"Disciplined Systematic Global Macro Views" focuses on current economic and finance issues, changes in market structure and the hedge fund industry as well as how to be a better decision-maker in the global macro investment space.

Thursday, April 28, 2022

Inflation is a global problem well before the Ukraine War

Wednesday, April 27, 2022

Long-term monetary policy and asset valuation - Dovish and hawkish regimes

Monday, April 25, 2022

Inflation persistence - It is not going away even with an aggressive Fed

Friday, April 22, 2022

The liberal world order and global arbitrage

Globalization and the liberal world order can be viewed through the impact of market arbitrage and the law of one price. In a globalized world based on free trade, higher prices in one country will be offset by importing to increase supply and take advantage of any price discrepancy. For commodities, there will likely be one world price after accounting for transportation costs, tariffs, and processing. In the case of energy, oil or natural gas will converge to one price. Of course, this may not fully represent reality, but it is an ideal which is a driving force behind market behavior.

The law of one price can be applied to capital and labor. There will be winners and losers as market equilibrate to one price, but uncertainty is reduced. Investment decisions can be based on the law of one price. Access to commodities will be at the world price so considerations for plant location will be based on labor costs and nearness to the consumers. The law of one price will increase economic efficiency.

In a world where it is more difficult to achieve a world price for commodities, trade and manufacturing will have to be reconfigured. If there is a breakdown in trade as well as the free flow of labor and capital, market inefficiencies will arise, and optimal global growth will not be achieved. Those without access to supply will see growth languish as resources are squandered to support an inefficient world.

Equity and bond markets will not be integrated and return dispersion will increase and correlation across markets will decline. Holding international portfolios will become riskier at the same time diversification will increase. There will be winners who exploit inefficiencies, but consumers will be net losers. Country and regional assessments will need to be improved because declining integration create structures to deal with supply shortages. Finance and investing will be harder with a greater focus on local market dynamics. We have not seen this type of disorder in decades and it represents a headwind that reduces consumer welfare.

Chairman Powell - Multiple 50 bp increases coming

Thursday, April 21, 2022

Trading trends and exploiting volatility differences

Wednesday, April 20, 2022

Stocks don't react early to a recession - new evidence

A traditional view is that stocks are forward-looking and can provide early insight on a downturn in the economy. Significant empirical evidence has shown counter-cyclicality between equities and macro-aggregates. However, new evidence suggests that stock prices reflect the onset of a recession but with a delay. It is a matter of properly measuring the business cycle. (See "Late to Recessions: Stocks and the Business Cycle" This delayed response means that the business cycle itself provides information about equity return and not the reverse. Equity returns are predictably negative after the onset of a recession before turning positive. There is strong momentum during a recession while there are mild reversals associated with discount rate changes during expansion.

Equities under-react to a business cycle downturn. Hence, there is the opportunity to form trading rules that will add alpha and increase the Sharpe ratios from active equity trading around business cycle events. This value-added all revolves around the ability to measure or assess regime changes in the business cycle. This measurement is not immediately intuitive but there is known modeling technology that focuses on regime switching that can be used to exploit macro opportunities.

The author shows that even a simple trend with macro downturn model will add value and account for the combination of market downturn with the autocorrelated behavior in equities.

The true useful extension of this paper is connecting regime changes with the time series behavior of stocks. Expected returns can be forecast through using a state-dependent autocorrelation model.

Exploit trends during contraction periods and account for reversals in expansionary phases. The intuitive explanation for this equity behavior is that investors are often late in reacting to a recession, that is, investors are poor at adjusting their forecasts to an impending downturn.

Equity convexity value - Holding positive gamma conditional on the macro environment

By focusing on long convexity and using macro signals, the researchers found that a portfolio can be developed with higher returns and higher return to risk than holding an index (MSCI world), albeit for a limited period.

Tuesday, April 19, 2022

Increased corporate credit risk - A fall-out from QE

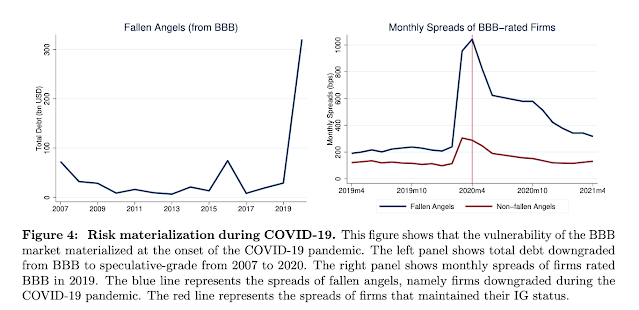

A provocative paper from the NY Fed "Exorbitant Privilege? Quantitative Easing and the Bond Market Subsidy of Prospective Fallen Angels" tells the tale of unintended consequences from the Fed's extended QE programs. Keeping rates low created the search and reach for yield in the corporate bond market. Borrowers were able to obtain cheap financing and lenders took greater risks than normal. Normal returns and risk measures were discarded.

