There is a unique risk premium associated with skew and it exists to varying degrees across all asset classes, equities, bonds, commodities, and currencies. Creating rank weighted asset class portfolios that are long negative skew and short positive skew and bundled equally across all four asset classes can generate a portfolio that has a Sharpe of .72 over the period from 1990-2017. The value of skew is shown in the paper, "Cross-Asset Skew" which creates a global skewness factor.

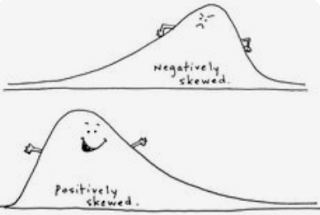

The value of skew can be seen using several different statistical measures and is robust across different data sub-samples. The value of skew cannot be explained by other factors like momentum, carry or value. It is unique. Additionally, the skew risk premium seen in one asset class is not correlated with the skew in other asset classes. Investors need to be compensated for the risk of negative skew and investors overpay for the lottery ticket embedded in a positive skewed asset. The combination of going long (short) skew and negative (positive) skew is pervasive Except for currencies across all asset classes. Even though asset classes may have most markets negatively skewed, the rank ordering shows the pervasive benefit from buying the lowest ranked skewed markets and selling the highest rank.

Forming mean variance efficient multi-factor portfolios, the researchers find skewness is given a positive weight. Holding the skew factor is relevant for improving the efficient frontier especially at lower volatility.

No comments:

Post a Comment