I needed some time to digest Fed Chairman Powell's comments, and it all comes to the same conclusion. The Fed is behind the curve with respect to monetary policy.

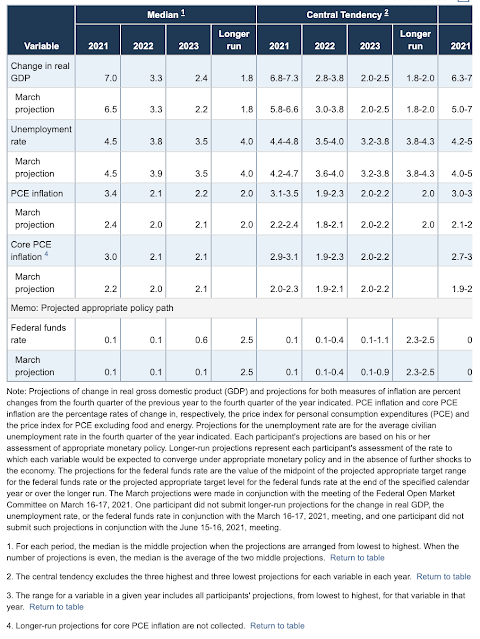

1. The dot-plots have moved forward into 2023 with two increases. However, Chairman Powell told us not to look too closely at these numbers and "take them with a grain of salt". The producer of the numbers tells us that they are likely wrong. Ouch. Is this supposed to be forward guidance?

2. The Fed raised reverse repo rate and the rate paid on reserves held at the Fed. These are technical issues, but it tells us that there is just too much money floating around in the system. Without technical support, rates would fall lower.

3. Inflation forecast for 2021 have moved significantly higher relative to March. So much for transitory inflation in 2021. Inflation in 2022 and 2023 are supposed to be tame; however, market expectations are not being well-behaved especially with consumers.

4. The Fed is now talking about tapering not "talking about talking about tapering".

Lookout for Eurodollar curve trading. We will get a wilder market on "go - no-go" trades.

No comments:

Post a Comment