Global macro trading is not easy, but it can be supported through simple tools that provide some conditional probabilities of success for asset classes and risk premia through measuring partial correlations on a grid between two factors. An investor's forecast skill may not be strong, but tilts can be created to exploit likelihoods for gains. See the older paper, "Mapping Investable Return Sources to Macro Environments" from AQR.

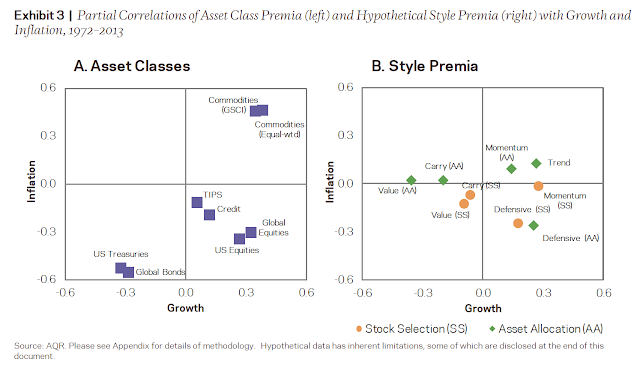

Directional as well as relative value macro trades are based on identifying and measuring the macro regime. Where are we in the business cycle? What is the inflation environment? Returns for asset classes as well as style premia are time varying and conditional on the macro regime. For example, commodities are positively correlated with growth and inflation. At the same time, bonds are negatively correlated to growth and inflation. Asset class tilts are possible to exploit the current regime. Unfortunately, the partial correlations for style premia are more difficult to map because partial correlations are lower with respect to growth and inflation. Nevertheless, momentum and trend are both correlated with growth and inflation.

The 2x2 mapping for global macro can be extended to other macro variables like real yields, volatility, and illiquidity. In these cases, the investor is still burdened with identifying the macro environment. Conditional on the macro assessment, the investor can improve his odds of success through matching macro factor partial correlations with style premia and asset classes.

No comments:

Post a Comment