A provocative paper from the NY Fed "Exorbitant Privilege? Quantitative Easing and the Bond Market Subsidy of Prospective Fallen Angels" tells the tale of unintended consequences from the Fed's extended QE programs. Keeping rates low created the search and reach for yield in the corporate bond market. Borrowers were able to obtain cheap financing and lenders took greater risks than normal. Normal returns and risk measures were discarded.

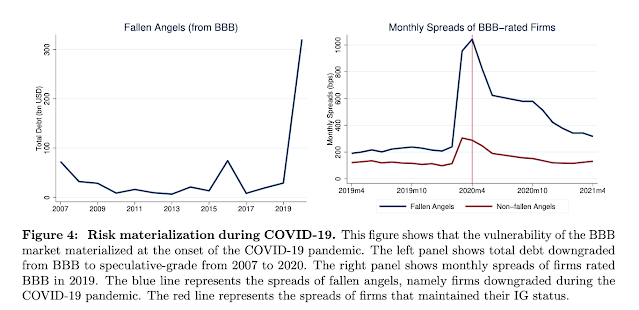

We have corporate zombies among us, and this was caused by the Fed's QE policy that forced fixed income investors to buy marginal corporates to meet their liability needs. Now that we are seeing a change in Fed policy, the cost of subsidies to risky corporates will be felt by the same investors who reached for these yields. The impact will be felt especially by bonds on the cusp between investment grade and high yield.

This cusp risk is made possible by the ratings inflation from ratings agencies who kept ratings stable even as credit quality has deteriorated.

Could this exorbitant privilege of lower borrowing costs to cusp investment grade firms have been anticipated? It should not have been surprising. In extreme environments, firms engage in extreme behavior. Risks are taken and exploited because consequences are pushed into the future. The negative consequences will now be felt as rates are normalized.

No comments:

Post a Comment