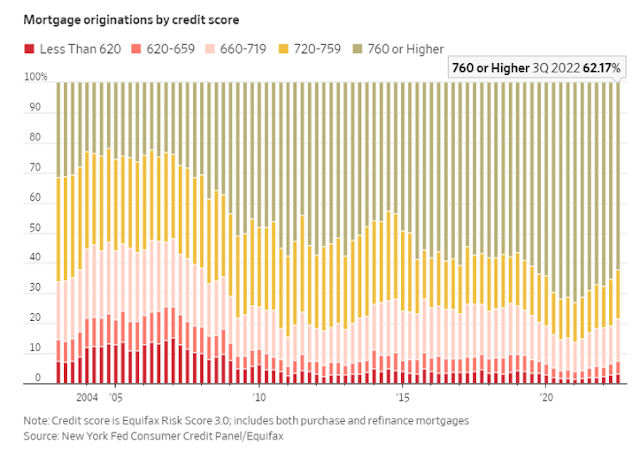

The housing market has been shocked by the increase in interest rates. Homebuilders have been crushed and home prices are coming down after the post-pandemic spike, but this time is very different from the last housing bubble. The equity value versus debt has a huge positive gap. Housing price declines will eat into consumer balance sheets, but it will not lead to household failures. More homeowners have locked-in low interest rates which also helps. However, there will be problems. The credit quality of new buyers has been high for the last decade, so homeowners at these higher prices can weather any decline. Nevertheless,

1. Housing is still more important for middle- and lower-income households. A decline in home value will translate into lower spending, but the wealth effect decline will be limited since we are just seeing a reversal of a pandemic spike.

2. New home buyers cannot afford current housing which reduces demand.

3. Existing homeowners cannot afford to move which reduces supply and will translate into less labor mobility.

Overall, there will not be a leverage problem but there will be a housing gridlock problem that will translate into a lower wealth effect for spending. Housing will not as big a drag on GDP as the seen during the GFC.

No comments:

Post a Comment