Stocks in the US have moved significantly higher, but we have not seen much movement in commodity markets. The reason can be found in looking at emerging market growth. The world has changed and to see the driver of commodity growth you have to look more at developments in emerging markets.

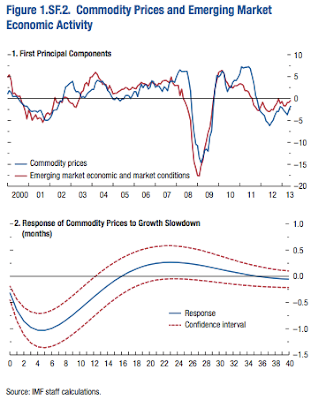

A slowdown in growth in the EM sector suggests that commodities will have a tailwind and not a headwind. This is the conclusion of the IMF in their recent World Economic Outlook (WEO). We show some of their research. Using principal component analysis, they find there is a .8 correlation between the primary factor in commodity prices and EM growth. These tow series are closely related so any negative shock will depress prices even if the G4 is improving.

While there is a clear focus on China growth, this places a better framework on thinking about commodity price movements. The EM growth factor is the key macro pressure point.

No comments:

Post a Comment