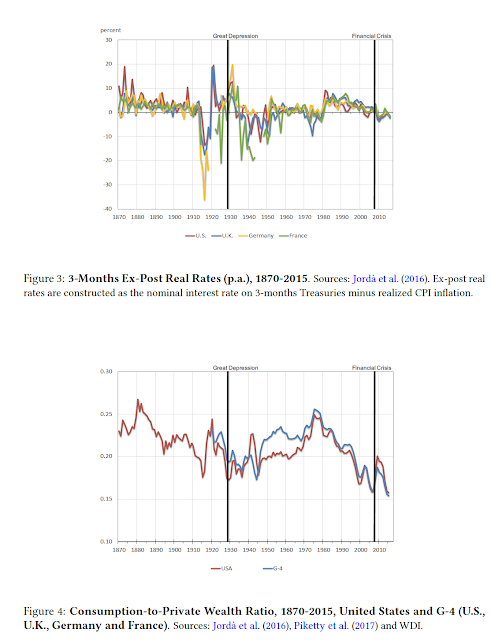

Real rates are exceptionally low. We have discussed the trend in real rates in a previous post, "What should be the real rate of interest - don't expect a positive value in the near-term". The historical view of a 2% real rate should not exist. The low negative real rates will continue not just because of monetary policy also because of secular trends in the consumption/wealth ratio. This secular effect was researched in the BIS paper "Global Real rates: A Secular Approach".

Fluctuations in the consumption/wealth ratio can predict real rates as well as equity risk premia through looking at simple present value calculations on future consumption and wealth. A large fall in the ratio which means a high increase in wealth and will likely indicate a fall in real rates in the future to move the ratio back to the long-term average. The extreme low consumption/wealth ratio cases occurred before the Great Depression and the Great Financial Crisis. Calculating the consumption/wealth ratio is not exactly easy and will be affected by such factors as productivity, demographics, deleveraging, and risk appetite, but even simple measures of consumption to market capitalization suggests that we are at extreme levels.

If you follow the logic, there should be concern about future declines in real rates. Monetary policy today is leading to the conditions that will impact rates and consumption/wealth ratios tomorrow. Conventional wisdom may suggest that real rates are too low when below long-term GDP growth, but there are several factors that suggest that a trend to higher real rates higher in the near-term will be very difficult.

No comments:

Post a Comment