"Disciplined Systematic Global Macro Views" focuses on current economic and finance issues, changes in market structure and the hedge fund industry as well as how to be a better decision-maker in the global macro investment space.

Sunday, May 29, 2022

Savings rate still declining - forces GDP back to old trend line

Friday, May 27, 2022

The Fed has been tightening financial conditions (Chicago Fed ANFCI index)

Financial conditions are tied to the stock market. As stress increases, stocks should decline. Looking at the Chicago Fed Adjusted Financial Conditions Index ANFCI and the SPX over one month shows a strong relationship. This is. due to the construction of the index which includes market prices for many fixed income instruments. This index provides a strong indication as to the impact of Fed policy on financial stress. Clearly, raising rates will tighten conditions. Another way of viewing financial conditions is through a swirligram — a combination of level and changes for a variable. Positive (negative) ANFCI indicator, the vertical axis, will represent tight (loose) conditions. The horizontal axis represents the change in ANFCI. A negative (positive) number will mean deteriorating (improving) conditions.

Since the beginning of the year, we have seen a steady deterioration of conditions and a movement from loose to tight. There has been an ebb and flow with this decline in conditions with changes in market reaction to Fed statements and policy, but the pull to tightening as been consistent all year.

The highest weights for the ANFCI index which includes over 100 indicators. Th complete list of indicators ANFCI index can found here.

Tuesday, May 24, 2022

Inventory to sales data suggest further retail adjustments - A business cycle indicator to watch

Stagflation thinking peaking at highest levels since 2008

Monday, May 23, 2022

The inflation - equity valuation trade-off is not attractive

Friday, May 20, 2022

One of the better non-investment investment books - Think Again by Adam Grant

Some of the better investment books have nothing to do directly with investing. The book Think Again: The Power of Knowing What you Don't Know by Grant Adams is a perfect example. The focus is on how to keep an open mind and accept alternative points of view. We have to unlearn what is wrong and learn how to accept alternative views and ideas. If all we do is reinforce or original thinking, we are not really thinking. The book focuses on the idea that we have to think like scientists filled with skepticism and constantly focused on the evidence to disprove our beliefs. If you are not questioning long held assumptions, you really are not effectively thinking. Our experience and expertise are helpful but they should not dampen our questioning mind.

Thinkers or arguers can be classified as preachers (no proof required), politicians (no training required), prosecutors (too much training required), or scientists (experiments required). Smart people can fail because they do not question; they only assert or look for confirmation to their logic. There is nothing wrong with being wrong, if you learn from the experience what is right.

Most investing is learning to accept being wrong, not holding a single point of view, and working to discover what is not known. It is forcing yourself to be the ultimate scientist. Grant presents this open learning in an accessible way that engages readers.

Thursday, May 19, 2022

Inflation measures and company margins; follow the CPI-PPI difference

The Conference Board LEI index forecasts slower growth

Wednesday, May 18, 2022

Credit spreads and the equity decline - corporate risk abounds

An office market debacle is still ahead of us

Monday, May 16, 2022

What is the optimal inflation target - Not what you may think

Would it surprise you to find out that there is no agreement that a 2% inflation target is the right number? In fact, a careful review of all the academic papers on monetary policy and inflation target suggest that the best number is zero. There is no magic with a 2% target. There is limited rationale for that number so there should not be any magic goal to get back to 2%. There still is a relentless fall in purchasing power even at the 2% number. See Fed economist, Anthony Diercks, "The Reader's Guide to Optimal Monetary Policy", also see his interactive app on optimal monetary policy research.

I just found this research and it is very provocative given it is a summation of all work on this topic. We have picked an inflation target that may not match research. Does this help us today? No, but we should place less stock in what the Fed may tell us as optimal.

Philadelphia survey shows significant change in forecasts

Friday, May 13, 2022

Living with a 60/40 portfolio - Ouch!

Some facts about the combination of 60% SPY and 40% AGG. No protection from the classic diversification portfolio.

Through April 2022, the -11.5% return is the worst year ever recorded from a start date of 1977. This is 730 bp below the next worse year, 1977. It looks like the 60/40 portfolio is down 13% through the market close today.

There has never been a down SPY with the AGG also being negative. This year both are stocks and bonds are down double digits. There is no diversification benefit. The return to risk ratio is more negative for bonds than stocks in 2022.