We have corporate zombies among us, and this was caused by the Fed's QE policy that forced fixed income investors to buy marginal corporates to meet their liability needs. Now that we are seeing a change in Fed policy, the cost of subsidies to risky corporates will be felt by the same investors who reached for these yields. The impact will be felt especially by bonds on the cusp between investment grade and high yield.

This cusp risk is made possible by the ratings inflation from ratings agencies who kept ratings stable even as credit quality has deteriorated.

Could this exorbitant privilege of lower borrowing costs to cusp investment grade firms have been anticipated? It should not have been surprising. In extreme environments, firms engage in extreme behavior. Risks are taken and exploited because consequences are pushed into the future. The negative consequences will now be felt as rates are normalized.

Monday, April 18, 2022

Fin-Fi (Financial Fiction not Sci-Fi Science Fiction) - Just speculation without focus

There is a new fad in finance - Fin-Fi, not to be confused with Sci-fi although there are similarities. Fin-Fi is the description of alternative finance universes that may evolve from the current environment. These narratives are futuristic visions of what finance and economies may be like, not what they are today. It can be viewed as fun thought experiments worthy of good cocktail chatter, but these fin-fi stories create a distortion about risks and uncertainty in financial markets can have real effects.

Is it important to think about alternative futures of finance? Yes, but what is often missing is the story of transition or how we go from today to these new tomorrows.

The current fad in fin-fi is what the world monetary order will look after the sanctions on Russia. Some have suggested a new world order, Bretton Woods 3, which will be a return or variation on commodity-based currencies. It is provocative and provides a new perspective, yet it not something we will likely see in the near-term. Many fin-fi stories have suggested the demise of the dollar as the international reserve currency. Some have called for world broken into free and authoritarian countries in a new Cold War. The liberal dollar order is under stress but that is different from a new monetary regime. Let the narrative come forth, nevertheless, separate dollar action from storytelling.

Can you make money from these thought experiments and descriptions? Unlikely. While the world order may fall quickly, the price activity before the fall will drive profits not a vision of what the new order will look like. Follow the price action in an uncertain world.

However, there is a major global economic theme that should be accounted for; the tension between mercantilism and the liberal order of free trade and capital. When the global economy is expanding, the liberal order is in ascent. If there are shortages, mercantilism will be the choice of governments. The world focuses on real commodity assets not fiat money. National order trumps liberal order during crises. This is something that is not fin-fi, but geopolitical reality.

Thursday, April 14, 2022

Reputation risk matters - Do investors focus on these risks?

Financial risk, risk appetite, and sovereign spreads

With the change in Fed policy, the deterioration of financial conditions, and the mixed US yield curve signals, there will be widening of sovereign bond spread and greater differentiation between country yields. Changes in the risk appetite of financial institutions that are the underwriters of sovereign debt will spill-over to market prices regardless of the current account fundamentals.

Using an excess bond premium (EBP) model and a Global Financial Cycle (GFC) model, researchers have found a clear link with sovereign spreads, "Global financial risk factors and sovereign risk".

The EBP model looks at US corporate bond spreads net of default risk as a signal of risk appetite. The GFC factor model focuses on US monetary policy tightening as the key to deleveraging of financial intermediaries, a decline in domestic credit and tightening of foreign financial conditions and credit flows. Tightening US monetary conditions, given the role of the dollar, will have an international transmission effect that is different than the credit and risk-taking channel.

Thursday, April 7, 2022

You are not the boss, the market situation is the boss

We cannot control war. We cannot control Fed policy. We cannot control shifts in demand and consumer tastes. We must bend to the situation presented. However, we can react and respond, so identification and response time is critical.

For the trend-follower, it is the identification and response time to price behavior. For the relative value trader, it is identification of misallocations. In both cases the market activity is bossing your decisions.

Investors are not helpless to market situations bossing your behavior. Investors can prepare for different scenarios. Investors can be resilient to shocks and manage risks, but they will always be reactors to market behavior. We can only take what the markets will give us. Understanding who is in control can reduce anxiety and allow for focusing on responses to market shocks.

Wednesday, April 6, 2022

Fed balance sheet reduction - A cautious approach

Yes, the Fed will start balance sheet reductions in May through roll-offs of their Treasury and MBS holdings with caps of $60 billion for Treasuries and $35 billion for MBS. If the roll-off in a given month is greater than the cap, then there will be reinvestment of the proceeds. Hence, the Fed will still be buying securities in selected months.

We will note that the roll-off strategy will be less than the $120 billion of securities buying that occurred each month during the pandemic period. The roll-off will be slower than the purchases.

If the Fed hits the cap each month, it will take 5.5 years to get back to February 2020 levels for Treasuries and a little over 3 years to get back to old MBS levels. In a rising interest rate environment, there will be less prepayment of mortgages, so the Fed may have to engage in actual sales to reach the cap levels.

These reductions are almost double from the levels of the last QT of respectively $30 billion and $20 billion of Treasuries and MBS, but the balance sheet was half as large.

