A broad measure of equity financing activity.

- Insider trading - A measure of what corporate insiders think about their company.

These sentiment measures can be used in concert to form a sentiment indices which can measure the deviations from fair value of speculative stocks. Sentiment can proxy for speculative demand that may be reversed as new fundamental information is released. Positive sentiment can push prices higher and create volatility only to be reversed as news enters the market.

Sentiment may not be based on fundamentals, but it can play an important role for exploiting opportunities in hard to value (arbitrage) stocks. Sentiment in other asset classes that are hard to value can be employed to measure market extremes.

Saturday, June 25, 2022

Credit spreads and equity levels

Credit spreads and mean reversion - works well with trends

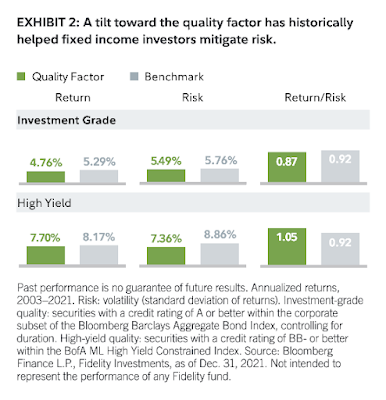

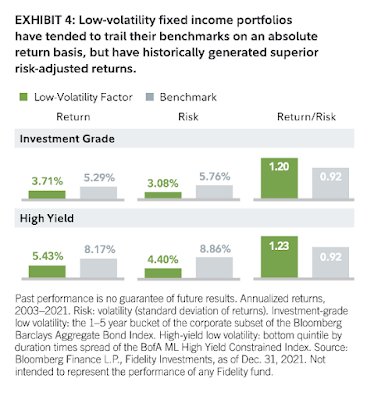

Fixed income factor investing - Some evidence

Thursday, June 23, 2022

The "two cousins" - asset and price inflation

"The real danger comes from [the Fed] encouraging or inadvertently tolerating rising inflation and its close cousin of extreme speculation and risk taking, in effect standing by while bubbles and excesses threaten financial markets."

- Paul Volcker

Volcker warned about the two cousins of inflation - asset and price inflation. We got the asset inflation over the last decade, but we had to wait for the price inflation after the pandemic. The asset inflation is easy to identify and control. Equities gained from strong earnings and increasing valuations. Price inflation is more complex to identify. There can be supply shocks which create relative price distortions and there can be feedback from price gains to wage increases.

The Fed is doing its job to arrest the stock market. Increasing discount rates reduces the present value of earnings and reduce the value of projects. We are in a bear market that reverses asset inflation. The price inflation has yet to be reversed. Increasing rates will reduce aggregate demand, but it is a blunt instrument. A tightening policy can reduce overall demand, but it cannot reverse gasoline prices or food prices. Weaker demand will reduce wage pressure, but it will not create new jobs.

The Fed cannot just reduce asset or price inflation. These inflation cousins are joined together. When one goes down, the other will follow it.

The allocative effect of low rates and easy money

Wednesday, June 22, 2022

The Fed reaction function - Where all the market action is focused

- The market has discounted increases in rates, so the trade is whether Fed will become more aggressive and realize market expectations or whether the Fed will be condition in its fight against inflation. Is the Fed willing to sustain multiple 75 bps increases?

- The market is discounting a higher probability of a recession than the Fed. If these likelihoods are true, the question is whether the Fed will again move away from its current project path of rate increases. If unemployment moves to 4.5%, will it slow rate increases or cut rates?

- Finally, there is the question of how much financial instability will the Fed allow before acting to stem. We are in a bear market. Will the Fed be willing to see a 40+% correction and still increase rates. Will the Fed increase rates even if there was a funding problem on Wall Street. The likelihood increases as rates increase. Will the Fed sustain rate increases if there are increased threats of financial instability?

Tuesday, June 21, 2022

Investors and memory - Don't be fooled by only focusing on the good trades

You have heard this story. I am a good investor! Why? Because I have a good memory of my past trades and those trades have all worked out. This is a nice narrative, but it is not true. Some recent researchers formed some structured experiments and found that most investors have a memory bias. (See "Investor Memory".)

The researchers tested for a memory effect or bias with investments. They found that subjects over-remember positive outcomes and under-remember negative returns. This pattern of remembering leads to overly optimistic beliefs and reinvestment. Any bad trades will soon be forgotten while those winners will be front and center in an investor's mind. It takes a special investor to focus memory on both good and bad decisions.

Other researchers have found that positive memory biases lead to overconfidence and more trading. If I think I am right, I should do more of the same. (See "Investor memory of past performance is positively biased and predicts overconfidence") However, by exposing investors to their bad trades and training them not to have a positive bias, this overconfidence and memory bias can be reduced.

A quantitative model will not have a memory bias. It will view positive and negative decisions the same. There is no extra training needed, no overconfidence, no belief bias, and no excessive trading. If you don't use a model, at least spend time reviewing bad trades to minimize a memory bias.

