“People judge humans by their intentions and machines by their outcomes.” - César A. Hidalgo

Why aren't we more accepting of systematic models and algos for our investment decisions? We have talked about the interesting research on algo anxiety - even if a model is a better predictor many are willing to go with the discretionary forecast. Discretion always adds choice and flexibility if there is new information or situations, even if modeler may get it wrong. Users feel constrained and don't want to be limited by a model.

Philosophical and ethic thinking concerning machine decisions have focused on the chasm between how we accept algo decisions versus those by humans. For example, humans can do a good job of appreciating the nuances between broad terms like good and bad. For example, was the weather bad today? Nevertheless, more AI is being used to make decisions about who is extended credit or who should be given parole. Judgment by machines is encroaching on what used to be human decisions. This encroachment can be for the better given a machine can make consistent decision albeit there is still the issue of biases in the modeling process.

This can be a big investment problem - should you prefer machine decisions or human decisions? Many will not care - the proof is always in the returns, yet those who have studied human and machine decisions find that the criteria for judgment are different. See "Why We Forgive Humans More Readily Than Machines"

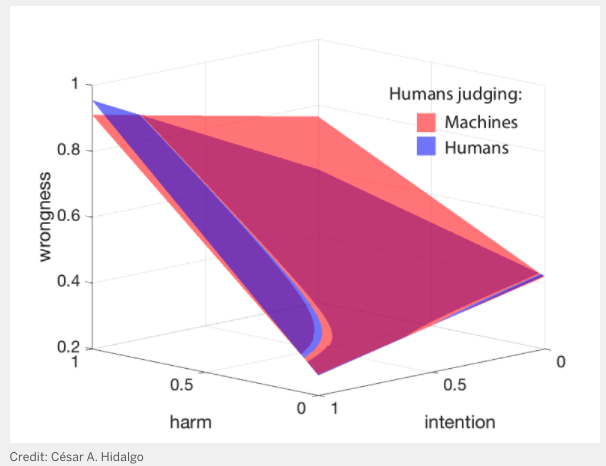

Research has found that humans judge on three criteria, wrongness, harm, and intentions. In the graph below, humans judge machines differently from machines. The researcher looks at the trade-off plane from humans judging humans and humans judging machines. When judging machines, the harm is the key criteria - what is the results of the decision. For humans judging other humans, there is a clear bias toward the intentions of the decision maker. There is a forgiving of harm based on a judgment of the intentions.

In the portfolio management space, humans may be forgiving of the discretionary trader who fails if his intentions were good. He tried to make money and had a good narrative of what he was trying to do. Unfortunately, that is a poor way to judge trading - the focus should always be what are the results. Knowing the process is critical but not an excuse for poor performance.

No comments:

Post a Comment