This the first time the SPY and AGG are both in double digit drawdowns at the same time.

April was the worst month for the NASDAQ composite in 20 years; Investors have to go back to the tech bubble burst in 2021.

On a year to date basis, SPY is down the most since 1939.

Inflation is at the highest level (CPI YOY) since 1981 which has been a significant drag on bonds.

Other assets have reflected bubble behavior. Median home prices to household income is at the highest level ever recorded at 6.5. It was at 4.8 just two years ago. The average new home price is approximately $524,000, up 26% in one year. Home prices are up 114% by the Case-Shiller index since the low in 2012.

Learning and the unfolding of disaster events on market prices

There can be a good story for each, but since these scenarios having changing probabilities the pricing of these disasters only unfolds over time. We often do not know whether we are facing a Great Depression or a Great Recession. Mild or severe, a future disaster is not clear given that the market faces imperfect information. Ex post, the signs may seem obvious, but not ex ante when information is unclear and strong beliefs are hard to form.

The result is that equity prices will only gradually react to consumption declines as investors learn, uncertainty is resolved, and imperfect information is clarified. See "Learning, Slowly Unfolding Disasters, and Asset Prices". I will not go through all the specifics of the model but point out the key point that when there is imperfect information and learning about a large potential disaster, the price asset price paths will often be slow to discount these big moves.

In this type of environment, the world is not efficient in the traditional sense but subject to trends as risk is repriced through time. The slow revealing of information and learning means that deep out of the money downside put protection may not serve investors well because the gradual adjustment does not allow the full put value to be realized. It also means that the VIX, and variance risk premia will only slowly adjust to a pending disaster. Consumption will be affected differently if market prices slowly adjust, a slow grind of a negative wealth effect.

The dynamic of this model fit well with the current environment. I am not suggesting a disaster, but a soft or hard landing, overshooting of policy, or a changing inflation environment is only being revealed slowly and prices are reacting in a similar fashion.

Wednesday, May 11, 2022

Fed "Behind the Curve" Template - A measure of what the Fed needs to do

A simple Fed "behind the curve" template can provide context for a discussion on what the Fed needs to do to get back to a neutral policy that is consistent with long-term inflation and growth objectives. We look at the MPS (monetary policy stance), the Taylor rule using the inputs form St Louis Fed president Bullard, and the inflation rate above target. We also include the shape of the yield curve on the front-end and the expectations embedded in the Fed funds futures.

The MPS is equal to the real Fed fund rate minus r-star which we estimate given other studies as being approximately .5. The MPS is minus 5% when in a normal environment it should be above zero. Clearly, the Fed stance is not hawkish or restrictive on inflation.

The Taylor Rule is modified to account for a very conservative estimate based work from the St Louis Fed. Again the result suggest that rates should be a lot higher. If we assume that the 2-year rate gives a forward estimate of what the market expects, there still is a further Fed increases necessary albeit the gap is less than what would be given using current Fed funds.

The inflation numbers are all above the target level and actually moving away from 2%.

The estimates for the Fed funds futures for December suggest that the Fed has to raise rates 175 bps to just be consistent with market expectations. This is also consistent with the difference between current and 1-year forward eurodollar futures and the spread between 2-year Treasuries and current EFFR.

So when asked, "Is the Fed behind the curve?", you can place some context and numbers with that statement.

Corporate bond issuance and trading impacted by Fed policy and inflation

Tuesday, May 10, 2022

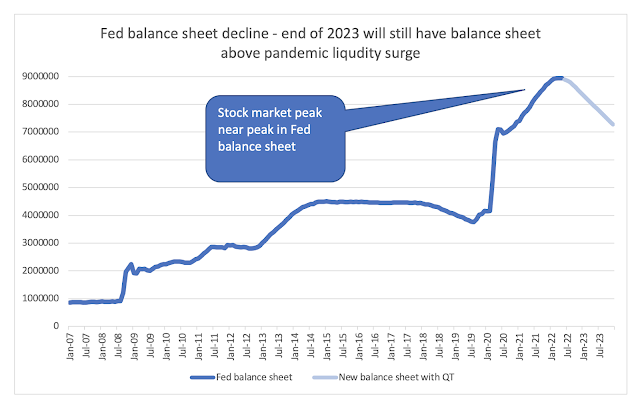

Removing the punchbowl moment with QT - Impact not as strong as inflation expectations

The Fed QT plan is measured and cautious; however, the last QT program only occurred well after the beginning of the Fed rate hikes. Now, we are having the beginning of the rate hikes and QT occurring within 3 months of each other. The plan is an initial roll-off of Treasuries and mortgages with a ramp-up in September when the cap for reductions will be $90 billion.

