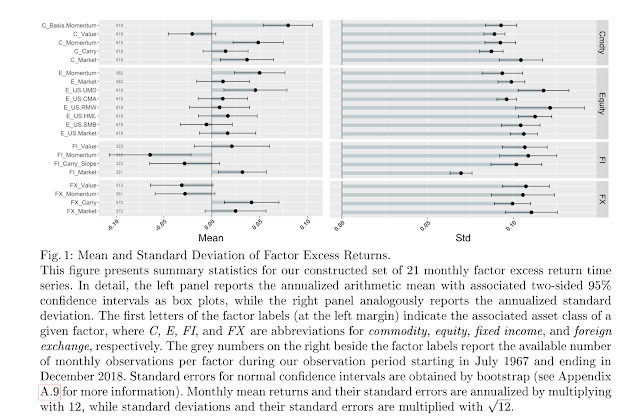

Alternative style risk premia exist across all asset classes, equities, fixed income, currency, and commodities. The ARP returns are highly variable but generally positive. The correlations across these ARPs are generally close to zero with only a few showing significant values. It has been found that macro factors can be explain the variation in the times series of the risk premia.

In a practical paper on the link between macro variables and ARPs, "Time-varying Factor Allocations", the authors show that tilting exposures based on signals from macro predictors can add significant value to any ARP portfolio. These macro predictors include business cycle indicators, inflation, and short-term rates. Carry, value, and momentum styles are all sensitive to macro predictors.

The tilting strategies using different macro variable generate significant excess returns relative to a naive basket portfolio.

The predictors that serve to tilt the ARP portfolios show significant value-added relative to a naive strategy.

Alternative risk premia returns will change with the macro environment. Investors who want to create portfolio improvements can use macro now-casts to adjust their exposures to asset class styles.

No comments:

Post a Comment