The uncertainty concerning the Fed balance sheet reduction has been partially eliminated; however, it cannot be said that this is an aggressive policy given the high inflation and the size of the balance sheet. Given that the ON reverse repo open market operations are well over $1.6 trillion, the Fed could reduce the balance sheet faster and still have money funds looking for lending.

Tuesday, April 5, 2022

"Only the Paranoid Survive" Revised - Be on guard for strategic inflection points

Only the Paranoid Survive by the late Andy Grove, the driving force behind Intel, is a business classic that is still relevant in the current tech and macro environment. While Grove applied this wisdom to a technology company, there is value for any investor. Some of his writing may seem dated, but the premise is correct.

Beware of the "inertia of success" which for investing could be a long-term trend of equity success. It could be a good past track record based on success rules of thumb. Believing in your record as a measure of future success is dangerous. Of course, we have heard this before, "past returns is not indicative of future success", but it also applies to strategies and processes. Changes in markets require changes in assumptions and framing of problems.

Grove believes there are strategic inflection points when the market environment changes. Unfortunately, it is unlikely there will be an announcement or a headline of an inflection point; consequently, investors must constantly be looking for these inflection points and be ready to implement a plan of action. Old beliefs may have to be jettisoned when faced with an inflection point. The goal is to be ready for change.

For example, the sanctions on Russia may represent a broader inflection point on global finance and currency markets, but it will not just happen in a day or a week. The closing of the LME nickel market may be another inflection point for metals trading, but the new order may not yet be evident. Hence, the paranoia comes from always watching for changes that can create inflection. The world tomorrow will be different from today.

There may be an inflection point and switching from growth to value. There can be an inflection point in energy policy given the Russian sanctions. There could be an inflection point toward greater inflation fighting by the Fed. These points may appear at any time, so investors must accept their possibility.

The core question is how much of an investment process should be thrown out if faced with an inflection point. Here is where I may differ with Grove. The focus should be on identification of inflection points and rapid response, but the core investment action should be well-defined and repeatable. For example, trend-following can focus on inflection points and limited inertia but have a decision plan once markets move. The paranoia comes with a willingness to adapt portfolio weighting and response to changing regulation, central bank behavior, or market structure; however, that is not the same as costly changing behavior.

Monday, April 4, 2022

Vertical integration reversal - debundling and paying for all embedded services

The hallmark of business growth is tied to gaining scale. Economies of scale help reduce the marginal cost which translate to lower prices. Firms that have scale can undercut smaller firms, drive them out of business, and take market share.

Scale is often associated vertical integration and bundling activities under centralized management. A firm moves activities in-house to manage and control the total business process. Vertical integration should allow for better planning, lowers transaction costs, and more efficient monitoring. Oversight of activities will allow for lower costs. Yet, vertical integration also creates costs and inefficiencies when faced with uncertainty and dramatic changes and innovation. Scale and integration are hard to reverse leaving excess capacity and the inefficient use of capital.

The movement to outsourcing lead to the dismantling of the vertical integration model. Non-essential services were jettisoned. If not part of the core business, services were contracted to specialized firms that could create their own scale. Component manufacturing could be done on an outsourced basis with final assembly done by the parent firm.

This process of outsourcing and deconstruction all worked well in a competitive globalized world with logistic management and excess labor supply. Send out for bid to competitive suppliers your needs and increase capital efficiency. Why hold the capacity under your name when you can outsource and keep the core business lean?

The world has changed. Labor is tight. Logistics are a nightmare. Supply costs are increasing. Firms will now have to pay a higher price for all the outsourced services which may have been controlled better if in-house.

The new business model may see more work being brought in-house and performed locally. The return of vertical integration may be upon the corporate world. It may still be early to make an assessment on vertical integration, but firms are rethinking their business order and outsourcing may be out, control may be back in.

Saturday, April 2, 2022

Eurodollar option - Open interest switching to lower strikes

We have not provided alternative expirations, but this does suggest the direction of option trader focus. For the end of the year, there is a strong expectation that rates are going higher than the closing futures contract at 97.16. Higher inflation and talk of 50 bps increases is leading some traders to think that moves in 2022 will be greater than expected.

The heavy hand of dealers and managed money (commitment of traders) in futures trading

The commitment of traders report provides useful information on who are the longs and shorts in futures trading and whether a trade is getting crowded. A quick review over the last three years tells a story on who is driving the markets. The difference in the commitment of traders across markets and through time can be substantial.

We will highlight three markets to give a taste of the difference and where are the pressure points.

Corn - There is a strong money manager and dealer component to positioning, and it is net long. The flow of money manager money over the last three years is substantial as measured by the percentage of open interest. Producers have increased their net short positions.

Crude oil - This is not as sensitive to money managers and dealer exposures. There is no crowded trade in this market when comparing percentage of open interest over the last three years.

Stock index - The levered funds have added to their short exposures this week, but their overall percent of open interest is stable at just under 15 percent.