Monday, June 20, 2022

Credit drives all financial and real markets

- Increase in the risk-free rate of return will reverse the reach for yield when rates were close to zero.

- An increase in the discount rate will reduce the present value of all cash flows. Firms that expect more distant cash flows will be more affected.

- Rising rates will reduce cash available for investors and projects if rates go higher; more will go to debt holders.

- The cost of capital will increase, so investment projects will be rejected.

- Firms that made a low return on capital but above zero were able to continue operations. It will be the case as rates increase. Firms will go out of business.

Sunday, June 19, 2022

Central banks and being behind the curve this week

There is the old joke about wearing running shoes in the woods as a protection against bears. All you need to do is outrun the other hikers not the bear. The dollar is appreciating because Fed monetary policy is outrunning other central banks at being more hawkish. It is showing in currency pairs. The only exception with tightening is the BOJ which is holding to its loose policy. All central banks are acting as though they are behind the inflation shock. All these banks are giving forward guidance that rate increases will increase.

- Fed raise 75 bps forward guidance more tightening

- SNB raises 50 bps forward guidance more tightening

- BOE raises 25 bps forward guidance more tightening

- Brazil raises 50 bps

- BOJ holds policy forward guidance more of the same

Friday, June 17, 2022

Bear markets and recession - A serious signal

Monday, June 13, 2022

Consumer sentiment index shows strong pessimism

Inflation - More volatile and stronger short-term moves

Thursday, June 9, 2022

How persistent or transitory is inflation?

Wednesday, June 8, 2022

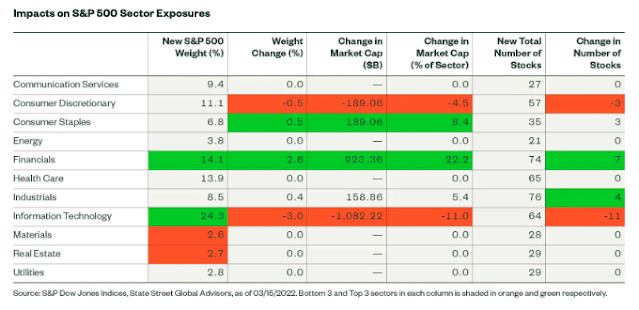

Sector classification is a dynamic process

Commodity super-cycle is here but different from the past

Tuesday, June 7, 2022

Know the counter-argument for any investment

“He who knows only his own side of the case, knows little of that.”

— John Stuart Mill

"I never allow myself to have an opinion on anything that I don’t know the other side’s argument better than they do."

- Charlie Munger

"Ignorance more frequently begets confidence than does knowledge."

- Charles Darwin

If you want to understand your position in any argument, learn what is the counter-argument. Whether associated with investing or current events, serious knowledge of the alternative will only help you refine your position. Describing pros and cons of any investment is a critical skill, yet it is harder than most think. Of course, it is easy to detail the arguments that support a position, and then the counter-arguments become a perfunctory process with minimum effort. A counter-argument cannot be the mirror opposite of an existing position, nor can it be a straw man that can be easily defeated. A good counter-argument should have the potential to be persuasive.

For example, someone could argue that the Fed is going to follow a hawkish policy because inflation is going higher given continued supply congestion and oil price increases. The counter-argument cannot just be that oil prices and bottlenecks will be reversed. The process of why must be detailed and given specificity.

The counterargument issue becomes especially difficult when developing quant models. There is no counterargument except through breaking the model, running alternative scenarios, or having another model to contrast against the primary model. There is a reason for why ensemble modeling is used to solve the counterargument problem. What do alternative models say about output?

Monday, June 6, 2022

The Global Supply Chain Pressure Index worth following

Davos and globalization

Data and lawlessness - think in frequency and when in doubt, think random

In his well-written book, Chancing It - The laws of chance and how they can work for you, Robert Matthews explains well the basics laws of chance and probability, but he also spends time describing what he calls the principles of lawlessness. It is a nice device to remember some important statistical concepts.

The first law of lawlessness - do not look at events look at the frequency of events. Every number should be looked at in context, the context of likelihood. Ask the simple question - what is normal and what is abnormal. Risk management is all about getting the frequency right.

The second law of lawlessness - When trying to understand random events don't assume they are independent and don't assume that correlated events will stay that way. Live would be so simple if the events were independent. The probability of A and B occurring is just the product of the individual probabilities. However, if you know the correlation of two variables, do not assume that this correlation will stay the same. Correlations change and may be related to a third variable.

The third law of lawlessness - randomness does not ultimately have patterns; but in the short-run there can be regularity. When in doubt, go with random. You may think you see a pattern in the short run, but that does not mean the pattern will continue, nor does it say that a time series is non-random. A random series does not mean-revert. A series of heads does not mean the next flip is more likely a tail, yet in the long run the frequency of a tail is .5.

Be cautious of any number and any count. A small sample will tell a different story from a large sample and the actual likelihood may be different from any data collected. When in doubt, trust randomness.