Past evidence suggests higher volatility in bond markets like what we are seeing now, but that was associated with poorer forward guidance from the Fed, and we have more inflation risk. Currently, the announcement of the QT plan has been linked with the equity and bond selloffs, yet correlation is not causality when there really is no sample of past action.

The decline in the Fed balance sheet through 2023 will only take levels back to the summer of 2020 and will not reverse any of the initial pandemic stimulus, so there should be limited reason to expect a strong bond sell-off from the decline. Additionally, given fiscal policy has slowed, the demands for the Treasury to raise funds will not be as strong as in 2020-21. Finally, the bond sell-off has started to make current US Treasury yields attractive to investors. The question is always what the incremental pressure on yields will be. Can the bond market take a reduction? At this point, there are other more pressing risks for bonds.

Monday, May 9, 2022

Where are consumers spending? It matters for markets

Where are consumers spending money? It matters given the overall market weakness. We should expect greater dispersion in equities because the there is greater dispersion in expenditures. There has been greater spending on gasoline because of the oil price shock and this has been reflected in integrated oil companies. The big switch is from buying things to doing things - goods to service switch.

Consumers are traveling which reflects the switch from goods to services.

Saturday, May 7, 2022

Can we measure whether the Fed is "behind the curve"

The Fed is behind the curve with respect to fighting inflation. I believe it and so do many others, but can some number be put to this belief. Of course, we can look at the difference between some inflation measure and Fed funds. Whether CPI, PCE, core, or trimmed, inflation is high versus short rates and real rates are at extreme negative values, yet we can be more precise about being behind the curve.

St Louis Fed president Bullard has done a good presentation last month on this issue that is short, clear, and easy to read. It was updated and presented at the Hoover Institute this week, see "Is the Fed behind the curve? Two Interpretations". It takes a conservative approach and shows that by using a simple Taylor Rule, the Fed is behind and has a lot of wood to chop.

If you account for the market moves out the curve as a response to forward guidance, the Fed is still behind the curve. The gap has closed slightly since March given the fixed income sell-off, but there is still more rate increases necessary.

The question is not whether the Fed is behind the curve, it is, but what is the cost of closing the gap and how fast should it be done. It can be done quickly or slowly but the path does matter. Right now, the Fed has provided guidance on the path. A fast path may work but at the expense of financial markets. A slow path may cause inflation expectations to be driven higher.

China tail risk for global economy

An underpriced economic tail risk facing investors is from the China slowdown associated with zero tolerance COVID lockdowns. The CAIXIN China composite PMI fell to below 40 this week, the worst reading since the beginning of the pandemic.

Friday, May 6, 2022

Bond Vigilantes - They are back

What defines a bond vigilante? Where have they been? Why are they out riding now? Regardless of what you call the marginal sellers of bonds, they certainly are back. There are no marginal buyers that are independent of market reality. Central bankers were the marginal buyers, but they are gone. The Fed will be reversing their bond portfolio starting next month.

Thursday, May 5, 2022

What a difference a day makes - Major reversal after Fed rate hike

24 little hours

Brought the sun and the flowers

Wednesday, May 4, 2022

The forward guidance - Fed not actively considering 75 bp hike

Fed forward guidance changes the behavior of investors. "Listen to what I say, and I will tell you where we are headed". The focus is on the words of the Fed Chairman and not just Fed action. The Fed action like today was clearly telegraphed. The reaction from the announcement was minimal before Chairman Powell spoke; nevertheless, he provided the magic words that a 75 bps rise was not being actively considered. As soon as the announcement was made, the stock market was moving higher, yields moving down, and the dollar selling off.

Was the comment intentional? Powell is very careful with his comments, so my impression is yes, but it is restrictive and shows the Fed as not a serious inflation fighter.