Leverage is a core to the financial system as funds flow from those who have excess savings with unclear views to those that have a savings shortfall and strong beliefs. Finance is all about finds funds to give to those who want leverage. Leverage seeps into the financial system in places that are not always expected or closely watched. When the cost of borrowing increases, conviction goes down and the marginal view is cancelled. When leverage is taken out of the system, demand falls and prices must adjust.

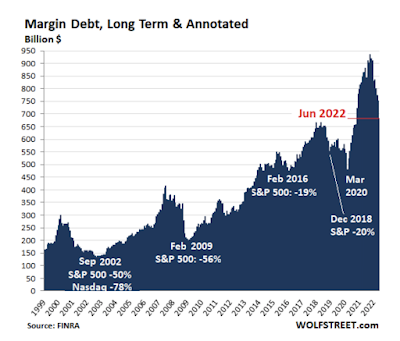

There is a great deleveraging in equity markets that started when the Fed said they would end cheap money. At close to zero rates and negative real rates, borrow. When the cost of money increases, it is time to scale back bets. Margin debt has declined by a quarter of trillion dollars since the peak, that is money not entering the markets. Every time there has been a double digit fall in margin debt, there has been a subsequent fall. The decline in debt may not be the cause of the stock decline; however, markets are driven by feedback loops. Rising borrowing costs and falling valuation from lower present values all contribute to the same result, lower prices. The hawkish Fed should lead to further declines in margin debt and less equity buying demand.

No comments:

Post a Comment